1 Department of Economics, Indian Institute of Foreign Trade, Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This perspective seeks to elucidate the trends and patterns in India’s luxury goods market. The country has seen a rise in its youth population over the past decade. In addition, economic prosperity has increased. This bodes well for the prospects of the country’s luxury goods industry. However, the same has not happened. On the contrary, using data and analysis from Statista and ITC Trade Map for select categories of luxury goods, namely, luxury leather goods, luxury watches and jewellery, luxury fashion (high-end apparels and footwear), luxury eyewear, luxury cosmetics and fragrances, including select skin care products, it is evident that India’s luxury goods market could perform better in terms of revenue generation, market footprint and trends in trade. Desirable outcomes on this front could be attained if certain policy stances of the likes of making the luxury markets less overcrowded and more spacious, curbing the flow of counterfeits from domestic markets, reducing import duties and taxes on luxury goods, upgrading the managerial skills of staff involved in day-to-day supervisory operations and embracing sustainable practices are adopted.

India, luxury, luxury goods, patterns, trends

Introduction

Luxury could be defined as ‘the comfort provided by expensive and beautiful belongings, surroundings and food or something enjoyable and expensive but not necessary for human survival’ (Cambridge Dictionary, 2024). The fundamental principle for comprehending luxury lies in the notion of exclusivity. This exclusivity is primarily upheld through elevated prices, alongside a deliberate restriction of sales volumes and distribution channels. According to Statista, luxury goods consist of exceptionally exclusive personal items that reflect the tastes and status of their owners (Statista, 2024).

Currently, in India, the Northern region leads the market, possessing a substantial market share of approximately 35.45% in 2024–2025. This market growth is propelled by rising disposable incomes, an expanding middle and upper class, and an increasing consumer interest in premium experiences. Furthermore, the heightened demand for personalised luxury, along with shifting consumer preferences towards exclusivity and customisation, is contributing to the market’s growth, rendering luxury goods more accessible and appealing throughout India. Additionally, the swift expansion of e-commerce platforms has opened new avenues for luxury brands to connect with tech-savvy urban consumers, thereby enhancing the market share of luxury goods in India (IMARC, 2025).

The consistent increase in disposable incomes among Indian consumers is a crucial element that positively influences the market. With the Indian economy expanding and wages on the rise, consumers are equipped with more disposable income to allocate towards discretionary products. According to an industry report, Indian private consumption has nearly doubled to USD 2.1 trillion in 2024, reflecting robust growth in consumer purchasing power (Business Standard, 2025; IMARC, 2025; Press Trust of India, 2025). This trend is leading to a heightened demand for premium goods and services, particularly in urban regions. Furthermore, the rise in income levels is driven by the expansion of key sectors such as information technology, finance, and manufacturing, where salary scales and career opportunities are continually improving. Additionally, government initiatives that promote economic growth, along with the rapidly expanding middle class, are significant contributors to the increase in disposable income. The result of this growing disposable income is the emergence of a consumer class that is now financially positioned to indulge in luxury items such as designer apparel, fine dining, high-end automobiles, and premium travel (IMARC, 2025).

Broadly, the luxury goods market is divided into the following five segments. First, luxury leather goods encompass a range of products, including handbags, suitcases, briefcases, and smaller items such as wallets (Statista, 2024). Second, luxury watches and jewellery, often referred to as ‘hard luxury’, are distinguished from fashion and accessories, which utilise relatively ‘soft’ materials. This segment’s definition aligns broadly with the Consumer Market Insights Watches and Jewellery Segment within the Accessories market, focusing solely on the sales of luxury brands (McKinsey, 2025; Statista, 2024). Third, luxury fashion comprises luxury apparel and footwear, which includes designer clothing and accessories that are produced as ‘ready-to-wear’, along with leather shoes, athletic footwear, sneakers, textile shoes, sandals and other types of footwear. The definition of this segment is consistent with the Consumer Market Insights Apparel and Footwear markets, concentrating exclusively on the sales of luxury brands (Statista, 2024). Fourth, luxury eyewear includes both eyewear frames and sunglasses. The market definition adheres to the Consumer Market Insights Eyewear market, with a focus on the super-premium to luxury price range, excluding lenses and contact lenses (Statista, 2024). Fifth, Prestige Cosmetics and Fragrances consist of prestige skin care, prestige fragrances and prestige cosmetics, which include subcategories for Eyes, Face and Lips, all related to decorative cosmetics. The market definition aligns with the Consumer Market Insights Beauty and Personal Care Cosmetics and Skin Care markets, emphasising only the super- and ultra-premium ranges, while excluding hair care, oral care and personal hygiene products (Statista, 2024).

