1 Department of Commerce and Management Studies, University of Calicut, Thenhipalam, Kerala, India

2 Department of Commerce, St Thomas’ College (Autonomous), Thrissur, Kerala, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

In spite of the initiatives by the Government of India for reviving private infrastructure investment, its growth is not up to the mark, especially after the COVID-19 pandemic. It is well known that the contribution of the private sector to infrastructure is inevitable to the overall growth of a country. An enquiry into its determining factors will help to explore the reasons behind the ebb and flow of private infrastructure investment in India and helps in finding solutions to revive it. This paper aims to identify the macroeconomic determining factors of private infrastructure investment in India after the liberalization period. ARDL-bound test results show that in the long run, there exists a positive long-run relationship between private infrastructure investment with gross domestic product (GDP), public infrastructure investment and domestic credit to the private sector, whereas in the short run, it was found that only the GDP and domestic credit to the private sector are statistically significant. Although there are many empirical studies that presented the contribution of macroeconomic factors to the growth of private investment in general, this study stands out as this is the first attempt to identify the determinants of private infrastructure investment.

Private infrastructure investment, GDP, public infrastructure investment, ARDL-bound test, domestic credit

Introduction

Private sector investment is very crucial as it fuels the economic growth of a country (Khan & Reinhart, 1990). It brings together the idle funds of private investors in the country and employs them for various productive purposes. In addition, management skills and technical expertise of the private sector can also enhance productivity and help the economy to revive from crisis. When it comes to the efficiency of investment, there are findings glorifying private investment over public investment. Frimpong and Marbuah (2010) established that economic growth led by private investment would be more efficient than public-led investment.

For sustainable growth in the economy, the presence of private investment must be ensured to complement public investment. Public investment, to a large extent, depends on the perspectives of the ruling government. Their ideologies will prioritize the areas and the volume of investment. As the economy grows, investment by the public sector cannot bear alone all the financial burden needed for developmental activities (Varshney, 2008). There comes the private investment, which pools together the investments of individuals and invests in productive purposes. Boosting private investment as an alternative source of financing is a vital step taken by many developed countries to solve the resource crunch. However, traces of this paradigm shift are visible in India only after 1991.

When it comes to the infrastructure sector, it was proven that both public and private infrastructure investments have a significant impact on the economic growth of India (Unnikrishnan & Kattookaran, 2020). Findings from the same study also elucidated that, compared with public investment, it is private investment which is capable of giving a better impetus to economic growth. The government has initiated many remedial measures for reviving private infrastructure investment in India. Among them, the steps taken by the RBI and the SEBI are really appreciable. Banks providing long-term infrastructure loans have been liberalized by the RBI. In addition, special-purpose vehicles for undertaking infrastructure projects are also encouraged by banks in the private sector. Infrastructure companies are provided with additional relaxations such as minimum subscription and price fixing by the SEBI. IDFC was formed to provide capital, advisory, and asset management services for the infrastructure sector of India. However, although there was an increase in private investment in Indian infrastructure after 1991, it was not up to the required level (Varshney, 2008). Mishra et al. (2013) opined that although the heavy financing needs of infrastructure investment can be met by larger outlays from the public sector, it has to be coupled with a more than proportional increase in private investment. However, from the recent statistics, the growth of private investment is showing greater volatility than public investment. Due to the lack of adequate research in this field, the exact reasons behind this phenomenon are still undiscovered.

Empirical studies present contradicting views regarding the impact of public investment over private investment (Shanmugam, 2017). Some argue that public investment will crowd-in private investment (Hailu & Debele, 2015; Molapo & Damane, 2015), while some other provides evidence for the crowd-out effect (Kaputo, 2011; Naa-Idar et al., 2012. In addition, several other variables can influence the private infrastructure investment of a country. This study is an earnest attempt to identify the important factors that determine private infrastructure investment in post-liberalized India. An investigation of the various determinants will help in finding out the exact reason for the ebb and flow of private infrastructure investment in India. The study will contribute to the economy by identifying those factors that cause the rise or fall in the growth of private infrastructure investment in India. This will help the policymakers to know what exactly drives-in private investment and how to frame policies in accordance with them. Moreover, empirical studies on finding determinants of individual sectors of private investment are conducted very rarely.

Review of Literature

Past Studies

Government intervention and its impact on the economy were a matter of attention since the time of the famous economist Adam Smith. What he advocated was a free market mechanism with a limited role of the government in an economy. However, he was not against government intervention (Mueller, 2013). What he opposed was the wrong kind of intervention. The scenario in India before the New Economic Policy of 1991 can be compared to this “wrong kind of intervention” by the Indian government.

After independence, India concentrated on state-led and centrally planned economic growth (Joseph et al., 2018). As a result, several restrictions were imposed on the private sector, such as licensing of industrial activities, barricades to foreign trade, arduous regulatory system, and restrictions on banking credit allocation schemes. However, this public sector–led growth resulted in a heavy budget deficit and piling up of domestic borrowings. Domestic borrowings of the government grew from 4% to 9.28% between the period 1960 and 1986, and the private sector was holding a considerable proportion of it. A serious setback of the excessive borrowing was the narrowing down of investment opportunities for the private sector. As a result, public investment and private investment moved in opposite directions. It was later realized that restriction to the private sector would not benefit the economy. The narrowing down of economic growth and the rising investment gap in crucial areas of the country led to the need of the private sector as an alternative source of investment.

