1 Brooklyn College, The University of New York, USA

2 Independent Researcher, USA

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This study delves into the relationship between incentive-based compensation models and corporate governance, focusing on the Boeing 737 MAX incident as a critical case study. It thoroughly examines data from annual reports of Boeing Company (2007–2014) and the proxy statements issued between 2008 and 2015 (Boeing Company, 2008–2015), highlighting the impact of incentive-driven decisions, particularly by Boeing’s CEO. Post-2011, the CEO’s compensation, heavily linked to a risk reduction strategy, saw a substantial increase. This strategy received backing from a compensation committee, members of which shared the CEO’s General Electric background, raising concerns about potential conflicts of interest. The research emphasizes the urgent need to reassess corporate governance norms, focusing on executive pay structures and the independence of corporate boards. The Boeing 737 MAX incident starkly warns of the dangers and ethical issues associated with misaligned incentive frameworks. The study calls for reforms to ensure corporate decisions are ethically responsible and in harmony with long-term, sustainable business practices.

Boeing 737 MAX, corporate governance, incentive pay, research article, board independence

Introduction

In April 2019, following the crashes of two newly manufactured Boeing 737 MAX jetliners within six months, Boeing CEO Dennis Muilenburg made a statement:

We at Boeing are sorry for the lives lost in the 737 MAX accidents. These tragedies continue to weigh heavily on our hearts and minds. We extend our sympathies to the loved ones of the passengers and crew on board Lion Air Flight 610 and Ethiopian Airlines Flight 302 … it is apparent that in both flights, the Maneuvering Characteristics Augmentation System, known as MCAS, activated in response to erroneous angle of attack information.… It is our responsibility to eliminate this risk. We own it, and we know how to do it.

Following investigations traced the cause to a unique feature of the 737 MAX (Schaper, 2019). The aircraft was equipped with the Maneuvering Characteristics Augmentation System (MCAS), designed to activate only during manual flight operations. During a congressional hearing on October 30, 2019, about the Boeing 737 MAX crashes, Muilenburg admitted that Boeing had made mistakes in designing and developing the 737 MAX’s flight control system (Schaper, 2019).

In 2018, after the first 737 MAX crash and just before the second, Muilenburg earned over $23 million, including stocks and bonuses, marking a 27% increase from 2017 (Clough & Melin, 2019; Isidore, 2019). As noted by Cosgrove (2019), the subsequent reduction in his compensation was in reaction to escalating public and congressional pressures due to the two fatal crashes and Boeing’s financial troubles. Muilenburg, facing these challenges, opted for a pay cut instead of resigning as CEO.

Our research, however, shifts focus from Muilenburg to James McNerney, the preceding CEO, particularly examining the compensation committee’s decisions in 2011, a crucial year marking the launch of the 737 MAX. Notably, a board member involved in the underfunded inception of the 737 MAX was later promoted to non-executive chairman during the post-crisis restructuring, replacing Muilenburg with lead director David Calhoun.

This analysis suggests that the board of directors, active during the 737 MAX’s 2011 introduction, bears more accountability than Muilenburg. The development of the 737 MAX, with a budget of only $2.5 billion (Flight Global, 2012), was notably constrained, costing less than a quarter of designing a new aircraft. To save costs, Boeing took specific shortcuts, such as fitting oversized engines onto a decades-old airframe, ultimately contributing to the aircraft’s issues.

In the words of Boeing’s then-CEO (James McNerney) in the Boeing Company’s annual report in 2011:

With development costs and risks far below an all-new airplane, the 737 MAX will provide customers the capabilities they want, at a price they are willing to pay, on a shorter, more certain timeline. This approach is an all-around winner for Boeing, too. We maintain our qualitative advantage over competitors in the segment, free up resources to invest in other growth projects, and reduce our business risk substantially for the next decade. (Boeing CEO James McNerney, 2011 annual report)

The phrase “risk reduction” was not just a boast for public relations purposes in the annual report. Instead, it was intricately linked to the compensation policy, as detailed in that year’s proxy statement:

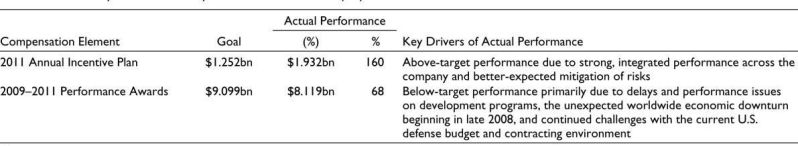

This above target performance resulted in a Company performance score of 1.6.… The above-target performance scores were primarily due to strong integrated performance across the company, including better-than-expected mitigation of risks. (2011 Annual Incentive Assessment, 2012 proxy statement)

This article highlights and supports theoretical and empirical findings on board governance (i.e., agency theory and stewardship theory), management compensation systems and rewards, and business ethics. Examining the issues surrounding the Boeing Company’s 737 MAX jetliner incident highlights the impact of compensation based on incentives and problematic governance practices. These included a lack of sufficient independence in both the board and the compensation committee, which led to significant risks for Boeing and ultimately caused the tragic loss of many lives.

The examination of poor corporate governance at Boeing and further understanding of how it paralyzes the Boeing CEO’s decision-making process regarding the 737 MAX are imperative, relevant, and timely. Ineffective, weak, and dysfunctional governance structures and monitoring systems have already led to several publicized and damaging corporate scandal cases. For example, due to the Volkswagen board’s lack of genuine involvement in senior managers’ decision-making process, the Volkswagen diesel vehicles are equipped with emission-defeating devices to pass the EPA test. Sharpe (2017) argues that the cosmetic board independence or the formality of a two-tier board of directors without effective board monitoring and supervisory attributes contributed to the downfall of Volkswagen. In Tyco’s case, Kozlowski bribed the board members to hide his use of the company’s money to purchase a mansion for himself and his wife (Romero, 2020). Under a failed financial audit provided by PricewaterhouseCoopers (PwC), Kozlowski continued his illegal, greedy, and materialistic gain from buying millions of dollars’ worth of art (Romero, 2020).

Moreover, lack of accountability and weak board oversight allowed CEO Kozlowski, CFO Swartz, and their accomplices to exploit Tyco’s Key Employee Loan Program to pay for things other than taxes on their stock options (Romero, 2020). In the case of Enron, Dibra (2016) argues that the board members’ unethical behavior, immorality, and willingness to participate in fraudulent activities (i.e., waiving conflict of interest rules in 1999) led to corporate governance failure in Enron. The root cause of the WorldCom scandal is that CEO Bernie Ebbers put his financial interests ahead of shareholders’ (Stefano, 2005). Bernie Ebbers used the company’s stock to make significant acquisitions to show Wall Street the growth needed to increase compensation. The accounting statements were falsified to facilitate the fraud (Stefano, 2005).

Last but not least, despite Markopolos’s efforts to make the Securities and Exchange Commission (SEC) investigate Madoff since 2000, Madoff’s Ponzi scheme was not prosecuted until 2009 (Rhee, 2009). Rhee (2009) finds that the SEC’s staff lawyers do not have adequate knowledge and experience in financial markets to read the early warning signs of Madoff’s Ponzi scheme, leading to ineffective fraud monitoring and detection. All these scandal cases are wake-up calls for us to study the detrimental effects of weak corporate governance, dysfunctional executive compensation and incentive systems, and unethical senior managers’ behavior on stakeholders’ interests and organizational outcomes.

Background of the Literature

An Overview of the Problematic MCAS Revision and the 737 MAX Launch

The revised MCAS system that caused two 737 MAX crashes was rushed through the development phase, not rigorously tested, and flawed for relying on a single angle-of-attack sensor instead of two or more sensors (Gates & Baker, 2019). There were communication failures as well among the managers, engineers, system designers, test pilots, and regulators (Nicas et al., 2019). It is a classic information asymmetry problem, part of the agency issue (Mishra et al., 1998). This problem was compounded by the silo segmented approach, in which each Boeing employee focused on a small part of the plane without knowing the whole picture of how the revised MCAS would affect the plane (Nicas et al., 2019). 737 MAX was rushed to meet aggressively targeted earnings and yearly goals set by the CEO, senior managers, and board of directors. At the time of 737 MAX development and pre-launch, Boeing faced significant competitive pressure from its rival Airbus. According to three Federal Aviation Administration (FAA) officials, Boeing did not disclose the redesign of the MCAS system to the FAA (Nicas et al., 2019). In the final version, safeguards were removed to make the MCAS system more compatible with all types of situations. MCAS was also allowed to operate longer than usual. Its aggressiveness and duration of activation were dramatically increased in the final version. The Boeing employees and the regulators did not fully understand the newly revised MCAS system. Neither did the MCAS certification agency perform a safety analysis on the design changes from multiple sensors to only one (Nicas et al., 2019). The faulty angle-of-attack sensor scenario was not tested, because Boeing underestimated the risk of external events (e.g., bird collisions, bumps) that are classified as “hazardous” but not catastrophic, with a frequency of occurrence less than 1 in 10 million flight hours.

