1 Department of Business Economics, University of Vavuniya, Northern Province, Sri Lanka

2 Independent Researcher, Vavuniya, Northern Province, Sri Lanka

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This study investigates the role of bank lending in fostering economic growth in Sri Lanka over the period 1991–2023. As a critical financial intermediary, bank lending facilitates the allocation of capital toward productive investment and economic development. Despite its importance, empirical evidence on the causal impact of bank credit on Sri Lanka’s economic performance remains limited. Using the Autoregressive Distributed Lag (ARDL) Bounds Testing approach, the study examines the short-run and long-run dynamics between Gross Domestic Product (GDP) growth and key financial and macroeconomic variables, including bank lending rates (BLR), private-sector credit, credit-deposit ratio (CDR), inflation (INF), labour force participation, trade openness, and gross capital formation. The findings reveal that credit to the private sector (CPS) unidirectionally drives GDP growth (GDPG), while the reverse relationship is not significant, confirming that bank lending is a key driver of economic expansion rather than merely responding to growth. Other variables, such as trade openness, the CDR, and labour force participation, exhibit bidirectional causality with GDP, highlighting complex feedback mechanisms within the economy. These results underscore the importance of enhancing access to credit and improving the efficiency of lending mechanisms. The study concludes with policy recommendations aimed at reinforcing the banking sector’s role in promoting sustainable and inclusive economic growth in Sri Lanka.

ARDL bound test, bank lending, economic growth, private-sector credit, Sri Lanka

Introduction

Bank lending plays a vital role in economic development by mobilising savings and channelling credit into productive sectors. It supports investment, entrepreneurship, and consumption, thereby influencing both the pace and structure of economic growth. A well-functioning banking system contributes to efficient capital allocation, risk diversification, and liquidity provision. According to Levine (2005) and Levine et al. (2000), economies with more developed banking sectors tend to experience higher and more inclusive growth, as financial intermediation fosters productive investment and enhances economic efficiency.

In Sri Lanka, bank credit constitutes the largest share of domestic financial intermediation and serves as a primary source of finance for households and firms. As the country continues to face persistent challenges—including sluggish Gross Domestic Product (GDP) growth, mounting public debt, inflationary pressures, and the lingering effects of the COVID-19 crisis—the importance of bank lending in reviving economic activity has become increasingly significant. Historically, credit flows from the banking system have supported capital formation and investments in agriculture, industry, infrastructure, and services (Central Bank of Sri Lanka, 2022). Small and medium-sized enterprises (SMEs), which account for over 52% of GDP and provide the majority of private-sector employment, are particularly reliant on bank loans for expansion and sustainability (Asian Development Bank, 2020).

Empirical research examining the credit-growth nexus in Sri Lanka provides mixed evidence. Edirisuriya (2007) noted that despite financial sector reforms since the late 1970s, structural inefficiencies in the banking sector limited its contribution to growth. Similarly, Perera and Liyanage (2012) found that bank lending did not exert a statistically significant impact on GDP growth (GDPG) once other macroeconomic variables were considered, suggesting that the influence of credit may be indirect or hindered by inefficiencies. In contrast, recent evidence from Ganepola and Jayasinghe (2023) shows a strong positive relationship between private-sector credit and economic growth, underscoring the potential role of bank lending in stimulating economic activity. These divergent findings highlight the need for further empirical investigation.

This ambiguity underscores a critical research gap, particularly in the Sri Lankan context, namely the direction of causality between bank lending and economic growth—whether bank lending drives growth or economic growth stimulates credit demand. Addressing this gap, the present study empirically examines the relationship between bank lending and economic growth in Sri Lanka over the period 1991–2023. Specifically, the analysis explores both short- and long-run dynamics, incorporating key macroeconomic indicators such as GDPG, private-sector credit, lending rates, inflation (INF), labour force participation, trade openness, and gross capital formation.

The study is guided by two hypotheses developed from theoretical and empirical insights: the first proposes that bank lending has a significant positive impact on economic growth in the short run, as increased access to credit enhances investment, stimulates aggregate demand, and supports productive activity; the second extends this relationship to the long run, suggesting that sustained bank lending contributes to capital formation, industrial expansion, and structural transformation, thereby promoting stable economic growth.

The findings confirm that private-sector credit, labour force participation, and trade openness positively and significantly influence economic growth in both the short run and the long run. The error correction mechanism indicates a stable long-run equilibrium relationship, while diagnostic tests validate the reliability and robustness of the estimated models. By empirically testing these hypotheses, the study contributes to the broader discourse on financial intermediation and growth, offering policy-relevant insights into how the structure and direction of bank lending can support inclusive and sustainable development in Sri Lanka.