Empirical studies present the contribution of a number of macroeconomic factors to the private investment of a country. A majority of them come up with a conclusion that GDP is the most significant factor in determining the growth of private investment. According to Jalloh (2014), real GDP has a significant positive relationship with private investment in Sierra Leone, along with the availability of credit to the private sector and public sector investment. However, its relationship with interest rate, inflation, and political instability is negative. Similarly, Augustine (2014) estimated the determinants of private investment in Ghana and found that GDP, inflation, and exchange rate had a significant impact on private investment. Assa and Abdi (2012) also had a similar conclusion regarding the effect of GDP on private investment in Malawi. He found that in the long run, the GDP growth rate and the real exchange rate had a strong impact on private investment. However, in the short run, public investment, real interest rate, and bank credit influence private investment.

Out of the important studies regarding private investment, Agu (2015) stood out because he did not consider GDP as a factor of private investment determinant. He concluded that the real interest rate and infrastructure facilities created a positive effect on the private investment growth in Nigeria. He also stated that a decrease in public expenditure, savings, and infrastructure facilities along with an increase in bank interest rates would slow down private investment.

While examining the past studies, it is noticed that public investment becomes the next important factor after GDP in determining private investment. The literature presented contradicting views regarding the impact of public investment on private investment. Adugna (2013) found that GDP, public investment, and external debt had a positive relationship with private investment in Ethiopia. This finding similar to that of Hailu and Debele (2015), that long-run private investment in Ethiopia was positively influenced by public investment, real GDP, and money supply of the economy, whereas negatively affected by the real exchange rate. Similarly, Molapo and Damane (2015) also found that in Lesotho, public investment has a significant role in crowding-in private investment, and price level had a negative impact on it. Blejer and Khan (1984), while identifying the determinants of private investment in developing countries, found that public investment in infrastructure had a crowd-in effect on private investment whereas public investment in non-infrastructure sectors crowd-out private investment.

While a majority of studies found a positive influence of public investment on private investment, in some studies, the crowd-out phenomenon worked. In Naa-Idar et al. (2012), the impact of public investment on private investment was negative. Among the factors that affected private investment, GDP growth, inflation rate, real effective exchange rate, and trade openness affected positively whereas external debt and public investment affected negatively. Similarly, Kaputo (2011) while estimating the determinants of private investment in Zambia established that there was a long-term relationship between GDP growth rates, credit distributed to the private sector, public investment, real exchange rate, inflation, real interest rate, and private investment. A significant finding from his study was that public investment creates a crowd-out relationship with private investment.

Studies also showed contradicting views regarding the impact of credit provided to the private sector. Some studies found the positive impact of credit in boosting private investment while some challenged its effectiveness. According to Majeed and Khan (2008), the volume of bank credit was one of the most important factors that contributed to private investment in Pakistan. Moreover, private sector output, past capital stock, and net capital inflow to the private sector also positively impacted private investment in the country. The role of credit given to the private sector was highlighted by Kaputo (2011). He adds that private firms, which play a major role in the private investment of a country, heavily depend on bank credit for their funding requirements, especially in developing countries. Variations in bank credit were significant determinants in the study of Blejer and Khan (1984). He adds that, whenever there is a decrease in the quantum of credit provided to the private sector, private investment also shows a decrease in the real value. Erden and Holcombe (2005) also support the finding that bank credit is one of the crucial factors that influences private investment in an economy. Similarly, Fleta.png) Asín and Muñoz (2021) emphasized the support of multilateral development banks in boosting the participation of private investors in renewable energy public–private partnerships.

Asín and Muñoz (2021) emphasized the support of multilateral development banks in boosting the participation of private investors in renewable energy public–private partnerships.

On the contrary, Ouattara (2004) found that the relationship of private investment with credit to the private sector and terms of trade was negative. The absence of expert personnel and an adequate institutional environment was pointed out as the reason for this. However, this was not a stand-alone finding. The negative impact of credit on the private investment growth rate was also an important finding of Mbaye (2014). A positive relationship was found between real GDP growth rate, real exchange rate, broad money, domestic savings, and debt service with domestic private investment in Kenya. However, the relationship of private sector credit with private investment and public debt was negative.

In the Indian context, identifying the determinants of private investment in India was attempted by many scholars. Chhibber and Kalloor (2017) found public sector capital stock, exchange rate, availability of credit, and public investment as determining factors of overall private investment in India. The study also provided evidence for crowd-in relationship between public and private investment in India. Crowd-in effect in India was the major finding in the study of Bhanumurthy et al., (2015). However, there was a negative effect of interest rates. In Ang (2009), private investment was explained as a function of GDP, public investment, credit programs, cost of capital, and liquidity requirements. Mallick (2002) also established that public investment positively contributed to private investment in India. In contrast, Murthy and Soumya (2011) established that in the short run, public investment in sectors except agriculture crowds out private investment. Mitra (2006) believed that public investment crowds out private investment in the short run. However, he also adds, in the medium and long run, crowd-in relationship is observed. Similarly, a mixture of the crowd-in and crowd-out relationship was found by Bahal et al. (2015). They found evidence of a crowd-out relationship between public and private investment until 1980. However, later it was found that policy reforms during the early 1980s were attributed to the change in relationship between the public and private investment and crowd-in effect. Apart from the economic factors, psychological factors also influenced the decision of private investors (Amine et al., 2023). Financial literacy played a crucial role as literate people can better evaluate investment options (Ammer & Aldhyani, 2022).