On March 30, 2016, Mark Forkner, Max’s chief technical pilot, made the request to FAA to remove MCAS from the pilot’s manual. The three FAA officials were not told that MCAS was undergoing revisions at that time (Nicas et al., 2019). This decision is to cut down on the training cost for a new system that deviates from previous versions of the 737. The decision also smoothens the sale of the 737 MAX to customers who are familiar with the current 737. Forkner was a former FAA employee, which indeed created a conflict of interest. Moreover, Boeing made the change to switch tech pilots from active pilots to simulator pilots. According to the three FAA officials, the malfunctioning sensor was never tested, and the new MCAS system does not require new training (Nicas et al., 2019). Herkert, Borenstein, and Miller (2020) find that Boeing downplayed MCAS’s role. A recording reviewed by The Times revealed Boeing’s underestimation of the MCAS system (Nicas et al., 2019). Following the incidents, three senior Boeing managers regretted the profit-driven and cost-cutting approach regarding the training process (Ellis, 2019).

Risk Reduction and 737 Max

In Boeing’s 2011 annual report and 2012 proxy statement, CEO James McNerney commended the 737 Max for the reduction of risks and costs: “With development costs and risks far below an all-new airplane, the 737 Max will provide customers the capabilities they want, at a price they are willing to pay, on a shorter, more certain timeline.” Here, we examine what risks and costs were to be reduced and how they motivated the launch of the 737 Max.

First and foremost, in order to catch as many market shares as possible from the rival Airbus, the 737 MAX was conceived to shorten the lengthy development, certification, and deployment time by fitting a new engine onto the current 737 platform. R&D costs were also reduced due to reuse of the 737 airframe and other familiar technologies.

Second, the training, maintenance, and transaction costs for pilots and maintenance (e.g., time spent on studying a completely new airplane, productivity loss during the trail-and-error period) were significantly cut down (Gelles & Kaplan, 2019; Rindfleisch & Heide, 1997), thereby appealing to existing customers such as Southwest and prospective customers who know the 737 platform well.

Third, the MCAS software was implemented to address an expensive and time-consuming hardware fix for relocated new engines disrupting the aerodynamics of the 737 airframe (Herkert et al., 2020).

Fourth, building on an established 737 platform expedited Boeing’s commercialization of the 737 Max airplane through FAA’s self-certification program, which put the 737 Max more quickly to the market compared to its competitor Airbus, albeit with the fatal oversight of underestimating the power of the revised MCAS and the significance of over-relying on a single angle-of-attack sensor without any other redundancy in case of sensor failure (Federal Aviation Administration, 2021; Herkert et al., 2020).

Beyond Complexity: Insights from the Corporate Governance and Executive Compensation Theories

Vaughan (1996) told a detailed story of the Challenger disaster from anthropological and sociological points of view. More importantly, she analyzed how large complex institutions work, why accidents occur in a complex system, and what we can learn from the Challenger incident. From her work, we learn that the Challenger disaster was caused by the acceptance of calculated risk (i.e., issuing waivers and lifting launch constraints), the shift in NASA’s organizational norm and culture (i.e., from space exploration to regular shuttle launch or the “culture of production”), and constrained nontransparent information flows (i.e., no official channel for Thiokol engineers to report to the launch control managers the potential O-ring failure in unusually cold conditions). Perrow (1999, 2004) described inevitable failures and accidents in a highly complex system. Two constructs, namely, complexity and tight coupling, were used to examine the accidents and why and how they take place. Perrow (2004) argued that high-risk, complicated technologies that interact with each other and are tightly coupled can eventually lead to disastrous system outcomes (“normal accidents”).

We feel that there is more to it than organizational and engineering complexity in the case of the 737 Max disaster. It is not our intention to imply that Boeing ignored the 737 Max risks. But rather, Boeing did not fully disclose and test the revised MCAS fitted on the 737 Max (Gates & Baker, 2019). In fact, Boeing underplayed the MCAS system (Herkert et al., 2020). Its employees (including test pilots, engineers, and safety analysts) as well as FAA regulators were not fully informed about the revised MCAS system, which relies on a single sensor rather than multiple sensors (Gates & Baker, 2019). There were also communication obstacles and information disconnectedness among upper management, employees, and regulators (Nicas et al., 2019). Mr. Schubbe, a senior FAA official interviewed by Nicas et al. (2019), described:

The way the system was presented to the F.A.A., the Boeing Corporation said this thing is so transparent to the pilot that there’s no need to demonstrate any kind of failing.

Extending Perrow’s (1999) theory, we posit that the danger of oversimplifying a complex system is underestimating the simple failure of familiar technologies. In 737 Max, underestimating the angle-of-attack sensor failure clearly leads to severe consequences.

Although deserving further examination, organizational complexity and organizational culture, which may directly or indirectly cause the 737 MAX disasters, are beyond the scope of this article. The purpose of this article is to explore the corporate governance issues (e.g., dysfunctional incentive pay, non-independent board of directors) underpinning the poor managerial decisions made toward the revised MCAS and 737 Max. We also look at the factors attributed to these governance problems. Catchpole (2020) discovered that the high-pressure, cost-cutting, and profit-driven corporate culture at Boeing is attributed to the 737 Max crisis. We argue that such a culture and working environment have fostered a dysfunctional incentive and reward system and a weak non-independent board structure at Boeing, which in turn resulted in poor, short-sighted managerial decisions focusing on inflating earnings and managers’ self-interests at the cost of long-term shareholders’ and stakeholders’ value. As Catchpole (2020) wrote:

These twin crises, industry insiders say, spring from a culture that consistently put short-term rewards to shareholders ahead of engineering-driven decisions and long-term strategy. For all of Boeing’s business coups and innovation, one stark statistic has come to symbolize the company’s priorities: Over the past six years, Boeing spent $43.4 billion on stock buybacks, compared with $15.7 billion on research and development for commercial airplanes. The board even approved an additional $20 billion buyback in December 2018, less than two months after the first 737 Max crash, though it subsequently shelved that plan.

By looking at the phenomenon from the angles of moral hazards (i.e., information asymmetry) and opportunistic behavior (i.e., misuse of trust), the corporate governance and strategic management theories, namely, agency theory and stewardship theory, complement Vaughan’s (1996) and Perrow’s (1999) organizational and engineering complexity theories.