The Granger causality results from our study indicate that private-sector credit unidirectionally drives GDPG, whereas the reverse effect is not statistically significant. This confirms that bank lending in Sri Lanka acts as a key driver of economic expansion rather than merely responding to growth. In addition, variables such as trade openness, credit-deposit ratio (CDR), and labour force participation exhibit bidirectional causality with GDP, highlighting complex feedback mechanisms in the economy. These findings provide clear evidence of the causal role of bank lending in facilitating investment, capital formation, and productive activity, supporting GDPG over the study period.

The remainder of this article is structured as follows: The second section provides a comprehensive review of the theoretical and empirical literature relevant to the relationship between bank lending and economic growth. The third section examines the trends and patterns of bank lending in Sri Lanka over the study period. The fourth section describes the econometric methodology employed in the analysis, while the fifth section presents and interprets the empirical results. Finally, the sixth section concludes the study by summarising the key findings and discussing policy implications.

Literature Review

Theoretical Literature

Bank lending plays a crucial role in economic development by mobilising savings and directing credit to productive sectors, thereby fostering investment, entrepreneurship, and consumption. This relationship is well-grounded in key economic theories such as financial intermediation theory, endogenous growth theory, and the various finance-growth causality hypotheses.

According to the financial intermediation theory, banks serve as intermediaries by channelling funds from savers to borrowers, facilitating efficient capital allocation, reducing transaction costs, and managing risks. This role is fundamental in supporting productive investments that drive economic growth (Boyd & Prescott, 1986; Diamond, 1984). In developing economies like Sri Lanka, the effectiveness of bank lending strongly influences the flow of capital to sectors critical for economic expansion.

The endogenous growth theory (Lucas, 1988; Romer, 1986) highlights how financial sector improvements enhance growth by increasing investment efficiency, supporting innovation, and channelling savings into productive uses. Banks are instrumental in financing projects that improve human capital and technological progress, especially relevant to Sri Lanka’s ongoing industrial and infrastructure development (Levine, 2005).

The relationship between financial development and growth is further explored through three causality hypotheses: The supply-leading hypothesis posits that financial sector development, especially bank lending, initiates economic growth by providing credit essential for investment and productivity gains (McKinnon, 1970; Shaw, 1973). The demand-following hypothesis argues that economic growth drives financial development, as expanding economies create greater demand for credit (Robinson, 1952). The feedback hypothesis suggests a bidirectional relationship where finance and growth mutually reinforce each other (Awdeh, 2012; Patrick, 1966).

The Wicksellian theory adds that the relationship between interest rates and economic growth is mediated by credit availability, emphasising the central bank’s role in maintaining equilibrium via monetary policy (Wicksell, 1936). The credit channel theory also underscores how monetary policy influences economic activity by affecting bank lending conditions (Bernanke & Gertler, 1995). Finally, financial liberalisation is theorised to enhance banking efficiency, increase competition, and improve credit access, thereby fostering growth (Bumann et al., 2013; Shaw, 1973). Sri Lanka’s financial liberalisation reforms have been critical in expanding credit and modernising banking services.

Empirical Literature

The relationship between bank lending and economic growth has long been a focus of empirical investigation. Early foundational studies provided strong evidence of a positive linkage between financial development and economic performance. King and Levine (1993) demonstrated that financial deepening, particularly measured through private-sector credit as a percentage of GDP, significantly enhances long-term economic growth. Building on this, Arestis and Demetriades (1997) argued that financial development improves resource allocation by directing credit to high-productivity sectors, fostering sustained economic expansion. Levine (2005) further reinforced these findings, emphasising that banks, as core financial intermediaries, facilitate savings mobilisation, risk diversification, and efficient capital allocation—key ingredients for economic development.

During the 2000s, empirical attention turned toward specific country contexts and methodologies. Mishra et al. (2009) studied India’s financial sector using a VAR framework and Granger causality tests, revealing a dynamic relationship where economic growth stimulated credit market development. Rexiang and Rathanasiri (2011), focusing on Sri Lanka, found that credit flow to the private-sector contributed positively to economic growth. However, the study cautioned that inefficiencies and non-performing loans (NPLs) in the banking sector undermined this relationship.