Of late, the global luxury goods market is reeling under shifting macroeconomic headwinds, fluctuating client preferences and unattractive value propositions. Year 2025 is marked by the luxury goods segment being hit hard by the impending global slowdown, thanks to a host of unfavourable macroeconomic factors. Some of these could be listed as follows. Price hikes have hit a peak, and elevated prices are adversely impacting demand from aspirational luxury consumers. Macroeconomic challenges—particularly in the crucial Chinese market—are significantly burdening the sector. At the same time, the luxury clientele is becoming increasingly diverse, and their relationship with luxury goods is more intricate than ever before. It is crucial to have a distinct value proposition that resonates with this varied client base, especially in light of the expected low-growth climate. Moreover, clients are showing a growing interest in luxury experiences rather than merely luxury products. This shift introduces new trade-offs for clients to evaluate, necessitating that personal-luxury-goods brands surpass the heightened expectations of clients to secure spending on luxury travel and wellness experiences, for instance. However, the challenges facing the luxury industry are also somewhat self-inflicted. The sector’s swift growth over the last 5 years has resulted in overexposure, undermining the industry’s commitment to exclusivity, creativity, and craftsmanship. While brands have raised prices, some have not adequately adjusted their creative strategies and supply chains to accommodate the new scale of demands, thereby diluting their core value proposition and ultimately failing to fulfil their commitments to clients, leaving behind a trail of dissatisfied customers (McKinsey, 2025).

In light of the discussion so far, this perspective seeks to discuss the trends and patterns in India’s luxury goods market, a fad with the changing socio-economic contours of the country. An increasingly aspirational and prosperous populace seeks to purchase those goods and services that were seemingly out of their reach earlier, thanks to the exclusivity and selectiveness associated with them. Upward mobility is one of the major factors responsible for the growing demand for luxury goods in India.

This article is divided into the following segments. The first section introduces the focus theme. The second explains the key highlights of the luxury goods market in India. The third explicates the trends and patterns of exports and imports in India’s luxury goods segment. The last section concludes this study and lists its future policy implications.

The next segment lists the key highlights of the luxury goods market in India.

Key Highlights of the Luxury Goods Market in India

Any market could chiefly be defined in terms of a few attributes such as revenue and average revenue per capita, company shares and sales channels. On the basis of these factors, some of the prominent players in the international luxury goods segment are LVMH Moët Hennessy-Louis Vuitton SE, Kering SA, Compagnie Financière Richemont SA, The Estée Lauder Companies Inc. and Chanel Limited (Statista, 2024). These players have been shown as part of the competitive landscape and have a revenue of more than USD 150 million per year. All data pertaining to markets and companies’ shares always refer to the retail value (including sales taxes) (Statista, 2024).

In India, the luxury goods market could be characterised by the following trends.