While critically analyzing the literature, although several studies were conducted to investigate the determinants of private investment in general, a study is carried out for the first time to investigate the determinants of the private sector in the infrastructure sector. Focusing on the sector-wise determinants will make the study stand out from others as the determinants of private investment will differ according to the sector concerned. This study will be a remarkable contribution to the existing literature as it will motivate researchers to conduct more studies in other sectors too.

Theoretical Framework

Investment Theories

Investment theory believes that investment is regarded as an adjustment to capital stocks. Out of many investment theories, important three among them are discussed here.

The accelerator theory of investment. This theory states that in order to achieve a certain output, a specific amount of capital stock is necessary. In case any mismatch occurs between the desired capital stock and actual capital stock, it will be automatically resolved within a single time frame.

The internal funds theory of investment

This theory suggests that required capital stock is determined by the profit level. Thus, investment is positively correlated with expected profits.

The neo-classical theory of investment

This theory states that a decrease in the rental price of capital will lead to a hike in the investment rate.

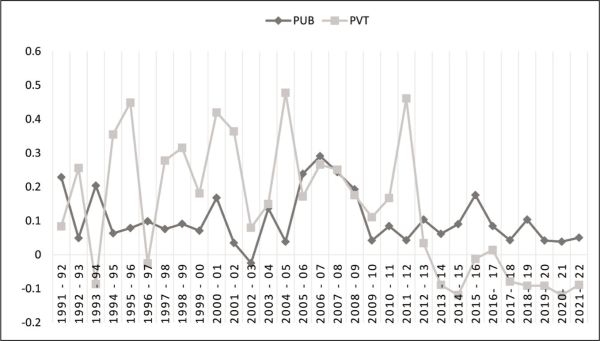

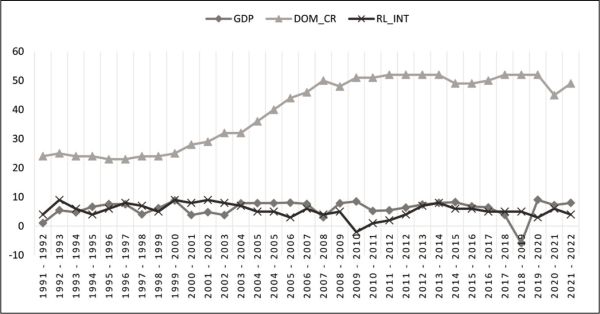

Figure 1 and Figure 2 show the trend analysis of the macroeconomic variables used in the study. This is followed by the theoretical explanation of the relationship between individual dependent variables with private investment.

Figure 1. Trend Analysis of Private and Public Infrastructure Investment in India.

Source: National Account Statistics published by the Ministry of Statistics and Program Implementation.

Figure 2. Trend Analysis of GDP, Domestic Credit to the Private Sector and Real Interest Rate in India.

Source: World Development Indicators published by World Bank and Handbook of Statistics by RBI.

Gross domestic product

GDP growth rate is one of the crucial factors that influences private investment in an economy. When the GDP of a country rises, economic activities will increase, and as an outcome, opportunities for private investment will also increase. The relationship between economic growth and investment can be also referred to as bidirectional, that is, when investment increases, aggregate demand increases and there will be a rise in economic growth. When an economy grows, there will be more disposable income in the hands of the private sector and it will lead to further investment. There are hardly any studies that criticize the role of GDP in the contribution of investment growth.

Public infrastructure investment

The next important variable that comes after GDP in influencing private investment is public investment. Findings on the impact of public investment on private investment can be bifurcated into two: supporting crowd-in effect and supporting crowd-out effect. When public sector capital provides input to various industries, it leads to a high return on capital to the private sector, and the possibilities of further investment will increase. In this way, the crowd-in effect operates in an economy by increasing private investment in accordance with the increase in public investment. On the other hand, when an economy operates under near capacity, borrowings by the public sector for investing will lead to budget deficits. This will eventually result in higher interest rates and decrease private investment. Moreover, sharing the same resources for financing also makes public and private investment move in opposite directions and thus crowd-out happens.

Domestic credit to the private sector

It refers to the monetary assistance provided to the private sector by entities such as monetary authorities, banks, money lenders, insurance corporations, pension funds, and foreign exchange companies. They are provided through loans, purchases of non-equity securities, trade credits, and other accounts receivable that establish a claim for repayment. Credit by financial institutions and finance from the capital market are the two important sources of capital formation. In many studies conducted, especially in developing countries, credit available to the private sector is found as the most influencing factors that stimulate private investment. This is because the capital markets of developing countries are not fully developed, and corporate investment heavily depends on the credit provided by financial institutions for making investment. When the quantum of government holdings in the banks increases, banks are forced to cut down the credit provided to the private sector. Banks follow this strategy to maintain a balanced portfolio and enhanced safety during stressful times. However, in many instances, the role of credit to the private sector turned out to have a negative impact. This happens when there is an absence of expert personnel and an adequate institutional environment. In addition, the credit given to the private sector may be used for activities other than investment.