In the early 2010s, country-specific and regional studies continued to support the role of bank lending in promoting economic activity. Zhang et al. (2012) examined China’s financial development and concluded that conventional indicators like deposits and savings supported growth, while a higher proportion of corporate deposits had a dampening effect. Chirwa and Odhiambo (2016) reported similar findings for sub-Saharan Africa, where access to private-sector credit was found to be a key determinant of economic growth, especially in the presence of well-functioning financial institutions. In Sri Lanka, International Monetary Fund (2023) emphasised that while credit expansion contributed to growth, operational inefficiencies and high NPLs in state-owned banks continued to restrict the full impact of lending.

The late 2010s saw an increased focus on financial inclusion and institutional efficiency. Asian Development Bank (2020) stressed the importance of expanding access to banking services in Sri Lanka, especially for SMEs, to strengthen the link between credit and growth. Khan (2008) applied the Autoregressive Distributed Lag (ARDL) model to Pakistan and confirmed that bank lending positively influences GDP in both the short and long term. These studies collectively highlighted that the short-run impact of credit tends to be more prominent, though long-term gains depend on institutional quality and credit allocation efficiency.

Entering the 2020s, researchers and international institutions increasingly stressed that Sri Lanka’s banking sector, while central to credit expansion and growth, remained constrained by structural weaknesses and governance challenges. Ramya et al. (2021) used data from 1989 to 2018 and observed a strong positive relationship between bank lending and GDPG in Sri Lanka, particularly during the economic recovery period. Similarly, Levine (2021) found that financial depth and efficiency, particularly measured by private credit to GDP, are strongly associated with long-run economic growth. However, Rathnayake and Dissanayake (2022) cautioned that persistent inefficiencies, especially within state-owned banks and rising levels of NPLs, continued to constrain the growth potential of bank credit. Further, Ganepola and Jayasinghe (2023) used ARDL models to confirm both short- and long-run relationships between Sri Lanka’s financial development and economic output. Their findings emphasised the role of efficient capital allocation in sustaining growth.

The International Monetary Fund (2023) Governance Diagnostic Assessment reported that state-owned banks continue to face high NPLs, weak credit risk management, and political interference, which limit their developmental contribution. Similarly, the International Monetary Fund (2024a) Article IV Consultation noted that Sri Lanka’s banks face elevated credit risks in private loan portfolios, narrowing net interest margins, and heavy exposure to the public sector, all of which undermine financial intermediation and growth. To address these issues, reforms have been initiated, including bank recapitalisation plans, new legislative frameworks for bank resolution, and governance reforms mandating state banks to operate with greater independence and professional oversight. These efforts are intended to restore banking stability and strengthen the role of credit in supporting long-term economic growth.

The Trends and Patterns of Bank Lending in Sri Lanka

Over the past three decades, Sri Lanka’s bank lending landscape has undergone notable transformations, shaped by economic liberalisation, financial crises, and technological innovation. Bank lending—particularly credit to the private sector—has exhibited cyclical fluctuations, mirroring the broader economic environment and the evolving capacity of the banking sector. One of the key indicators of financial sector performance, private-sector credit as a percentage of GDP, has seen significant changes during this period.

In the early 1990s, Sri Lanka’s bank lending to GDP ratio remained relatively low, largely due to a nascent financial system and limited access to credit outside urban centres. Financial intermediation was underdeveloped, and credit allocation was constrained by regulatory barriers and limited banking outreach. However, structural reforms and liberalisation during the late 1990s and early 2000s led to rapid expansion in the banking sector. With increased competition, product innovation, and enhanced financial access, private-sector credit rose steadily. By 2015, Sri Lanka’s private-sector credit stood at approximately 41.5% of GDP, reflecting the growing importance of bank finance in supporting economic activities (World Bank, 2021).

The period from 2010 to 2017 marked a high-growth phase for bank lending, driven by favourable interest rates, rising consumer demand, and an expanding middle class. During this time, private-sector credit peaked at around 45%–46% of GDP. However, this upward trajectory began to reverse due to macroeconomic pressures, including fiscal instability, weakening investor confidence, and mounting public debt. The situation worsened after 2019 as Sri Lanka faced a severe economic downturn, intensified by the COVID-19 pandemic. Businesses and households became risk-averse, while banks tightened lending criteria due to growing credit risk. Consequently, lending activity slowed significantly, and the NPLs ratio escalated, reflecting deteriorating asset quality across the sector.