First, a consistent increase in disposable incomes among consumers in India is a crucial element that positively influences the market. With the Indian economy expanding and wages on the rise, consumers now possess greater disposable income to allocate towards discretionary items. According to an industry report, private consumption in India has nearly doubled to USD 2.1 trillion in 2024, indicating robust growth in consumer purchasing power. This trend is leading to a heightened demand for premium goods and services, particularly in urban regions. Furthermore, the rise in income levels is driven by the expansion of key sectors such as information technology, finance, and manufacturing, where salary scales and career opportunities are continually improving. Additionally, government initiatives that promote economic growth, along with the rapidly expanding middle class, are significant contributors to the increase in disposable income. The result of this growing disposable income is the emergence of a consumer class that is now financially equipped to indulge in luxury items such as designer apparel, fine dining, high-end automobiles, and premium travel experiences (IMARC, 2025).

Second, the swift development of India’s middle and upper classes serves as a significant factor driving the growth of the luxury goods market in India. As the economy continues to rise, an increasing number of individuals are moving into the middle-income bracket, thereby enhancing the overall market for luxury products. Enhanced access to education, career opportunities, and lucrative employment has empowered these consumers with the financial means to purchase luxury items such as high-end fashion, luxury vehicles, and designer accessories. Additionally, the emergence of the ‘upper middle class’, characterised by individuals with higher incomes and assets, further reinforces this trend. An industry analysis predicts that the share of India’s middle class will nearly double to 61% of the population by 2047, indicating a long-term structural shift in consumer demographics that favours luxury expenditure. The expansion of the middle and upper classes is also encouraging luxury brands to launch more affordable yet premium products, targeting this expanding demographic (IMARC, 2025).

Third, the rapid growth of e-commerce platforms is transforming the way luxury goods are marketed and purchased in India, which is creating a positive Indian luxury goods market outlook. Online shopping offers Indian buyers unmatched access to a vast array of luxury products, bypassing geographic barriers and providing convenience at their fingertips. As consumers in urban and semi-urban regions increasingly adopt online shopping, luxury brands are using digital platforms to connect directly with a technologically savvy audience. It is particularly effective for the younger generations, who find it convenient and flexible to buy luxury products online. As per industry reports, the e-commerce market in India is projected to reach USD 163 billion by 2026, with a CAGR of 27%. This strong growth presents luxury brands with a great chance to increase their market coverage through e-commerce, leveraging an increasing base of digitally connected consumers. As Indian consumers increasingly adopt e-tailing, it is likely to keep reshaping the luxury goods market, offering brands a powerful means of addressing changing consumer desires (IMARC, 2025).

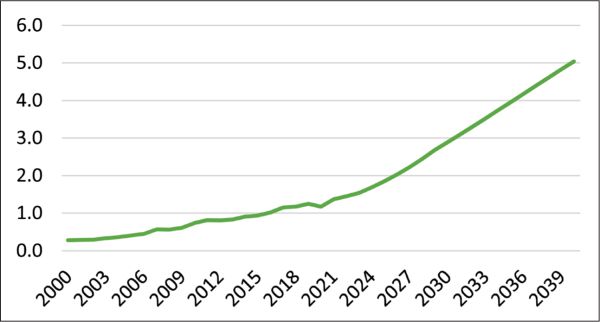

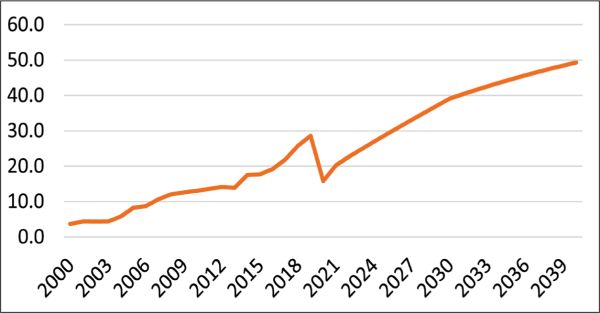

As Figure 1 shows, per capita consumer spending in India shows (and is also expected to show) a discernible upward trend from 2000 to 2040 as per Statista (2024). The same would translate into higher purchases of luxury goods, with increasing disposable incomes and a dynamic, young population (Statista, 2024). Another key indicator of luxury, international tourism expenditure, also shows an upward trend, based on actual and extrapolated values for 2000–2040 (Statista, 2024). The same depicts affluence in the Indian society. Figure 2 shows the graph for international tourism expenditure in the country.