In particular, we show that the dysfunctional incentive pay system (i.e., CEO compensation measured by non-GAAP performance adjusted for perceived risk reduction) (see sections “Goals and Incentive Systems,” “Policies on Executive Compensation at Boeing,” and “The Linkage Between Boeing’s Dysfunctional Compensation Incentives and Flawed MCAS”) and the weak corporate governance (i.e., inadequate independence of the board and compensation committee) (see the section “Insufficient Independence of the Compensation Committee”) can be taken advantage of by the opportunistic CEOs to maximize their own pay and consequently lead to poor managerial decisions and firm performance. We argue that such a dysfunctional incentive system, coupled with a non-independent governance structure, has expedited Boeing’s transition from a culture of meticulous engineering and R&D to a culture of sales-driven, cost-reduction, and production that aggressively presses on earnings to surpass its competitor Airbus. By not clearly disclosing the revised MCAS system to the involved parties (e.g., test pilots, engineers, safety analysts, employees, regulators, and 737 MAX buyers), strategically speaking, Boeing is killing two birds with one stone. In essence, Boeing is able to sell more 737 MAX planes to existing customers familiar with the previous 737 without incurring additional costs. One of our main contributions is to validate the managerial power theory (Bebchuk et al., 2002) and the managerial entrenchment and rent extraction theory (Jensen & Meckling, 1976; Shleifer & Vishny, 1989), in essence, the side effect of incentive pay, that CEOs can influence and manipulate the weak boards to maximize their compensations for self-interest. Moreover, based on the managerial entrenchment and rent extraction theory (Jensen & Meckling, 1976; Shleifer & Vishny, 1989), we argue that the Boeing 737 MAX project is not necessarily value-maximizing for shareholders, stakeholders, and Boeing in the long run, but rather the complexity and specificity of this project make the CEO McNerney costly to be replaced and thus for him to demand higher pay now and later (see Figure 1). To raise the expected earnings, McNerney and the Boeing board rushed through the decision to implement into the 737 MAX a flawed final version of the MCAS system relying on only one sensor, along with the removal of the description of MCAS from the pilot’s manual (Gates & Baker, 2019; Nicas et al., 2019). All these decisions are intended to significantly reduce the transaction and learning costs (e.g., training time and fees, difficulty in knowledge transfer, absorption and application, trial and error, adaptation to new working environment, productivity loss, and performance inefficiency) (Rindfleisch & Heide, 1997; Shi & de Jong, 2020); to decrease perceived engineering risks using familiar technologies (Branscomb & Auerswald, 2003); to increase sales by appealing to Southwest Airlines, which is one of Boeing 737’s largest customers (Gates, 2019); to increase Boeing’s expected earnings via perceived risk reduction (Guest et al., 2018); and consequently to raise McNerney’s compensation for high company performance score (CPS) (see Boeing 2011–2012 proxy statements, Figure 1 and Table 1). As noted by Lin and Shi (2020) and Shi, Lin, and Pham (2021), the good-intentioned incentive pay, based on agency theory or optimal contracting theory, which is to align CEO’s (agent’s) interests with principal’s (board of directors’) goals, can be misused to serve CEO’s own self-interests, as we see here in Boeing’s 737 MAX case. We emphasize these with a detailed case analysis in the section “Governance of the 737 MAX Launch.”

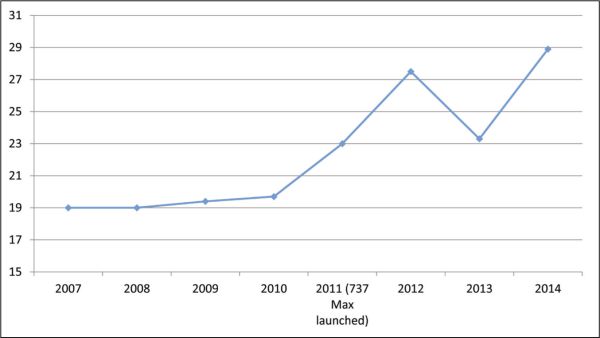

Figure 1. Total Compensation in Millions for Boeing CEO James McNerney (2007–2014), Analyzed About the 737 MAX Launch.

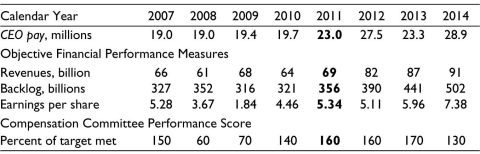

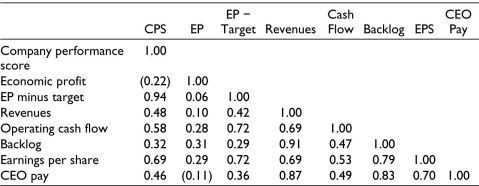

Table 1. Data Compiled from Boeing’s Proxy Statements, CEO Compensation, Objective Financial Metrics, and Compensation Committee Performance Score from 2007 to 2014.

Source:

Note: The year 2011, marked as significant, is when Boeing announced the 737 MAX.

Further Discussion of the Literature and Theories

The Importance of Board Independence in Agency Theory

The agency theory has been widely applied in many business studies to understand the relationship between the principal (i.e., board of directors) and the agent (i.e., executives) (Arthurs & Busenitz, 2003; Daily et al., 2003; Eisenhardt, 1989; Jensen & Meckling, 1976; Ross, 1973; Wasserman, 2006). It assumes that the agent will behave differently than the principal wants, in that the agent will behave opportunistically in their self-interest rather than the principal’s (Eisenhardt, 1989; Jensen & Meckling, 1976; Wiseman et al., 2012). In order to deter opportunistic behavior from the agent, the principal sets up an objective monitoring mechanism to align the principal’s interests with the agent’s (Cruz et al., 2010; Fama & Jensen, 1983). Information asymmetry is the core concept of the agency theory, with the assumption that neither of the two parties fully knows what the other party is doing, or, in other words, how the other party will behave. Thus, two problems surface: moral hazards and adverse selection (Eisenhardt, 1989; Karra et al., 2006). On the one hand, regarding moral hazards, the agent does not entirely fulfill the duties laid out in the contract and is in the best interest of the stakeholders (Chrisman & McMullan, 2004; Ross, 1973). On the other hand, the adverse selection issue occurs when the agent is not competent enough to do the job (Eisenhardt, 1989; Fama, 1980; Schulze et al., 2001). A robust monitoring mechanism (e.g., straightforward reporting procedures, third-party oversight committee), a transparent governance system (e.g., office of accountability, clearly stated organization structure, executive job titles and responsibilities, consistent and transparent corporate culture), and an independent board of directors (e.g., outsider directors with relevant industry backgrounds, separation of duties) are ways to minimize agency costs (Anderson & Reeb, 2004; Chrisman et al., 2007; Corbetta & Salvato, 2004; Donaldson & Davis, 1991; Fama, 1980; Jensen & Meckling, 1976; Wasserman, 2006).

One of the agency theory’s implications in the executive compensation field is the incentive pay or the so-called optimal contracting (Kaplan, 2008; Tosi & Gomez-Mejia, 1989), where CEOs are supposed to be paid for good performance and their ownership (i.e., stock shares) is linked tightly with the firm’s performance. However, without a robust independent board and a transparent, non-arbitrary monitoring system, the executives can exert power over the board and manipulate their compensations. Bergstresser and Philippon (2006), Shleifer and Vishny (1989), and Jensen and Meckling (1976) find that opportunistic CEOs can take advantage of the weak, non-independent board to inflate their compensations. These CEOs extract economic rents by investing in management-specific investments, which are not necessarily value-maximizing for the companies, to make them more complex and costly to replace (Shleifer & Vishny, 1989). Moreover, Murphy (2013) is concerned about the exploitable nature of the financial performance measures merely dependent on accounting figures.

In Boeing’s 737 Max case, a nontransparent and non-independent board compromises the monitoring mechanism and the incentive system. Ntim et al. (2019) find that, under a weak governance structure with an insufficient monitoring system, CEOs have the power to influence the board to rig the directors’ selection process and are thus able to set their pay that is not linked to desirable or optimal organizational outcomes. For example, Boeing CEO McNerney, close to the compensation committee (see the section “Insufficient Independence of the Compensation Committee”), took advantage of the non-GAAP performance measure (adjusted for perceived risk reduction from 737 MAX) to inflate his compensation at the cost of stakeholders’ interests and airplane safety. Both the monitoring mechanism and the incentive system failed because of managerial entrenchment and rent extraction (Jensen & Meckling, 1976; Shleifer & Vishny, 1989).

At the time of Boeing 737 MAX’s launch in 2011, Jim McNerney held both the CEO and the chairman title. Combining these two critical governance roles, the strength of the board’s independence, transparency, and objectivity is significantly weakened by the CEO’s ability to populate the board with nominally independent directors to pursue personal interests (Miller & Xu, 2019). The non-independent board structure erodes the monitoring mechanism for opportunistic managerial behavior and, therefore, comprises the proper alignment of managers’ self-motives, organizational outcomes, and societal benefits. Miller and Xu (2019) argue that self-serving executives can deploy short-term tactics, such as earnings management, to raise their pay and/or retain executive positions. We observe that Boeing’s CEO, board of directors, and compensation committee arbitrarily overemphasized the importance of risk reduction and inflated the CPS with adjusted non-GAAP performance measures.