Real interest rate

It is the lending interest rate measured by the GDP deflator and is adjusted for inflation. According to Keynesian and Neoclassical theories, real interest rates have a negative relationship with private investment. This is because at a higher rate of interest, the cost of borrowing increases, and private capital will need a higher rate of return to make the investment profitable. Pradhan and Hiremath (2020) found that although higher interest rates may impede future economic growth, these can also discourage capital flight from a country. This will eventually lead to a decrease in private investment in an economy. In addition, in economies where the interest rate is low or negative and self-finance is given the primacy, deposits will decrease. However, financial liberalization theories popularized by McKinnon and Shaw in 1973 challenged this concept by arguing that real interest rates seldom showed a net positive impact on private investment. This is because when the interest rate increases, savings will increase, thereby increasing the volume of domestic credit provided by financial institutions to the sector. This will eventually lead to an increase in private sector investments. Hence, it will depend on the nature of the economy whether the interest rate will be significant in influencing private investment or not.

Methodology

The data required for the present study were obtained from secondary sources, namely, National Account Statistics published by Central Statistical Organization under the Ministry of Statistics and Program Implementation, Handbook of Statistics by RBI, and Database of World Bank. The data mining method for the variables public infrastructure investment and private infrastructure investment was inspired by a series of studies done by Murthy and Soumya (2006). Gross capital formation in industry groups 4, 5, and 7, namely, electricity, gas, water supply; construction; and transport, storage and communication was termed as infrastructure investment. Yearly data on public and private infrastructure investment at constant prices were collected from 1990–1991 to 2021–2022 (updated to the latest issue available at the time of data analysis; National Accounts Statistics, 2023). In order to derive private investment, public investment is subtracted from aggregate investment. Data covering various base years were converted into single series (with the base year 2011–2012) using the splicing technique.

Other variables, namely, GDP (in real terms), domestic credit to the private sector as a percentage of GDP, and real interest rates (which is adjusted for inflation using the GDP deflator), were collected from the World Development Indicators published by the World Bank. All variables were measured in growth rates except domestic credit to the private sector and real interest rate (which was already available in percentages). As only year-wise data were available, it was converted to quarterly data for increasing the number of observations for analysis. The linear method was used for the conversion. Data analysis was done in the EViews software.

In order to best capture a clear picture of private infrastructure investment in India, the scope of the time period of the study has been shifted to the post-liberalization period in India, that is, after 1991. This is because only after that period a notable progress is visible in the growth rate of private infrastructure investment in India.

Empirical Model

In this framework, private infrastructure investment can be described as a function of GDP, public infrastructure investment, domestic credit to the private sector, and real interest rate. Thus

Econometric Model

where PVT represents private infrastructure investment, GDP represents the gross domestic product, PUB represents public infrastructure investment, DOM_CR represents domestic credit provided to private sector, RL_INT represents the real interest rate, and e represents the error term.

The augmented Dickey–Fuller (ADF) test was used to check the stationarity of the time-series data, and the Akaike information criterion (AIC) was used in determining optimal lag length for the model (Jacob et al., 2022). Later, the ARDL-bound test developed by Pesaran et al. (2001) was applied for estimating the short-run and long-run determinants of private infrastructure investment in post-liberalized India. ARDL is one of the most sought-after tools used in the analysis of finding determinants in recent studies, especially for private investment (Awad et al., 2021; Ayeni, 2020). In order to ensure that the model is free from the problem of autocorrelation and heteroscedasticity, Harvey’s heteroscedasticity test and Breusch–Godfrey LM test are used for conducting residual diagnostics. The Ramsey test and CUSUM test were used to check the stability of the model.

Although there are contradictions in the relationship between variables in past studies, the positive relationship of private investment with GDP was never questioned. However, it was interesting to find out the characteristics of the relationship between public infrastructure investment and private infrastructure investment, that is, whether crowd-in or crowd-out existed in the sector. Although there are exceptions, in most cases, the relationship of private investment with domestic credit to the private sector was positive, and the relationship with real interest rate was negative. Based on literature reviews, the following four hypotheses can be formed.

H1: Gross domestic product has a positive impact on private infrastructure investment in India in the long run and short run.

H2: Public infrastructure investment has a negative impact in the short run and a positive impact in the long run on private infrastructure investment in India.

H3: Domestic credit has a positive impact on private infrastructure investment in India in the long run and short run.

H4: Real interest rate has a negative impact on private infrastructure investment in India in the long run and short run.

Result and Discussion

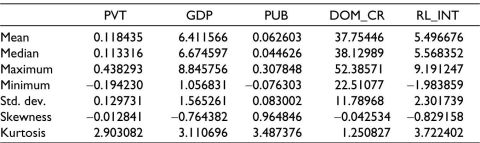

Descriptive Statistics of the Variables

Descriptive properties of the variables 1991–1992 to 2021–2022 are presented in Table 1. While observing the deviation in the minimum and maximum values of all variables, domestic credit to the private sector shows the highest deviation. The values of skewness depict that private infrastructure investment, GDP, domestic credit to the private sector, and real interest rate are negatively skewed and have long left tails. From the value of kurtosis, it can be concluded that GDP, public infrastructure investment, and real interest rate are heavily-tailed distribution and others are light-tailed distribution.

Table 1. Descriptive Statistics for the Determinants of Private Infrastructure Investment in India.