Figure 1.Consumer Spending (per Capita) in India (Thousand USD).

Source: Statista (2024).

Figure 2.International Tourism Expenditure by Indians (Billion USD).

Source: Statista (2024).

Major Categories of Luxury Goods in India

The luxury goods market in India is diverse and comprises segments of the likes of luxury leather goods, luxury watches and jewellery, luxury fashion (high-end apparel and footwear), luxury eyewear, luxury cosmetics and fragrances, including select skin care products (Statista, 2024).

Major Takeaways from India’s Luxury Goods Market

There are certain features/achievements in the country’s luxury goods market. First, in 2024, revenue in the luxury goods market would amount to USD 17.67 billion. This market is expected to grow annually by 3.17% (when calculated on the basis of compounded annual growth rate, CAGR from 2024 to 2029). Second, the largest segment in luxury goods is of luxury watches and jewellery with a market volume of USD 11.32 billion in 2024. Third, 1% of total revenue would be generated through online sales by 2024–2025 in the luxury goods market in India. Fourth, India is still a relative laggard when it comes to revenue generation through the luxury goods segment, especially in comparison to China, where more than USD 100 billion in revenue is expected to be generated by the end of 2024–2025. Fifth, in relation to total population figures, per person revenues of USD 12.26 are expected to be generated in 2024–2025 (Statista, 2024).

The succeeding segment discusses the trends and patterns of trade in India’s luxury goods market.

Trends and Patterns of Exports and Imports in India’s Luxury Goods Market

Prior to ascertaining conclusive trends and patterns in India’s luxury goods market, it is imperative to study the export–import trends in the same, for they constitute an important factor in the growth potential of the country’s luxury goods market. For the purpose of this analysis, data from ITC Trade Map is utilised for all the major categories of luxury goods in India (luxury leather goods, luxury watches and jewellery, luxury fashion [high-end apparels and footwear], luxury eyewear, luxury cosmetics and fragrances, including select skin care products, represented variously by HS codes at 2-digit levels, 41, 91, 71, 61, 62, 64, 90 and 33, respectively) (ITC Trade Map, 2024).

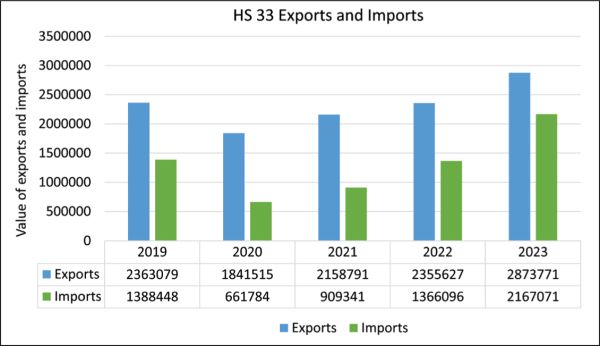

As Figure 3 depicts, over the 5-year period 2019–2023, India’s exports of HS 33 (broadly corresponding to luxury cosmetics and fragrances) outweigh imports of the same.

Figure 3. India’s Export–Import Trends in HS 33 (Luxury Cosmetics and Fragrances).

Source: ITC Trade Map (2024).

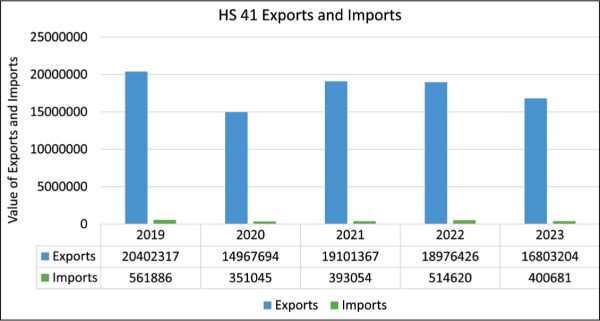

As Figure 4 depicts, over the 5-year period 2019–2023, India’s exports of HS 41 (broadly corresponding to luxury leather goods) outweigh imports of the same.