By 2022–2023, signs of stabilisation began to emerge following interventionist policies and international financial assistance. Structural reforms and monetary tightening by the Central Bank, combined with debt restructuring negotiations, began to restore market confidence. As a result, private-sector lending began to recover in 2024. According to the Central Bank of Sri Lanka (2024), commercial banks expanded credit to the private sector by LKR 146 billion in the first half of 2024. This represented a marked turnaround compared to the LKR 733 billion contraction observed between June 2022 and May 2023, during which firms aggressively deleveraged in response to the currency crisis and high INF (International Monetary Fund, 2023).

The improvement in credit flows was supported by the appreciation of the Sri Lankan Rupee and more stable monetary conditions. At the same time, credit to the government increased by LKR 354 billion in the first half of 2024, down from LKR 1,043 billion in the same period of 2023. This reduction is partly attributed to the LKR 517 billion allocated for restructuring the debt of State-Owned Enterprises (SOEs) (World Bank, 2024). Furthermore, the total government and SOE debt rose by LKR 293 billion in early 2024—less than the LKR 405 billion increase in the previous year—indicating improved fiscal discipline. Credit to SOEs also declined by LKR 60 billion, highlighting ongoing restructuring and reduced reliance on public credit channels (Central Bank of Sri Lanka, 2024).

A notable development in recent years is the rapid growth of digital lending platforms, which are revolutionising credit access in Sri Lanka. The number of users of online loan applications increased from just 10,600 in August 2021 to over 1.3 million by November 2023—a 125-fold growth in just over two years (Financial Stability Review, 2024). This surge reflects a growing shift towards fintech-driven financial inclusion, especially among underserved segments and informal sector participants.

On the asset quality front, there has been a significant improvement in recent months. The NPL index dropped sharply from 7.2 in Q2 2024 to –44.5 in Q3 2024, indicating a substantial decline in default rates. This positive shift is attributed to the Central Bank’s introduction of flexible repayment options, lower interest rates, and the broader economic recovery (Central Bank of Sri Lanka, 2024).

In summary, bank lending in Sri Lanka has followed a dynamic path, shaped by structural reforms, economic shocks, and technological advancements. The recent rebound in private-sector lending, decline in NPLs, and the exponential rise in digital credit solutions signal an improving financial landscape. While challenges remain—particularly in terms of SME access to credit and banking sector governance—the overall trajectory suggests that bank lending is once again positioned to support sustained economic recovery and growth in Sri Lanka.

Econometrics Methodology

Data and Analytical Framework

Annual time series data on GDPG, bank lending rate (BLR), credit to the private sector, CDR, trade openness, INF, labour force participation rate, and gross capital formation, during the period 1991–2023, have been used in this study. All the data has been gathered from the official database of the International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024), and the annual report of the Central Bank of Sri Lanka (2024).

Numerous econometric studies have been conducted using different techniques to analyse the role of bank lending in driving economic growth. However, this article uses the ARDL bounds test for cointegration developed by Pesaran et al. (2001). Due to the low power and further problems associated with other test methods, the ARDL approach to cointegration has become popular in recent years (Ravinthirakumaran, 2014; Ravinthirakumaran & Ravinthirakumaran, 2018). Further, this approach is accommodating variables that are stationary at either level I(0) or first difference I(1), but not second difference I(2). Unlike traditional cointegration techniques, the ARDL model can be applied to datasets with mixed integration orders I(0) and I(1)), making it a flexible and reliable tool for analysing long-run relationships (Pesaran et al., 2001). Therefore, this study utilises the ARDL cointegration bounds test to examine the role of bank lending in driving economic growth in Sri Lanka.

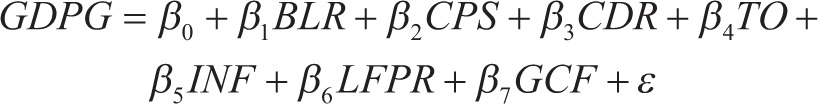

The econometric model for this study is formulated as follows to analyse the role of bank lending in driving economic growth in Sri Lanka:

(1)

(1)

where:

This model captures the relationship between key financial and economic variables to assess the influence of bank lending on economic growth in Sri Lanka. All variables in the model are transformed into their natural logarithms for standard statistical reasons, except for GDPG, the BLR, CDR, and INF. This transformation helps stabilise variance, improve normality, and interpret coefficients as elasticities, enhancing the robustness of the econometric analysis.