Guest, Kothari, and Pozen (2018) find that non-GAAP earnings measures lead to excessive executive remuneration. One key mechanism Boeing utilizes to set CEO pay is the risk-adjusted non-GAAP earnings. Ironically, Boeing adjusted earnings higher for compensation due to the perceived risk reduction from the 737 MAX. These high non-GAAP earnings led to Boeing CEO’s excessive pay. Despite the safety issues and long-term risks from the 737 MAX, it benefits the Boeing CEO in the short run because of the higher non-GAAP performance measure linked to enormous pay. This exposes the dysfunctional CEO compensation and incentive program at Boeing. Sufficient and substantial (non-superficial) compensation committee independence, in the form of governance structure and group dynamics, is critical for protecting the company from excessive executive pay (Grant, 2014). Main and Johnston (1993, p. 353) vividly describe that “in the absence of an independent compensation committee, managers write their contracts with one hand and sign them with the other.”

The Role of Board Governance in Stewardship Theory

The stewardship theory is in contrast to the agency theory discussed above. The agency theory assumes that the agent (i.e., executives) behaves irrationally and opportunistically so that the principal (i.e., board of directors) needs to implement robust monitoring mechanisms and objective incentive programs to deter the opportunistic behavior of the agent (Eisenhardt, 1989; Jensen & Meckling, 1976; Wiseman et al., 2012). However, stewardship assumes that the agent and the principal voluntarily and rationally work hand-in-hand for the best interests of everyone and society (Davis et al., 1997; Eddleston & Kellermanns, 2007; Zahra et al., 2008). At the core of this stewardship, it is assumed that opportunistic behavior can be minimized by humanism, and hence, organizational costs can be reduced by good corporate citizenship (Donaldson & Davis, 1991; Eddleston & Kellermanns, 2007; Tosi et al., 2003). Two factors, including external (environmental or situational) factors and internal (personal or intrinsic) factors, are the backbones of this stewardship (Corbetta & Salvato, 2004; Davis et al., 1997; Vallejo, 2009). As to external factors, a community-driven, low power distance, and experience-based corporate culture and working environment foster the stewardship behavior of taking responsibility, self-improvement, self-empowerment, accountability, and loyalty (Eddleston, 2012; Nicholson, 2008; Vallejo, 2009). Regarding internal factors, belonging, self-motivation, psychological rewards, and favorable international relationships promote stewardship (Lee & O’Neill, 2003; Ryan & Deci, 2000).

However, the stewardship theory puts too much burden and trust on self-guidance, which opportunistic CEOs can exploit. We argue that the reason for the corporate governance failure at Boeing may be because the board of directors over trusted their close friend, CEO McNerney, believing that he would voluntarily and rationally behave in the best interests of the company, board of directors, shareholders, customers, employees, and other stakeholders. On the contrary, he did not. Instead, McNerney deceived and persuaded the compensation committee to adopt the non-GAAP performance measure adjusted for perceived risk reduction in the future. This resulted in the failed launch of the 737 MAX, damaged Boeing’s reputation, led to a shrinking customer base, reduced profit, and caused the loss of hundreds of lives. In Boeing’s case, it is plausible that McNerney used stewardship to mislead the board of directors and benefit himself.

Goals and Incentive Systems

Kerr (1975, pp. 775–779) used vivid examples of a Midwest manufacturing company and an eastern insurance company to demonstrate a dysfunctional reward system in which the rewarded behaviors were not what the principal wanted and should have been discouraged. Several root causes were discovered by Kerr (1975), which led to this kind of behavior; for instance: (a) overly relying on quantifiable benchmarks or quantitative measures; (b) ignoring intangible behaviors such as team-building and creativity; (c) hypocrisy—saying one thing while doing another; saying such behavior should not be rewarded but rewarding the behavior; and (b) overcrowding the reward standards. Kerr (1975) proposed three measurements to combat the divergent behavior between the rewarder and the rewarded: (a) deploying a state-of-the-art selection and review process, (b) strengthening training and socialization of the employees to align the goals, and (c) recognizing the dysfunctionality of the reward system and revising it accordingly.

Moreover, Elson and Gyves (2003) found that well-intentioned, well-thought-out incentive plans could be better and entrenched by managers to their benefit. CEOs are thought to be paid for good performance, but instead, the auditors are the ones who help to show high values behind the scenes. The malfunctioning incentive systems have intensified the greedy nature of some executives and corrupted the corporate culture with personal fortune makers (Peregrine & Elson, 2021). In Boeing’s case, the CEO takes advantage of the dysfunctional incentive and reward systems that tie executive compensation to the non-GAAP performance measure adjusted for perceived future risk reduction from the 737 MAX. The malfunctioning CPS increases the CEO’s pay but at the cost of long-term stakeholder interests and product safety.

Methodology

Business studies are constantly challenged for their practical relevance and progressive scientific achievements. Cooper and Morgan (2008) find that the case study approach not only helps researchers respond effectively to these challenges and contribute to relevant knowledge but is also a valuable tool for understanding complex phenomena (too complicated for a survey or an experiment to deal with causality) (Yin, 2014), testing existing theory, and generating new theory. Within the domain of a case study, close attention is paid to specific processes and outcomes of particular events, situations, organizations, or social units. Interviews, documents, observations, surveys, and other data are curated to deeply examine what is happening, why, how the processes interact, what the outcomes are, and what we can learn from the case. The case study approach is beneficial for understanding a phenomenon that is hard to quantify or lacks sufficient quantitative data (Schoch, 2016). Moreover, a case study’s outcome often provides readers with a more practical lesson learned and an engaging experience. Since case studies are qualitative, they provide researchers with people’s perceptions of a particular phenomenon (Merriam & Tisdell, 2015) and diverse data sources (Yin, 2014).

We employ a case study approach to closely examine the corporate governance failures and dysfunctional compensation incentive systems related to the 737 MAX launch. According to Yin (1989, 2014), case studies are thorough and appropriate when researchers ask and answer the “how,” “why,” “what,” and “who” questions regarding phenomena and actions in an organization. In Boeing’s 737 MAX case, we analyze: (a) How did Boeing launch the 737 MAX? (b) Why was it launched even though the 737’s frame is unfit for modern jet engines? (c) What are the driving forces and motivations underpinning the deployment of the 737 MAX with a fatally flawed design? (d) Who is responsible and accountable for making the decisions about the 737 MAX launch? Moreover, (e) Who benefits or loses from the decision to launch the 737 MAX?

Even though the exploratory case approach has the advantages described above and is appropriate for our study, it does face certain disadvantages. For instance, the researchers might impose their preconceived biases, assumptions, or subjective opinions in data collection and analysis because researchers are highly engaged in qualitative studies during these two stages (Tufford & Newman, 2012). To mitigate this concern, the bracketing method is recommended by Tufford and Newman (2012) to ensure that researchers’ biases will not interfere with the studies. Also, case studies are complex and challenging, often requiring significant time and financial resources (Cooper & Morgan, 2008).

Governance of the 737 MAX Launch

Boeing’s Announcement of the 737 MAX in 2011

In 2011, Boeing made a pivotal decision to redesign its long-standing 737 airplane model, rebranding it as the 737 MAX, instead of embarking on the development of an entirely novel aircraft to replace the half-century-old airframe. Subsequent events would lay bare the profound repercussions of this momentous choice, substantially escalating Boeing’s operational and reputational risks. Boeing’s management believed this decision would “significantly mitigate our business risk for the next decade.” Leveraging the purported mitigation of business risk, the management successfully persuaded Boeing’s compensation committee to revise the economic profit metric to calculate compensation performance scores.

Furthermore, in 2013, Boeing completed 737 MAX’s engineering ahead of schedule, leading the compensation committee to recalibrate the economic profit measure again, incorporating “product development” considerations. This series of adjustments to the performance evaluation criteria was instrumental in driving a notable increase in the compensation of Boeing’s CEO at the time, James McNerney. His average annual compensation, initially at $19.6 million in the two years leading up to the 2011 launch of the 737 MAX, subsequently increased to an average of $26.5 million over the following three years.

James McNerney subsequently retired from his role as CEO in 2016, passing the baton to Dennis Muilenburg, who confronted the daunting task of managing the fallout from the two catastrophic 737 MAX crashes in 2018 and 2019. The insights gleaned from our investigation underscore the potential for incentive-based compensation structures in industrial enterprises to yield adverse long-term consequences.

Policies on Executive Compensation at Boeing

Our study of Boeing’s executive compensation practices indicates a pattern driven by self-serving motives, focusing on enhancing the CEO’s benefits. This approach, unfortunately, had negative repercussions for the company and led to the tragic loss of lives. In the crucial year of 2011, when the 737 MAX was launched, James McNerney was the CEO of Boeing, a position he had held since 2005. Before Boeing, McNerney had worked closely with Jack Welch at General Electric (GE) and later led 3M. The timeframe of our analysis extends from two years before the introduction of the 737 MAX to three years after its launch, concluding with McNerney stepping down from his role as CEO and from Boeing’s board of directors.