Figure 4. India’s Export–Import Trends in HS 41 (Luxury Leather Goods).

Source: ITC Trade Map (2024).

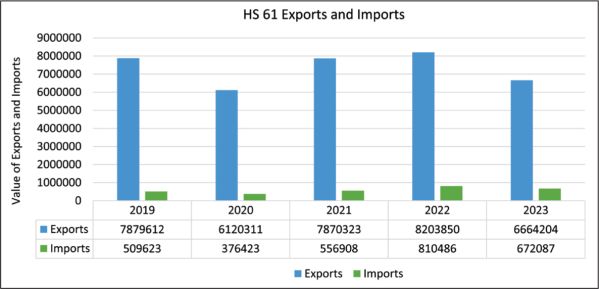

As Figure 5 depicts, over the 5-year period 2019–2023, India’s exports of HS 61 (broadly corresponding to the knitted or crocheted sub-category of luxury apparel) outweigh imports of the same.

Figure 5. India’s Export–Import Trends in HS 61 (Articles of Clothing and Apparel, Knitted or Crocheted; a Sub-category of Luxury Apparel).

Source: ITC Trade Map (2024).

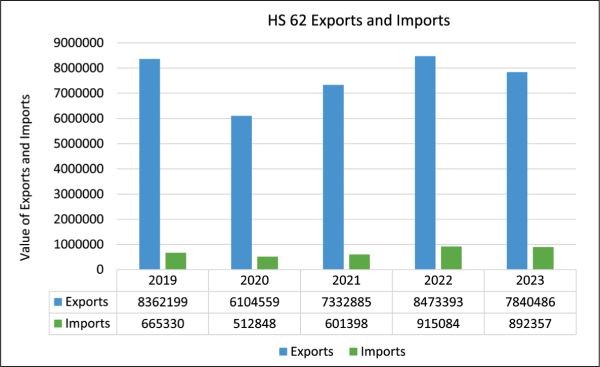

As Figure 6 depicts, over the 5-year period 2019–2023, India’s exports of HS 62 (broadly corresponding to neither knitted nor crocheted sub-category of luxury apparel) outweigh imports of the same.

Figure 6. India’s Export–Import Trends in HS 62 (Articles of Clothing and Apparel, Not Knitted or Crocheted; a Sub-category of Luxury Apparel).

Source: ITC Trade Map (2024).

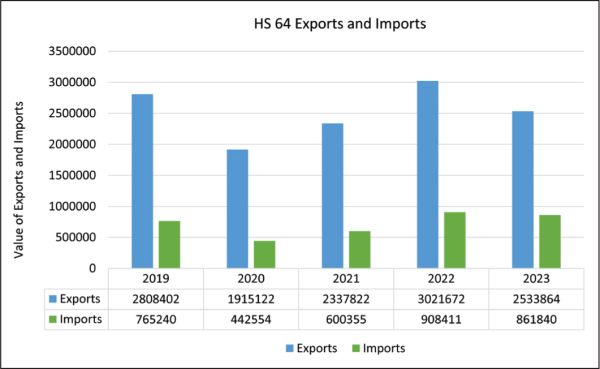

As Figure 7 depicts, over the 5-year period 2019–2023, India’s exports of HS 64 (broadly corresponding to the footwear and gaiters sub-category of luxury footwear) outweigh imports of the same.

Figure 7.India’s Export–Import Trends in HS 64 (Luxury Footwear).

Source: ITC Trade Map (2024).