(2)

(2)

Unit Root Test

This research applies the ARDL model through a structured series of steps. The first step involves conducting a stationarity test to determine whether the variables are integrated at order 0 (I(0)) or order (I(1)). To achieve this, the study employs the Augmented Dickey-Fuller (ADF) test.

As a preliminary step in the empirical analysis, this study conducts unit root tests to assess the stationarity properties of the variables included in the model. In this research, the ADF test is employed to determine the order of integration of each variable -that is, whether a variable is stationary at level [I(0)], or becomes stationary after first differencing [I(1)]. This step is particularly important because the ARDL bounds testing approach developed by Pesaran et al. (2001) requires that none of the variables be integrated of order two [I(2)] or higher. The ARDL model is uniquely suited to analyse relationships among a mix of I(0) and I(1) variables, allowing for both short-run dynamics and long-run equilibrium relationships to be captured within a single estimation framework.

ARDL Bound Test for Cointegration

Following the confirmation of the stationarity properties of the variables, the next step involves investigating the existence of a long-run equilibrium relationship among the selected macroeconomic variables. This is achieved through the ARDL bounds testing approach to cointegration, as proposed by Pesaran et al. (2001). This approach is particularly advantageous in small sample settings and in models involving a mix of stationary and first-difference stationary variables. It allows for the estimation of both short-run dynamics and long-run relationships within a single reduced-form equation.

The ARDL model for the standard log-linear functional specification of long-run relationships among the dependent and independent variables may follow as:

.jpg/10_1177_25819542251379960-eq3(1)__480x143.jpg) (3)

(3)

Where,

Δ is the first-difference operator

P: Lag orders of the dependent variable

q: Lag orders of the regressors (explanatory variable)

The coefficients αs represent the long-run relationships, while the βs parameters capture the short-run dynamics of the model. The structural lags p, q1, q2, q3, q4, q5, q6, q7 are determined by selecting the lag length that minimises the Schwarz Bayesian Criterion (SBC), ensuring that the model is both efficient and robust.

The ARDL bounds testing approach to cointegration involves three main steps to examine the existence of a long-run relationship among variables. In the first step, the ARDL model is specified and estimated using Ordinary Least Squares (OLS), ensuring that the optimal lag structure for each variable is selected based on the SBC. This step prepares the model in the form of an Unrestricted Error Correction Model (UECM), which includes both lagged level terms and first-differenced terms. The second step involves conducting the bounds test for cointegration, where an F-statistic is computed to test the joint significance of the lagged level variables. The null hypothesis of no cointegration is tested against the alternative that a long-run relationship exists. The null hypothesis H0 assumes that the coefficients are all zero (α1 = α2 = α3 = α4 = α5 = α6 = α7 = 0), against the alternative hypothesis H1, which posits that at least one of the coefficients is different from zero (α1 .png) α2

α2 .png) α3

α3 .png) α4

α4 .png) α5

α5 .png) α6

α6 .png) α7

α7 .png) 0). The decision rule is based on comparing the F-statistic to the critical values provided by Pesaran et al. (2001): if the statistic exceeds the upper bound, cointegration is confirmed; if it falls below the lower bound, there is no cointegration; and if it lies between the bounds, the result is inconclusive. Upon establishing cointegration, the third step involves estimating the long-run coefficients of the ARDL model and the associated short-run dynamics using an Error Correction Model (ECM). The ECM includes an error correction term that captures the speed of adjustment toward the long-run equilibrium, which should be negative and statistically significant to confirm a stable long-run relationship.

0). The decision rule is based on comparing the F-statistic to the critical values provided by Pesaran et al. (2001): if the statistic exceeds the upper bound, cointegration is confirmed; if it falls below the lower bound, there is no cointegration; and if it lies between the bounds, the result is inconclusive. Upon establishing cointegration, the third step involves estimating the long-run coefficients of the ARDL model and the associated short-run dynamics using an Error Correction Model (ECM). The ECM includes an error correction term that captures the speed of adjustment toward the long-run equilibrium, which should be negative and statistically significant to confirm a stable long-run relationship.