Figure 1 offers a graphical depiction of the analysis, showing that in the four years preceding the 2011 launch of the 737 MAX, the average annual compensation for the CEO was $19.3 million. This figure experienced a conspicuous surge to $23 million in the launch year. Subsequently, his average compensation stabilized at $26.6 million for the ensuing three years.

Boeing’s proxy statements include a section titled “Executive Compensation—Compensation Discussion and Analysis,” which sheds light on the company’s compensation policies. This section features “Performance Highlights” to justify the compensation awarded based on standard financial metrics such as revenues, operating cash flows, order backlog, and earnings per share. Notably, the CEO’s pay is primarily determined by a CPS, which is based on a calculation of “economic” profit. A CPS above 1.0 indicates Boeing exceeding its annual economic profit targets. As defined by Boeing, economic profit is “after-tax profit minus a capital charge.” As we discussed, this metric has influenced managerial decisions, contributing to the inadequate investment in the 737 MAX.

Our study’s Table 1 presents data compiled from Boeing’s proxy statements from 2007 to 2014. The 2008 statement was the first to outline company performance highlights, likely influencing the CPS calculation. In 2009, two years before the launch of the 737 MAX program, Boeing’s CPS was 0.7, indicating a 30% shortfall from the target. However, in the subsequent years, the CPS consistently surpassed this benchmark, with highs of 1.6–1.7 recorded during 2011–2013. Recognizing that the CPS is Boeing’s internal measure for gauging economic profit, calibrated against specific benchmarks, is crucial.

Boeing’s financial performance demonstrated a significant increase in revenues in 2011, rising from $69 billion to $91 billion by 2014. This impressive growth was driven by the launch of the innovative Boeing 787, which experienced a dramatic rise in deliveries, escalating from just three units in 2011 to 46 in 2012, as reported in the 2012 annual report (p. 26).

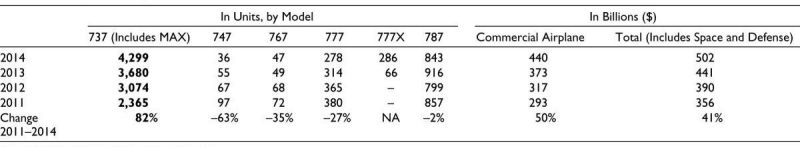

Table 2 in our study vividly illustrates this growth, emphasizing that the increase in the order backlog was due to the rising demand for the 737 MAX. This aircraft program became the only one to experience an expansion in its backlog. Over three years, this backlog nearly doubled, reaching approximately 4,300 units, offsetting declines in other commercial aircraft programs.

Table 2. Change in Backlog, 2011–2014.

Source: Boeing 2011 and 2014 annual reports.

Table 3. 2012 Proxy Statement on Key Drivers of the 2011 Company Performance Score.

Source:

In a 2011 conference call, Boeing CEO James McNerney highlighted the significant cost savings achieved by modifying the existing 737 model instead of developing a brand-new aircraft. The savings in R&D costs, particularly for engine modifications, were estimated to be between 85% and 90% compared to the $11 billion projected for designing a new airplane. This decision, as analyzed, likely saved Boeing close to $10 billion by avoiding the development of an entirely new design (Flight Global, 2012).

This strategy to reduce R&D expenses can be viewed as a form of earnings management, where curtailing such costs can enhance current earnings (Miller & Xu, 2019; Shi et al., 2021).

Boeing’s internal evaluations suggested that this cost-conscious approach diminished business risks. Therefore, before any revenue or sales were generated from the 737 MAX program, the company lowered its risk profile. This had a dual effect: first, it improved the actual economic performance against the set targets, and second, it significantly boosted the company’s performance score for that year.

Boeing identifies the key factors that influence its actual performance. While the company’s revenues and operating cash flows remained approximately consistent with the average of the preceding two years, Boeing perceived an improved mitigation of risks, exceeding expectations.

Table 4 outlines the correlation coefficients among several vital metrics: CEO compensation, CPS, economic profit, revenues, operating cash flows, backlog, and earnings per share (EPS). The primary focus of our analysis is on the factors that influence CEO compensation, CPS, and economic profit. Notably, despite its crucial role in the computation of the CPS, economic profit does not show a positive correlation with the CPS. This discrepancy arises because the CPS evaluates economic profit relative to a predetermined target rather than in absolute terms.

Table 4. Correlation Matrix: Company Performance and CEO Pay (2007–2014).

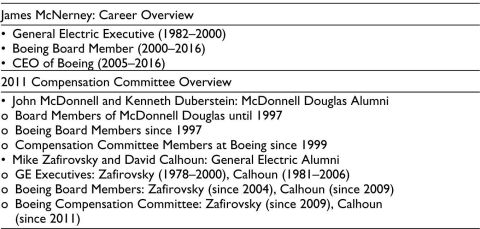

Table 5. Boeing CEO and 2011 Compensation Committee: Alumni from General Electric and McDonnell Douglas.

The Linkage Between Boeing’s Dysfunctional Compensation Incentives and Flawed MCAS

A jetliner that Boeing initially conceived in 2011 as a comprehensive success with minimal business risks ultimately transpired as a catastrophic failure, riddled with immeasurable business risks. Following the first 737 MAX crash but preceding the second one, the FAA conducted an assessment, revealing that the crash rate of the Boeing 737 MAX substantially exceeded that of previous Boeing models (Pasztor & Tangel, 2019). The FAA’s internal risk assessment highlighted concerns with the 737 MAX design, indicating a potential for one fatal crash every two or three years. This assessment was in place even before the first crash occurred, when Boeing’s engineers had already raised alarms about the design. This study will elucidate how Boeing’s asserted “risk reduction” measures propelled the CEO’s remuneration in 2011. Of paramount significance, the compensation committee within the board of directors played a pivotal role in fostering the perverse incentives that led to the budget-constrained launch of the 737 MAX, ultimately culminating in the MCAS debacle.

The MCAS in the 737 MAX aircraft was introduced as a solution to a significant design limitation. This issue stemmed from the original 737 airframe’s inability to accommodate modern, larger jet engines due to limited ground clearance, a design choice tracing back to the post–World War II era when planes were boarded via movable staircases. This low clearance, once an advantage, became a liability in the era of jet bridges (Vartabedian, 2019). The MCAS was designed to offset the instability caused by the powerful engines positioned unusually low, forward, and inward on the wings.

This design choice was also influenced by the management’s goal to reduce costs in aircraft development. Instead of designing a new aircraft similar to the Airbus A320 family or Boeing’s discontinued 757, Boeing modified the existing 737 model.

Moreover, the MCAS feature needed to be fully disclosed to pilots or, to some extent, the FAA. The MAX was marketed on the premise that pilots certified on previous 737 models would not require additional training, thereby saving Boeing various costs related to training and adjustment (Rindfleisch & Heide, 1997; Shi & de Jong, 2020). This particularly appealed to airlines like Southwest, which operated a fleet of 737s (Gates, 2019). However, had the full capabilities of MCAS and its potential to take over control of the aircraft been disclosed, it would have necessitated additional pilot training.

Lastly, Boeing’s executive compensation policies have incentivized cost cutting and lack of transparency, described above. This is supported by the CEO’s letter to shareholders and the 2011 annual incentive assessment detailed in the 2012 proxy statement, as mentioned in the “Introduction” section.

Insufficient Independence of the Compensation Committee

Chairman and CEO, James McNerney

For a more comprehensive insight into the tight-knit relationship between McNerney and the compensation committee, it is beneficial to explore his professional history, as outlined in Boeing’s 2012 proxy statement. This document reveals that McNerney’s career began in 1982 with a series of management positions at the General Electric Company. His tenure at GE culminated in the role of president and chief executive officer of GE Aircraft Engines, a position he served from 1997 to 2000.

After his tenure at GE, McNerney assumed the CEO role at 3M, a company headquartered in Minneapolis, where he served from 2001 to 2005. Intriguingly, he concurrently held a position on Boeing’s board starting in 2001. In a somewhat unconventional turn of events, McNerney took on the CEO role at Boeing, where he had been an external director. This transition prompted his departure from 3M in July 2005.