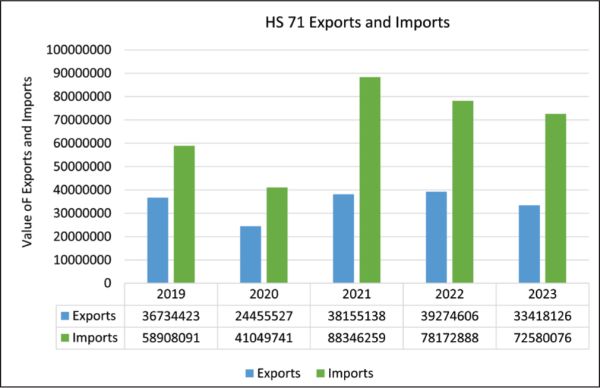

As Figure 8 depicts, over the 5-year period 2019–2023, India’s exports of HS 71 (broadly corresponding to the category of luxury jewellery) outweigh imports of the same.

Figure 8.India’s Export–Import Trends in HS 71 (Luxury Jewellery).

Source: ITC Trade Map (2024).

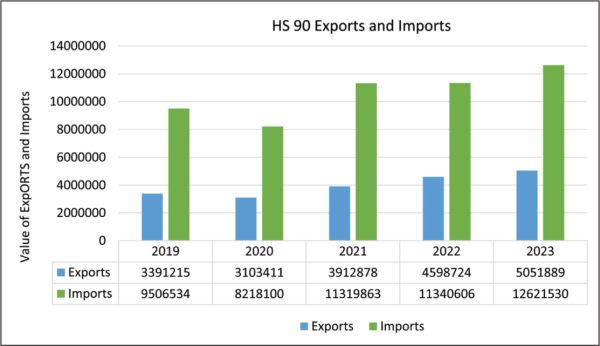

As Figure 9 depicts, over the 5-year period 2019–2023, India’s exports of HS 90 (broadly corresponding to the category of luxury eyewear) outweigh imports of the same.

Figure 9.India’s Export–Import Trends in HS 90 (Luxury Eyewear).

Source: ITC Trade Map (2024).

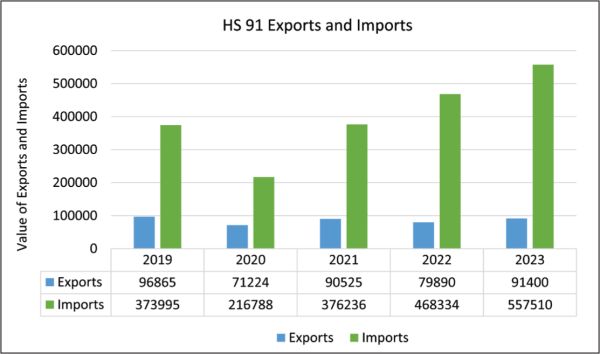

As Figure 10 depicts, over the 5-year period 2019–2023, India’s exports of HS 91 (broadly corresponding to the category of luxury watches) outweigh imports of the same.

Figure 10.India’s Export–Import Trends in HS 91 (Luxury Watches).

Source: ITC Trade Map (2024).

The performance on the front of exports for these luxury goods categories (or proxies of the same) is satisfactory. However, when it comes to imports, the same is less than adequate, despite a steady rise in the number of ultra-high net worth individuals (UHNIs) and a brand-conscious youth population, owing to a number of reasons. First, the country’s luxury markets are overcrowded and lack exclusivity. Second, counterfeits pose another major challenge to stakeholders in this industry. These impede the whole-hearted development of the niche luxury goods market in the country. Third, high import duties and taxes on luxury goods discourage their large-scale consumption-cum-penetration in India. Fourth, there is a persistent lack of suitable and spacious infrastructure, along with low-skilled managers who are ill-equipped to handle luxury goods marketing effectively. These challenges are acting as an impediment to the success of the country’s luxury goods markets (Singh & Gupta, 2019).

The next section concludes this perspective and lists its future policy implications.

Conclusion & Future Policy Implications

The luxury market holds tremendous potential in India, both for domestic and homegrown brands.