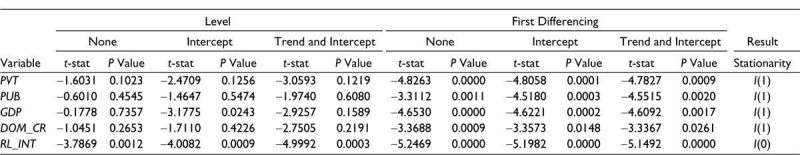

Unit Root Test

The ADF test is used to conduct unit root analysis of time-series data. Here, modified Akaike is used as an automatic selection criterion for identifying the lag length of the ADF test. Table 2 shows the ADF test results of the five variables under study. While real interest rates became stationary at the level, other variables show the presence of unit root at their levels. After the first differencing, variables became stationary. So real interest rate integrated at I(0) and all the other variables integrated in the same order, that is, I(1). If the order of integration of the variables is not uniform, the ARDL test developed by Pesaran et al. (2001) can be used (Augustine, 2014).

Table 2. ADF Test Results for the Determinants of Private Infrastructure Investment in India.

Optimal Lag Length Criteria

For analyzing the results of the ARDL model, the selection of optimal lag length is necessary. The time-series analysis is sensitive to the lag length of the model. Out of the several model selection criteria for estimating the lag length, Cherkassky and Ma (2003) suggest AIC as the best. This is because it yields superior predictive performance in model selection compared to others. Figure 3 represents AIC values of the top 20 models. Among these, the model showing the lowest AIC is selected as the optimum lag length of the model. The model with the smallest AIC value of –3.6262 is ARDL (2, 4, 0, 0, 0). So, this lag length can be considered as the optimum lag length for the model.

Figure 3. Optimal Lag Selection for the Determinants of Private Infrastructure Investment in India.

.jpg/10_1177_25819542241249606-fig3(1)__600x301.jpg)

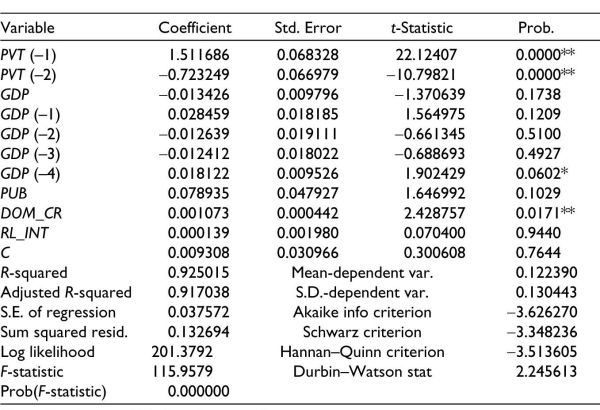

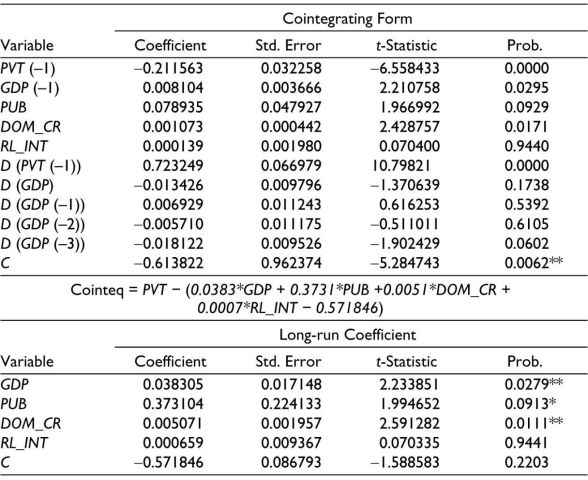

ARDL Short-run Coefficients

Table 3 shows the short-run coefficients of the ARDL model run between private infrastructure investment and its various determinants in India. While studying the relationship between the variables in the short run, it was found that the probability values of short-run coefficients of two macroeconomic variables, that is, GDP (lagged values) and domestic credit to the private sector, are statistically significant at 10% and 5%, respectively. The relationship with GDP was in accordance with prior expectations, that is, there is a positive impact of GDP on private infrastructure investment in the short run. This finding also supports the findings of many studies, such as Jalloh (2014), Augustine (2014), and as literature seldom contradicts with the impact of GDP over investment.

Table 3. ARDL Short-run Cointegrating Parameters of the Model for the Determinants of Private Infrastructure Investment in India.

Note: *Significant at 10%; **significant at 5%.

The relationship between private infrastructure investment and domestic credit provided to the private sector was also as per expectation—a positive relationship. This supports the findings of Majeed and Khan (2008), Kaputo (2011), and Blejer and Khan (1984). This is because whenever there is a decrease in the quantum of credit provided to the private sector, private investment also shows a decrease in the real value. However, when it comes to public infrastructure investment and real interest rate, the probability value shows that there is no significant relationship with private infrastructure investment because the analysis is carried out in the short run only.

ARDL-bound Test for Cointegration

After estimating the short-run coefficients under the ARDL method, the long-run relationships among the variables are checked using the bound test. The result of the bound test is given in Table 4.

Table 4. Bound Test Results for the Determinants of Private Infrastructure Investment in India.

.jpg/10_1177_25819542241249606-table4(1)__480x165.jpg)

Here, the value of F statistic is 7.37, which is above the I(0) and I(1) bound levels at all significant levels. This shows that there is a long-run relationship between private infrastructure investments and GDP, public infrastructure investment, domestic credit to the private sector, and real interest rates in the given model.