Boeing’s proxy statement reveals that McNerney was a board member for both IBM and P&G. Interestingly, the statement omits specific details about his involvement in the compensation committees of these companies, particularly his position as the chair of the committee at P&G. This background in compensation committees is likely to have equipped McNerney with the expertise and insight to exert influence on Boeing’s compensation committee.

Compensation Committee Overview

Three of Boeing’s board members also held positions on Caterpillar’s board, including Boeing’s lead director, David Calhoun, who served in a similar role at Caterpillar; Boeing CEO and Chairman Dennis Muilenburg; and Susan Schwab, a professor at the University of Maryland School of Public Policy and former US Trade Representative during the second Bush administration. Furthermore, there were overlapping board memberships with Marriott International, where two directors, Lawrence Kellner (ex-CEO and chairman of Continental Airlines) and Susan Schwab, were also part of Marriott’s board. Additionally, Schwab was a board member at FedEx.

Mike Zafirovsky: GE Alumnus

While McNerney might have been the inaugural GE alumnus to grace Boeing’s board, he was no longer the final addition to this lineage. In 2004, he was joined by Mike S. Zafirovsky, a former associate from his days at GE. The presence of a trusted confidant on the board may have played a role in facilitating McNerney’s appointment as CEO in 2005. According to the Boeing 2012 proxy statement:

Mr. Zafirovsky spent nearly 25 years with General Electric Company, where he served in management positions, including 13 years as President and Chief Executive Officer of five businesses in the consumer, industrial and financial services arenas, his most recent being President and Chief Executive Officer of GE Lighting from July 1999 to May 2000.

David Calhoun: GE Alumnus

McNerney was one of many Boeing board members with a background at GE. Mike S. Zafirovsky, a former GE colleague, joined the Boeing board in 2004, potentially influencing McNerney’s CEO appointment in 2005. Boeing’s 2012 proxy statement highlights Zafirovsky’s extensive 25-year career at GE, including his final role as president and CEO of GE Lighting until May 2000.

In 2009, during McNerney’s CEO tenure and after nine years on the board, another ex-GE colleague, Mr. Calhoun, was appointed. The 2012 statement documents Calhoun’s long career at GE, with roles such as vice chairman, president, and CEO of various GE divisions, including infrastructure and aircraft engines.

Including two former colleagues on the board raises questions about their independence. Notably, by 2011, during the launch of the 737 MAX, both Zafirovsky and Calhoun were members of the four-person compensation committee that determined McNerney’s salary, casting doubts on the fairness and neutrality of the compensation decisions.

John McDonnell and Kenneth Duberstein: McDonnell Douglas Alumni

Following Boeing’s 1997 merger with McDonnell Douglas, board members John F. McDonnell and Kenneth M. Duberstein transitioned to Boeing’s board. They both served as long-standing members of Boeing’s compensation committee, each taking turns as a committee chair at various times until McDonnell’s retirement in 2011.

The critical point is that the two committee members had long-standing professional relationships with McNerney, dating back well before their involvement with Boeing. Even though the non-GE alum members had established long-term associations, their close connections pose legitimate concerns about their ability to assess each other’s professional decisions critically.

A 2018 news report highlighted the strong bond between McNerney and Calhoun, underscoring their close working relationship at GE. McNerney described Calhoun as an inclusive leader who values diverse perspectives and synthesizes them effectively (Lovegrove, 2018). This description raises questions about the suitability of such traits in a compensation committee member overseeing a CEO with whom they have a close professional history.

Zafirovsky, who shares a substantial professional relationship with McNerney and has reported to him at GE, also exemplifies a similar lack of independence (Lublin, 2007).

Ironically, in October 2019, Calhoun was appointed Boeing’s non-executive chairman, a role previously held by CEO Muilenburg (Tangel et al., 2019). While Muilenburg was not involved in the initial development of the 737 MAX in 2011, Calhoun was instrumental in launching the 737 MAX with limited funding, highlighting a concerning overlap of responsibilities and relationships within Boeing’s leadership.

Conclusions and Discussion

Numerous quantitative studies have explored the relationship between firm performance and CEO pay, such as those supporting a positive correlation (Kaplan, 2008; Tosi & Gomez-Mejia, 1989) based on agency or optimal contracting theory. Conversely, others indicate a weak relationship (Jensen & Meckling, 1976; Shleifer & Vishny, 1989; Tosi et al., 2000) rooted in managerial power or entrenchment theory. Additionally, research has been conducted considering the interplay between firm performance and CEO pay, including the hybrid application of optimal contracting theory, managerial entrenchment theory, and Hambrick and Mason’s (1984) upper echelon theory (Shi et al., 2021). However, there is a gap in qualitative case studies focusing on the negative aspects of incentive pay and its impact on the ethical decision-making process.

Based on the agency theory (Kaplan, 2008; Tosi & Gomez-Mejia, 1989), the stewardship theory (Davis et al., 1997; Tosi et al., 2003), the managerial power theory (Bebchuk et al., 2002), and the managerial entrenchment and rent extraction theory (Jensen & Meckling, 1976; Shleifer & Vishny, 1989), we analyze the detrimental effects of the dysfunctional incentive pay and the weak non-independent board structure on management’s decision-making processes regarding the Boeing 737 Max. Our study complements and extends Catchpole’s (2020) finding that Boeing’s cost-driven culture attributes to the demise of the 737 Max and Herkert, Borenstein, and Miller’s (2020) study that examines the unethical engineering and commercialization processes of the 737 Max. Different from the perspective of organizational complexity and cultural influences (see Perrow, 1999, 2004; Vaughan, 1996; and the section “Beyond Complexity—Insights from the Corporate Governance and Executive Compensation Theories”), this article investigates other root causes (e.g., dysfunctional incentive pay, non-independent board) leading to the poor managerial decisions made toward the 737 Max crises.

Several insights are coming to light from this analysis. First and foremost, an in-house third-party oversight committee for executive compensation, rigorous engineering, and airplane safety is needed to deter opportunistic managerial behavior and fortify the monitoring mechanism to better serve stakeholders’ and Boeing’s long-term strategic goals. Second, we believe that a balanced corporate culture between meticulous engineering (i.e., rigorous R&D and testing) and production (i.e., high financial earnings), along with a less-hostile working environment, can discourage unethical opportunistic behavior and in turn help managers to focus on long-term goals instead of short-term earnings. Third, hiring an outsider CEO with expertise, engineering background, and on-flight experience in Boeing airplanes will result in better understanding of airplane engineering and smoother communication with the engineers, test pilots, and FAA regulators. Recruiting an outsider CEO will also bring about fresh new ideas and changes needed to turn around the current culture driven by cost and earnings (Shi & de Jong, 2020). Moreover, an outsider CEO can help avoid conflicts of interest as well as strengthen the independence of the board. Fourth, incentive pay should be tied to strategic long-term success (Lin & Shi, 2020; Shi et al., 2021) instead of financial earnings easily manipulated and exploited by the CEO (see Bergstresser & Philippon, 2006; Murphy, 2013). We strongly suggest that the pay-for-performance incentive program be formed based on the fit between the CEO’s strategic decisions and the core competency (i.e., in Boeing’s case, strong, rigorous, efficient, and effective engineering). Fifth, the performance measure for the incentive pay must be objective and based on Boeing’s strategic success rather than arbitrary measurements inflating executive compensations (see Jensen & Meckling, 1976; Shleifer & Vishny, 1989). As such, the performance measurement can be both quantitative and qualitative. We recommend that Boeing implement safety standards and rigorous testing into the compensation incentives, not just earnings. Sixth, the managerial decisions made have to be in the best interests of engineering safety, rigor, effectiveness, and efficiency while being strategically successful against the rival Airbus. This is achievable via the incentive pay program tied to strategic goals rather than mere financial earnings, as discussed in points 4 and 5). Seventh, we suggest that Boeing’s communication channels among executives, engineers, test pilots, and regulators be transparent, straightforward, easy to navigate, and smooth and fluid to minimize the agency cost of information asymmetry from stalled information and non-transparency. Eighth, the CEO contract has to be incentivized by Boeing’s long-term strategies and stakeholders’ best interests rather than short-term earning goals.