This is on account of impressive revenue growth in the country, brought about by a young, dynamic population with larger disposable incomes and online sales. However, India is still a relative laggard when it comes to revenue generation through the luxury goods segment, especially in comparison to China, where more than USD 100 billion in revenue is expected to be generated by the end of 2024–2025. There is scope for further market expansion and penetration, especially in relation to total population figures. Per-person revenues of USD 12.26 are expected to be generated in 2024–2025 as per current trends (Statista, 2024).

Despite the promise shown by luxury goods in terms of revenue generation, market footprint and trends in exports and imports, there are a few challenges that must be effectively met to ensure the success of the premium goods segment in India. Likewise, policymakers and stakeholders in this sector must focus on the following. First, the country’s luxury markets should be made less overcrowded by locating them on the outskirts of the city, as is done in Europe and the USA. Second, counterfeits should be discouraged from the domestic markets. For this purpose, stricter enforcement of rules and regulations must be the norm. Third, import duties and taxes on luxury goods should be slashed to encourage their large-scale adoption by the affluent classes. Fourth, the managerial skills of staff involved in day-to-day supervision of luxury goods markets should be upgraded in line with prevalent global practices in this domain. Last, the country’s luxury goods industry must seek to adopt sustainable practices to keep pace with changing customer tastes and preferences, while also carving a special place in India’s markets (Ahmad & Dubey, 2024; Kapferer & Michaut-Denizeau, 2015, 2019).

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Kanupriya  https://orcid.org/0000-0002-4186-4070

https://orcid.org/0000-0002-4186-4070

Ahmad, G., & Dubey, S. K. (2024). Sustainable luxury fashion in India: A case of Grassroot by Anita Dongre. Emerging Economies Cases Journal, 6(1), 48–58.

Business Standard. (2025, February 27). India’s private consumption almost doubles to $2.1 trillion in 2024: Report. Retrieved, 22 August 2025, from https://www.business-standard.com/india-news/india-s-private-consumption-almost-doubles-to-2-1-trn-in-2024-report-125022700698_1.html

Cambridge Dictionary. (2024). Luxury. Retrieved, 22 August 2025, from https://dictionary.cambridge.org/us/dictionary/english/luxury

IMARC. (2025). India luxury goods market size, share, trends and forecast by product type, distribution channel, end user and region, 2025–2033. Retrieved, 22 August 2025, from https://www.imarcgroup.com/india-luxury-goods-market

ITC Trade Map. (2024). Trade statistics for international business development. Retrieved, 22 August 2025, from https://www.trademap.org/Index.aspx?AspxAutoDetectCookieSupport=1

Kapferer, J. N., & Michaut-Denizeau, A. (2015). Luxury and sustainability: A common future? The match depends on how consumers define luxury. Luxury Research Journal, 1(1), 3–17.

Kapferer, J. N., & Michaut-Denizeau, A. (2019). Are millennials really more sensitive to sustainable luxury? A cross-generational international comparison of sustainability consciousness when buying luxury. Journal of Brand Management, 27(1), 35–47.

McKinsey. (2025). The state of luxury: How to navigate a slowdown. Retrieved, 22 August 2025, from https://www.mckinsey.com/industries/retail/our-insights/state-of-luxury

Press Trust of India. (2025, February 27). India private consumption at $2.1 trillion, set to be 3rd largest consumer market by 2026: Report. Outlook Business. Retrieved, 22 August 2025, from https://www.outlookbusiness.com/economy-and-policy/india-private-consumption-at-21-trillion-set-to-be-3rd-largest-consumer-market-by-2026-report

Singh, S., & Gupta, V. (2019). Luxury brand market in India: Recent trends, challenges and opportunities. Asian Journal of Managerial Science, 8(2), 104–107. https://www.trp.org.in/wp-content/uploads/2019/05/AJMS-Vol.8-No.2-April-June-2019-pp.-104-107.pdf

Statista. (2024). Luxury goods in India. Retrieved, 22 August 2025, from https://www.statista.com/outlook/cmo/luxury-goods/india