ARDL Long-run Coefficients

Table 5 shows the long-run coefficients of the ARDL model run between private infrastructure investment and its various determinants in India. C is the coefficient of speed of adjustment in the long-run ARDL model. Here the error correction value of the model is -0.6138 and statistically significant at a 5% level of significance. This means that the system automatically corrects the temporary disequilibrium in order to attain a long-term relationship between private infrastructure and its various determinants. A sign of the coefficient and the probability value shows the relationship between dependent and independent variables. From the results, it is revealed that in the long run, private infrastructure investment in post-liberalized India is positively associated with GDP, public infrastructure investment, and domestic credit to the private sector. This shows that an increase in the growth rate of these variables will have a significant positive impact on the growth of private infrastructure investment in India. However, in the long run, the real interest rate does not have a significant relationship with private infrastructure investment.

Table 5. ARDL Long-run Cointegrating Parameters of the Model for the Determinants of Private Infrastructure Investment in India.

Note: *Significant at 10%; **significant at 5%.

In this study, GDP has a strong positive influence on private infrastructure investment both in the short run and the long run. The findings are similar to the study of Ang (2009) that explained private investment as a function of GDP. In addition, Adugna (2013), Hailu and Debele (2015), Molapo and Damane (2015) showed similar findings on the impact of GDP on private investment.

As already mentioned, the influence of public investment in the growth of private investment can be bifurcated into crowd-in effect and crowd-out effect. There is evidence of public investment crowding-in private investment due to the complementary effect and sometimes crowding-out private investment due to the substitution effect. The result of the present study shows that there is a crowd-in relationship between public infrastructure investment and private infrastructure investment in the long run. In other words, public infrastructure investment has a complementary effect on the long-term growth of private infrastructure in India. Although public infrastructure investment has no impact on private infrastructure investment in the short run, it has a strong impact in the long run. This happens because public investment increases the marginal productivity of private investment in the long run, and it improves economic growth. This will eventually pave the way for more investment by the private sector. Chhibber and Kalloor (2017) also provided evidence for a crowd-in relationship between public and private investment in India. Similar was the finding in the study conducted in India by Bhanumurthy et al. (2015) showing that public investment in infrastructure crowds-in private investment of that particular sector. Mallick (2002) also established that public investment positively influenced private investment in India.

Domestic credit to the private sector is showing a strong positive relationship with the private infrastructure investment in India both in the long run and the short run. It is obvious that, for the growth of an economy, infrastructure investment is a must. So, credit given by financial institutions to the private sector in the form of loans and other advances, especially to corporates who are indulged in investing activities, will increase the investment of the private sector in infrastructure. Low credit to the private sector is a major factor that has hindered private sector investment (Ayeni, 2020). Financial crunch is an important reason for the lack of private participation in investment activities. Financial assistance powered by such institutions will act as a strong pillar to support private investors to invest more and more in the infrastructure sector. The findings of the study are also supported by the studies of Majeed and Khan (2008), Kaputo (2011), Erden and Holcombe (2005), etc.

However, the real interest rate showed a negative and insignificant relationship with private infrastructure investment in India both in the long run and the short run. A significant relationship of credit provided to the private sector and an insignificant relationship with real interest rate with private investment would surprise us. However, this contradicting phenomenon was the core theme of Lugo (2008). The findings of that study showed that there was no evidence found for real interest rate acting as a transition variable for private investment, whereas credit availability does. Ayeni (2020) also found that a real interest rate does not have an impact on private investment in Gambia, a less developed country. Awad et al. (2021) also agree with the finding. Chhibber and Kalloor (2017) in the Indian context also proved that real interest rate did not have a significant impact in determining private investment in the country.

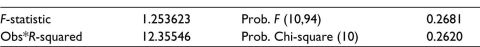

Residual Diagnostics

To ensure the goodness of fit, it is important to check whether the model suffers from the problem of serial correlation and heteroscedasticity, which are the common problems of time series data analysis. Harvey’s heteroscedasticity test and the Breusch–Godfrey LM test are used for conducting residual diagnostics. Table 6 presents the result of Harvey’s heteroscedasticity test of the model. Heteroscedasticity occurs when the error term changes with time and is not equally distributed among the range of variables. If the probability value lies above 0.05, the series of data is said to be homoscedastic. As the value is 0.2681, it can be concluded that the model is free from the problem of heteroscedasticity.

Table 6. Heteroskedasticity Test for the Determinants of Private Infrastructure Investment in India.

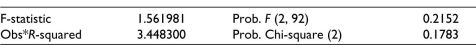

Table 7 presents the results of the Breusch–Godfrey serial correlation LM test, which is used for identifying the presence of autocorrelation. The probability value should be greater than 0.05, and here it is 0.2152. Thus, there is no evidence of autocorrelation.

Table 7. Serial Correlation Test for the Determinants of Private Infrastructure Investment in India.

Stability Diagnostics

Like residual diagnostics, stability diagnostics is equally important for checking the adequacy of the model. The Ramsey test and CUSUM test are used here to check the stability of the model.

Table 8 presents the result of the RESET test, that is, the regression specification error test (Ramsey, 1969) for the model. This test helps to check whether the model is well specified and not omitted significant variables. For the model to be adequate, the probability value should be greater than the 5% significant level. Here, the value is 0.8959, which is satisfactory.