Furthermore, our examination of the 737 MAX Jetliner case underscores the pivotal role played by Boeing’s compensation committee’s ineffective corporate governance. The functioning of this committee holds significance in ensuring prudent management within the company, thereby ensuring the delivery of safe products and the preservation of sustainable and consistent earnings. Our findings underscore the essential role of Boeing’s compensation committee in shaping executive compensation. Consequently, the selection and composition of this committee are of paramount significance for achieving effective governance at Boeing. This naturally leads us to inquire about the composition of Boeing’s compensation committee, the duration of their service, and the process by which they are appointed. Additionally, it is imperative to establish processes and policies that shield the compensation committee members from organizational political influences that could undermine their performance.

One cannot help but contemplate whether a more diverse compensation committee, encompassing a broader range of personal relationships and backgrounds, would have been more assertive in challenging the CEO’s risk assessments. Ironically, Boeing’s compensation committee did have a single female member at one point, but her tenure lasted just one year in 2010, after which she served on other committees. The similarities in professional backgrounds and prior relationships among the committee members raise legitimate questions about the transparency and integrity of the selection process. The tightly knit and homogeneous nature of the committee in 2011 was not ideally suited for robustly scrutinizing the CEO’s assertions regarding the reduced risk associated with the 737 MAX. In 2018, McNerney even commended committee member Calhoun, stating, “He appreciates others’ perspectives more than his own in many cases and does a good job of synthesizing things.” While such qualities may be commendable in personal relationships, they do not necessarily reflect independent oversight. Regrettably, Boeing has yet to learn from these lessons and take steps to enhance the diversity of the compensation committee, in terms of both personal relationships and professional backgrounds.

This study also offers valuable insights into business ethics. Fang and Slavin (2018) propose an adherence to “Golden Rule” ethics, rooted in the teachings of Confucius and monotheistic religions, which contrast with “ethical egoism,” which focuses on self-interest. However, the Boeing case practically challenges applying the “Golden Rule” ethics. The mistakes made by Boeing’s management and board would not have been quickly resolved by simply adopting this ethical approach. Instead, it required an organizational culture fostering “adversarial collaboration,” a concept advocated by Kahneman and Klein (2009) and Tetlock and Mitchell (2009). Such a culture would encourage the board and its committees to critically scrutinize the management’s claims about risk and potential rewards, challenging assumptions and decisions to ensure more ethical and practical outcomes.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Ngoc Cindy Pham  https://orcid.org/0009-0004-3401-8695

https://orcid.org/0009-0004-3401-8695

Anderson, R. C., & Reeb, D. M. (2004). Board composition: Balancing family influence in S&P 500 firms. Administrative Science Quarterly, 49(2), 209–237.

Arthurs, J. D., & Busenitz, L. W. (2003). The boundaries and limitations of agency theory and stewardship theory in the venture capitalist/entrepreneur relationship. Entrepreneurship Theory and Practice, 28(2), 145–162.

Bebchuk, L. A., Fried, J., & Walker, D. (2002). Managerial power and rent extraction in the design of executive compensation. The University of Chicago Law Review, 69(3), 751–846.

Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80, 511–529.

Boeing Company. (2007–2014). Annual reports.

Boeing Company. (2008–2015). Proxy statements.

Branscomb, L. M., & Auerswald, P. E. (2003). Taking Technical Risks: How Innovators, Managers, and Investors Management Risk in High-tech Innovations. MIT Press.

Catchpole, D. (2020). The forces behind Boeing’s long descent. Fortune. https://fortune.com/longform/boeing-737-max-crisis-shareholder-first-culture/

Chrisman, J. J., & McMullan, W. E. (2004). Outsider assistance as a knowledge resource for new venture survival. Journal of Small Business Management, 42(3), 229–244.

Chrisman, J. J., Chua, J. H., Kellermanns, F. W., & Chang, E. P. (2007). Are family managers agents or stewards? An exploratory study in privately held family firms. Journal of Business Research, 60(10), 1030–1038.

Clough, R., & Melin, A. (2019, March 15). Boeing increases CEO’s pay 27% to $23.4 million for last year. Bloomberg News. https://www.bloomberg.com/news/articles/2019-03-15/boeing-increases-ceo-s-pay-27-to-23-4-million-for-last-year

Cooper, D. J., & Morgan, W. (2008). Case study research in accounting. Accounting Horizons, 22(2), 159–178.

Corbetta, G., & Salvato, C. (2004). Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on “comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence.” Entrepreneurship Theory and Practice, 28(4), 355–362.

Cosgrove, E. (2019, October 30). Boeing CEO grilled about salary, accountability in second day of congressional questioning. CNBC. https://www.cnbc.com/2019/10/30/boeing-ceo-grilled-over-salary-accountability-on-capitol-hill.html

Cruz, C. C., Gómez-Mejia, L. R., & Becerra, M. (2010). Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Academy of Management Journal, 53(1), 69–89.

Daily, C. M., Dalton, D. R., & Rajagopalan, N. (2003). Governance through ownership: Centuries of practice, decades of research. Academy of Management Journal, 46(2), 151–158.

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Davis, Schoorman, and Donaldson reply: The distinctiveness of agency theory and stewardship theory. Academy of Management Review, 22(3), 611–613.

Dibra, R. (2016). Corporate governance failure: The case of Enron and Parmalat. European Scientific Journal, 12(16), 283–290.

Donaldson, L., & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49–64.

Eddleston, K. A., & Kellermanns, F. W. (2007). Destructive and productive family relationships: A stewardship theory perspective. Journal of Business Venturing, 22(4), 545–565.

Eddleston, K. A., Kellermanns, F. W., & Zellweger, T. M. (2012). Exploring the entrepreneurial behavior of family firms: Does the stewardship perspective explain differences?. Entrepreneurship Theory and Practice, 36(2), 347–367.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74.

Ellis, J. E. (2019, December 23). Where the 737 Max went off course. Bloomberg Businessweek, p. 15.

Elson, C. M., & Gyves, C. J. (2003). The Enron failure and corporate governance reform. Wake Forest Law Review, 38, 855.

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288–307.

Fama, E. F., & Jensen, M. C. (1983). Agency problems and residual claims. Journal of Law and Economics, 26(2), 327–349.

Fang, J., & Slavin, N. (2018). Ethics—Comparing ethical egoism with Confucius’s golden rule. Journal of Business and Economic Studies, 22(1), 17–31.

Federal Aviation Administration. (2021, February 23). Weakness in FAA’s certification and delegation processes hindered its oversight of the 737 MAX 8. https://www.oig.dot.gov/sites/default/files/FAA%20Certification%20of%20737%20MAX%20Boeing%20II%20Final%20Report%5E2-23-2021.pdf

Flight Global. (2012, January 27). Boeing disputes 737 MAX development cost report. https://www.flightglobal.com/news/articles/boeing-disputes-737-MAX-development-cost-report-367504/

Gates, D. (2019, October 7). In scathing lawsuit, Southwest pilots’ union says Boeing 737 MAX was unsafe. Seattle Times. https://www.seattletimes.com/business/boeing-aerospace/in-scathing-lawsuit-southwest-pilots-union-says-boeing-737-max-was-unsafe/

Gates, D., & Baker, M. (2019, June 22). The inside story of MCAS: How Boeing’s 737 MAX system gained power and lost safeguards. Seattle Times. https://www.seattletimes.com/seattle-news/times-watchdog/the-inside-story-of-mcas-how-boeings-737-max-system-gained-power-and-lost-safeguards/

Gelles, D., & Kaplan, T. (2019, March 19). F.A.A. approval of Boeing jet involved in two crashes comes under scrutiny. New York Times. https://www.nytimes.com/2019/03/19/business/boeing-elain e-chao.html

Grant, B. (2014). Independent yet captured: Compensation committee independence after Dodd-Frank. Hastings Law Journal, 65(3), 761–810.

Guest, N., Kothari, S. P., & Pozen, R. (2018). High non-GAAP earnings predict abnormally high CEO pay (Massachusetts Institute of Technology Working Paper). http://covestreetcapital.com/wp-content/uploads/2019/04/SSRN-id3030953-1.pdf

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as reflection of its top managers. Academy of Management Review, 9, 193–206.

Herkert, J., Borenstein, J., & Miller, K. (2020). The Boeing 737 MAX: Lessons for engineering ethics. Science and Engineering Ethics, 26, 2957–2974.

Isidore, C. (2019, November 5). Boeing CEO Muilenburg won’t get most of his 2019 pay. CNN. Retrieved from https://www.cnn.com/2019/11/05/business/boeing-ceo-pay/index.html

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kahneman, D., & Klein, G. (2009). Conditions for intuitive expertise: A failure to disagree. American Psychologist, 64(6), 515.

Kaplan, S. (2008). Are U.S. CEOs overpaid? Academy of Management Perspectives, 22, 5–20.

Karra, N., Tracey, P., & Phillips, N. (2006). Altruism and agency in the family firm: Exploring the role of family, kinship, and ethnicity. Entrepreneurship Theory and Practice, 30(6), 861–877.

Kerr, S. (1975). On the folly of rewarding A, while hoping for B. Academy of Management Journal, 18(4), 769–783.

Lee, P. M., & O’Neill, H. M. (2003). Ownership structures and R&D investments of US and Japanese firms: Agency and stewardship perspectives. Academy of Management Journal, 46(2), 212–225.

Lin, W. T., & Shi, J. (2020). Chief executive officer compensation, firm performance, and strategic coopetition: A seemingly unrelated regression approach. Managerial and Decision Economics, 41(1), 130–144.

Lovegrove, R. (2018, March 20). David Calhoun: Finding a meaningful balance of success, family, and giving back. Virginia Tech Daily. https://vtnews.vt.edu/articles/2018/03/calhoun.html

Lublin, J. (2007, January 2). In his rookie year, a CEO tests his limits. Wall Street Journal. https://www.wsj.com/articles/SB116769757461264308

Main, B. G., & Johnston, J. (1993). Remuneration committees and corporate governance. Accounting and Business Research, 23(suppl 1), 351–362.

Merriam, S. B., & Tisdell, E. J. (2015). Qualitative Research: A Guide to Design and Implementation. John Wiley & Sons.

Miller, D., & Xu, X. (2019). MBA CEOs, short-term management, and performance. Journal of Business Ethics, 154(2), 285–300.

Mishra, D. P., Heide, J. B., & Cort, S. G. (1998). Information asymmetry and levels of agency relationships. Journal of Marketing Research, 35(3), 277–295.

Murphy, K. J. (2013). Executive compensation: Where we are, and how we got there. In G. Constantinides, M. Harris & R. Stulz (Eds.), Handbook of the Economics of Finance (Vol. 2, pp. 211–356). Elsevier Science.

Nicas, J., Kitroeff, N., Gelles, D., & Glanz, J. (2019, June 1). Boeing built deadly assumptions into 737 Max, blind to a late design change. New York Times. https://www.nytimes.com/2019/06/01/business/boeing-737-max-crash.html

Nicholson, N. (2008). Evolutionary psychology, organizational culture, and the family firm. Academy of Management Perspectives, 22(2), 73–84.

Ntim, C. G., Lindop, S., Thomas, D. A., Abdou, H., & Opong, K. K. (2019). Executive pay and performance: The moderating effect of CEO power and governance structure. International Journal of Human Resource Management, 30(6), 921–963.

Pasztor, A., & Tangel, A. (2019, December 11). Internal FAA review saw high risk of 737 MAX crashes. Wall Street Journal. https://www.wsj.com/articles/internal-faa-review-saw-high-risk-of-737-max-crashes-11576069202

Peregrine, M., & Elson, C. (2021). Twenty years later: The lasting lessons of Enron. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2021/04/05/twenty-years-later-the-lasting-lessons-of-enron/

Perrow, C. (1999). Normal Accidents: Living with High Risk Technologies. Updated Edition. Princeton University Press.

Perrow, C. (2004). A personal note on “normal accidents.” Organization & Environment, 17(1), 9–14.

Rhee, R. J. (2009). The Madoff scandal, market regulatory failure and the business education of lawyers. Journal of Corporation Law, 35, 363.

Rindfleisch, A., & Heide, J. B. (1997). Transaction cost analysis: Past, present, and future applications. Journal of Marketing, 61(4), 30–54.

Romero, J. (2020, September 18). Tyco corporate scandal of 2002 (ethics case analysis). Panmore Institute. http://panmore.com/tyco-corporate-scandal-2002-case-analysis

Ross, S. A. (1973). The economic theory of agency: The principal’s problem. American Economic Review, 63(2), 134–139.

Ryan, R. M., & Deci, E. L. (2000). Intrinsic and extrinsic motivations: Classic definitions and new directions. Contemporary Educational Psychology, 25(1), 54–67.

Schaper, D. (2019, November 6). Boeing CEO says he decided not to quit after 737 MAX crashes and gave up bonuses. NPR. https://www.npr.org/2019/11/06/777078013/boeing-ceo-says-he-decided-not-to-quit-after-737-MAX-crashes-and-gave-up-bonuses

Schoch, K. (2016). Case study research. In G. J. Burkholder, K. A. Cox & L. M. Crawford (Eds.), The Scholar-Practitioner’s Guide to Research Design (pp. 5886–6283, 1st ed.). Laureate Publishing.

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms: Theory and evidence. Organization Science, 12(2), 99–116.

Sharpe, N. F. (2017). Volkswagen’s bad decisions & harmful emissions: How poor process corrupted codetermination in Germany’s dual board structure. Michigan Business & Entrepreneurial Law Review, 7, 49.

Shi, J., & de Jong, J. (2020). Insider or outsider? The separate and joint effects of firm performance and diversification on CEO recruitment. Journal of Management and Governance, 24(1), 91–115.

Shi, J., Lin, W. T., & Pham, N. C. (2021). The relationships among managerial discretion, firm performance, and chief executive officer compensation: A simultaneous equations system approach. American Business Review, 24(1), 114–140.

Shleifer, A., & Vishny, R. W. (1989). Management entrenchment: The case of manager-specific investments. Journal of Financial Economics, 25, 123–139.

Stefano, T. D. (2005, August 19). WorldCom’s failure: Why did it happen? Commerce Times. https://www.ecommercetimes.com/story/45542.html

Tangel, A., Sider, A., & Gottfried, M. (2019, October 14). Boeing’s new chairman is a boardroom force familiar with crises. Wall Street Journal. https://www.wsj.com/articles/boeings-new-chairman-is-a-boardroom-force-familiar-with-crises-11571061169

Tetlock, P. E., & Mitchell, G. (2009). Implicit bias and accountability systems: What must organizations do to prevent discrimination? Research in Organizational Behavior, 29, 3–38.

Tosi, H. L., Brownlee, A. L., Silva, P., & Katz, J. P. (2003). An empirical exploration of decision-making under agency controls and stewardship structure. Journal of Management Studies, 40(8), 2053–2071.

Tosi, H. L., Jr., & Gomez-Mejia, L. (1989). The decoupling of pay and performance: An agency theory perspective. Administrative Science Quarterly, 34, 169–180.

Tosi, H. L., Werner, S., Katz, J. P., & Gomez-Mejia, L. R. (2000). How much does performance matter? A meta-analysis of CEO pay studies. Journal of Management, 26, 301–339.

Tufford, L., & Newman, P. (2012). Bracketing in qualitative research. Qualitative Social Work, 11(1), 80–96.

Vallejo, M. C. (2009). The effects of commitment of non-family employees of family firms from the perspective of stewardship theory. Journal of Business Ethics, 87(3), 379–390.

Vartabedian, R. (2019, March 15). How a 50-year-old design came back to haunt Boeing with its troubled 737 Max jet. Los Angeles Times. https://www.latimes.com/local/california/la-fi-boeing-max-design-20190315-story.html

Vaughan, D. (1996). The Challenger Launch Decision: Risky Technology, Culture, and Deviance at NASA. University of Chicago Press.

Wasserman, N. (2006). Stewards, agents, and the founder discount: Executive compensation in new ventures. Academy of Management Journal, 49(5), 960–976.

Wiseman, R. M., Cuevas-Rodríguez, G., & Gomez-Mejia, L. R. (2012). Towards a social theory of agency. Journal of Management Studies, 49(1), 202–222.

Yin, K. R. (1989). Case Study Research: Designs and Methods. Sage Publications.

Yin, R. (2014). Case Study Research: Design and Methods (5th ed.). Sage Publications.

Zahra, S. A., Hayton, J. C., Neubaum, D. O., Dibrell, C., & Craig, J. (2008). Culture of family commitment and strategic flexibility: The moderating effect of stewardship. Entrepreneurship Theory and Practice, 32(6), 1035–1054.