Table 8. Ramsey RESET Test for the Determinants of Private Infrastructure Investment in India.

.jpg/10_1177_25819542241249606-table8(1)__600x190.jpg)

The CUSUM test or cumulative sum control chart is used for checking the stability of the parameters in the model by using the cumulative sum of the recursive residuals. If the blue line falls between the red lines, it is assumed that there are stable parameters. In Figure 4, the CUSUM line lies between the 5% significance level and the model is adequate.

Figure 4. CUSUM Test for Determinants of Private Infrastructure Investment in India.

.jpg/10_1177_25819542241249606-fig4(1)__600x274.jpg)

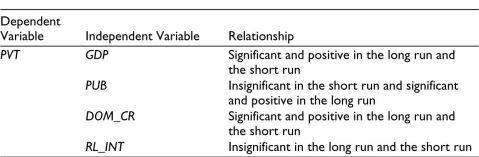

On the basis of the hypothesis formed and the results of the analysis, the conclusion of the study is summarized in Table 9.

Table 9. Relationship Between Macroeconomic Variables and Private Infrastructure Investment in India.

Conclusion and Policy Implications

Based on the results discussed above, it was evident that there exists a long-term relationship between GDP, public infrastructure investment, and domestic credit to the private sector with private infrastructure investment. In the majority of past studies which estimated the determinants of private investment, GDP was a macroeconomic variable which created a positive impact on private investment. It has also received some empirical support that an increase in public investment in infrastructure in the long run will result in attracting more private investment to the sector. Credit given to the private sector by banks created a positive impact on private infrastructure investment in India.

It has been proved that institutional and economic environments have a strong positive impact on the growth of private participation in a country (Fleta-Asín & Muñoz, 2021). India is a developing country where a deficiency of financial resources is an important hurdle to pass. Investment from the private sector is needed to complement public investment in order to solve the resource crunch faced by the country. Private investment, in every sector, except the sectors where the security of the nation matters, must be welcomed. Infrastructure investment is also one of such sectors where a major resource crunch is facing and needs more growth. In order to increase private infrastructure investment in India, the role played by GDP, public infrastructure investment, and domestic credit to the private sector are very important.

It is clear that the impact of the COVID-19 pandemic has changed each and every sector of the economy, and the infrastructure sector is not an exception. According to the World Bank (2020), the global economy shrank tremendously. As private investment is of ultimate importance to the economic growth of the whole world, there is an urgent need to revert the decreasing trend in private infrastructure investment due to COVID-19. As governments around the world restricted movement and business activity in an attempt to slow the spread of the coronavirus, private participation in infrastructure should be welcomed and the government should make adequate steps to provide the much-needed support to private investment.

Limitations and Future Areas of the Study

Capital formation in industry groups of only hard infrastructure was considered as infrastructure investment. Investment in other sectors of infrastructure (importantly, soft infrastructure) such as health care, education, and housing do not come under the purview of the study due to the unavailability of data. Moreover, the capital formation of subsectors under each industry group cannot be alienated due to insufficiency of information.

The current study is focused only on private infrastructure investment. Future studies could look into the macroeconomic determinants of public infrastructure investment in India. Researchers can also extend the model by analyzing the determinants of private investment in various subsectors of infrastructure. The identification of the determining factors of private investment in other sectors of the economy can also be studied.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Nishija Unnikrishnan  https://orcid.org/0009-0007-5683-6500

https://orcid.org/0009-0007-5683-6500

Adugna, H. (2013). Determinants of private investment in Ethiopia. Journal of Economics and Sustainable Development, 4(20), 186–194. https://doi.org/10.1.1.842.2677

Agu, O. C. (2015). Determinants of private investment in Nigeria an econometric analysis. International Journal of Economics, Commerce and Management, 3(4), 1–14.

Amine, O., Zineb, E., & Eddine, K. (2023). Study of the behavioral determinants of investment in the era of the COVID-19 pandemic among socially responsible investors in Morocco. Economic Archive, 20(2), 31–47. https://ideas.repec.org/s/dat/earchi.html

Ammer, M. A., & Aldhyani, T. H. (2022). An investigation into the determinants of investment awareness: Evidence from the young Saudi generation. Sustainability, 14(20), 13454.

Ang, J. B. (2009). Private investment and financial sector policies in India and Malaysia. World Development, 37(7), 1261–1273. https://doi:10.1016/j.worlddev.2008.12.003

Assa, M., & Abdi, E. K. (2012). Selected macroeconomic variables affecting private investement in Malawi. MPRA Paper No.40698. Munich Personal RePEc Archive.

Augustine, K. (2014). Determinants of private sector investment in Ghana, 1970–2011. Kwame Nkrumah University of Science and Technology.

Awad, I. M., Al-Jerashi, G. K., & Alabaddi, Z. A. (2021). Determinants of private domestic investment in Palestine: Time series analysis. Journal of Business and Socio-economic Development, 1(1), 71–86. https://doi:10.1108/JBSED-04-2021-0038

Ayeni, R. K. (2020). Determinants of private sector investment in a less developed country: A case of the Gambia. Cogent Economics & Finance, 8(1), 1794279. https:// doi:10. 1080/23322039.2020.1794279

Bahal, G., Raissi, M., & Tulin, V. (2015). Crowding-out or crowding-in? Public and private investment in India. IMF Working Paper 264.

Bhanumurthy, N. R., Bose, S., & Adhikari, P. D. (2015). Targeting debt and deficits in India: A structural macro-econometric approach. NIPFP Working Paper 2015-148.

Blejer, M. I., & Khan, M. S. (1984). Government policy and private investment in developing countries. IMF Staff Papers, 31(2), 379–403. https://doi.org/10.2307/3866797

Cherkassky, V., & Ma, Y. (2003). Comparison of model selection for regression. Neural Computation, 15(7), 1691–1714. https://doi.org/10.1162/089976603321891864

Chhibber, A., & Kalloor, A. (2017). Reviving private investment in India: Determinants and policy levers (IIEP Working Paper No. 181). www.gwu.edu/~iiep/Working Paper No. 181.

Erden, L., & Holcombe, R. G. (2005). The effects of public investment on private investment in developing economies. Public Finance Review, 33(5), 575–602.

Fleta-Asín, J., & Muñoz, F. (2021). Renewable energy public–private partnerships in developing countries: Determinants of private investment. Sustainable Development, 29(4), 653–670 https://doi.10.1002/sd.2165

Frimpong, J. M., & Marbuah, G. (2010). The determinants of private sector investment in Ghana: An ARDL approach. European Journal of Social Sciences, 15(2), 250–261.

Hailu, D. B., & Debele, F. (2015). The effect of monetary policy on the private sector investment in Ethiopia: ARDL co-integration. Economics 4(2), 22–33.

Jacob, T., Raphael, R., & Antony, A. (2022). Relationship between foreign portfolio investment and exchange rate: The case of India using VECM testing approach. BIMTECH Business Perspectives. https://bsp.bimtech.ac.in/doi/pdf/10.1177/bsp.2022.3.2.28.pdf

Jalloh, M. (2014). Private sector investment in Sierra Leone: An analysis of the macroeconomic determinants. Kenya: The African Economic Research Consortium.

Joseph, K. J., Singh, L., & Abraham, V. (2018). Dealing with the innovation–inequality conundrum: The Indian experience. In Inequality and development challenges (pp. 149–189). Routledge India.

Kaputo, C. C. (2011). Macroeconomic policy and domestic private investment: The case of Zambia, 1980–2008. University of Zambia.

Khan, M. S., & Reinhart, C. M. (1990). Private investment and economic growth in developing countries. World development, 18(1), 19–27.

Lugo, O. M. (2008). The differential impact of real interest rates and credit availability on private investment: Evidence from Venezuela. In Transmission mechanisms for monetary policy in emerging market economies 35(1), pp. 501–537). Bank for International Settlements. http://www.bis.org/publ/bppdf/bispap35y.pdf

Majeed, M. T., & Khan, S. (2008). The determinants of private investment and the relationship between public and private investment in Pakistan. MPRA Paper No. 49301. Munich Personal RePEc Archive.

Mallick, S. K. (2002). Determinants of long-term growth in India: A Keynesian approach. Progress in Development Studies, 2(4), 306–324. https://doi.org/10.1.1.498.5126

Mbaye, E. Z. (2014). Determinants of domestic private investments in Kenya. University of Nairobi.

Mishra, A. K., Narendra, K., & Kar, B. P. (2013). Growth and infrastructure investment in India: Achievements, challenges, and opportunities. Economic Annals, 58(196), 51–70.

Mitra, P. (2006). Has government investment crowded out private investment in India? American Economic Review, 96(2), 337–341. https://doi.org/10.1257/000282806777 211621

Molapo, S., & Damane, M. (2015). Determinants of private investment in Lesotho. European Scientific Journal, 11(34), 473–491.

Mueller, P. (2013). Adam Smith, politics, and natural liberty. http://dx.doi.org/10.2139/ssrn.2354960

Murthy, K. N., & Soumya, A. (2006). Effects of public investment in infrastructure on growth and poverty in India. Indira Gandhi Institute of Development Research Working Papers 2006-006.

Murthy, K. N., & Soumya, A. (2011). Macro-economic effects of public investment in infrastructure in India. International Journal of Trade and Global Markets, 4(2), 187–211. https://doi.org/10.1504/IJTGM.2011.039323

Naa-Idar, F., Ayentimi, D. T., & Frimpong, J. M. (2012). A time series analysis of determinants of private investment in Ghana (1960–2010). Journal of Economics and Sustainable Development, 3(13), 23–33.

Ouattara, B. (2004). Modelling the long run determinants of private investment in Senegal. Econstor. CREDIT Research Paper, No. 04/05.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bound test approaches for analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/ 10.1002/jae.616

Pradhan, A. K., & Hiremath, G. S. (2020). The capital flight from India: A case of missing woods for trees? The Singapore Economic Review, 65(2), 365–383. https://doi:10.1142/S0217590816500429

Shanmugam, M. (2017). Does public investment crowd-out private investment in India. Journal of Financial Economic Policy, 9(1), 1–27. https://doi:10.1108/JFEP-02-2016-0016

Unnikrishnan, N., & Kattookaran, T. P. (2020). Impact of public and private infrastructure investment on economic growth: Evidence from India. Journal of Infrastructure Development, 12(2), 119–138. https://doi.org/10.1177/0974930620961477

Varshney, S. (2008). Financing of infrastructural development in India since 1991. Aligarh Muslim University.