The Error Correction Model

The ECM constitutes the third and final step in the ARDL bounds testing approach, capturing the short-run dynamics and adjustment mechanism of the variables toward long-run equilibrium. After establishing the existence of a long-run relationship among variables, the ECM is estimated to understand how short-term deviations are corrected over time. The coefficient of the ECM plays a crucial role in indicating the speed at which the dependent variable, such as GDPG, adjusts to any disequilibrium resulting from a shock. A negative and statistically significant ECM coefficient confirms that any short-run divergence from the long-run equilibrium is corrected in subsequent periods, validating the presence of a stable system. In essence, the larger the absolute value of this coefficient, the faster the system returns to equilibrium. Additionally, the inclusion of short-run coefficients in the ECM allows for analysis of the immediate effects of changes in independent variables, making the model a powerful tool to distinguish between short- and long-term impacts. Overall, the ECM bridges short-run volatility and long-run stability in the dynamic relationship among variables.

The ECM for the short-run dynamics is specified as follows:

(4)

(4)

Where:

.png) represents the coefficient of the error correction term, which measures the speed of adjustment,

represents the coefficient of the error correction term, which measures the speed of adjustment,.png) t – 1 is the lagged error correction term,

t – 1 is the lagged error correction term,This equation captures how each of the variables (BLR, credit to the private sector, CDR, trade openness, INF, labour force participation rate, and gross capital formation) adjusts over time in response to changes, while also adjusting to restore the long-term equilibrium relationship, as indicated by the ECM.

Granger Causality Test

The Granger causality test is a vital econometric tool for this study as it allows us to empirically determine the direction of causality between bank lending and economic growth, as well as other key macroeconomic and financial variables. Unlike correlation analysis, which only measures the strength of association, Granger causality identifies whether past values of one variable provide statistically significant information in predicting the future values of another variable. In the context of Sri Lanka, where the causal link between bank lending and GDPG has been debated, this test helps clarify whether credit expansion drives economic growth or whether growth itself stimulates increased demand for credit. By establishing the direction of influence, the test provides deeper insights into the dynamics of financial intermediation, trade openness, labour participation, and capital formation.

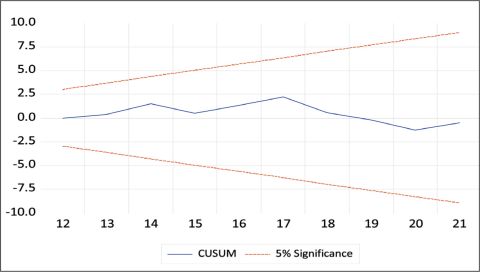

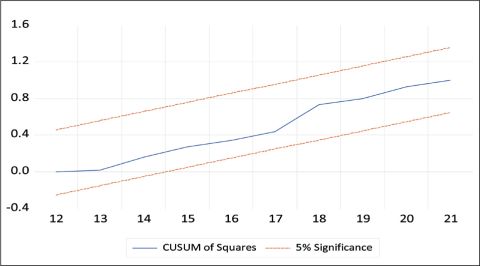

Diagnostic and Stability Tests

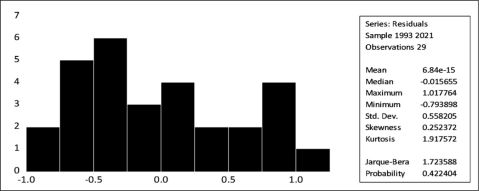

Diagnostic and stability tests are crucial to validate the reliability and robustness of the econometric model. The Breusch-Godfrey serial correlation LM test is used to detect whether the residuals from the regression are correlated across time, as serial correlation violates key regression assumptions and can lead to biased standard errors. The normality test, such as the Jarque-Bera test, checks whether the residuals follow a normal distribution, which is important for the validity of hypothesis testing, especially in small samples. Heteroskedasticity tests examine whether the variance of residuals remains constant; heteroskedasticity can cause inefficient estimates and unreliable inference if present.

To ensure the model’s parameters remain stable over the sample period, the cumulative sum (CUSUM) and cumulative sum of Squares (CUSUMSQ) tests are applied; these assess whether there are any structural breaks or changes in the relationship among variables. If the tests indicate stability, it means the model’s coefficients do not vary significantly over time, supporting the consistency and validity of the long-run and short-run estimates. Together, these tests provide confidence that the model is correctly specified and that the estimated relationships are robust and dependable for policy analysis.

Empirical Results

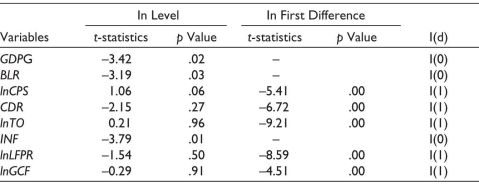

Unit Root Test Results

The results of the ADF test, presented in Table 1, show that GDPG, BLR, and INF are stationary at level [I(0)], while all other variables become stationary after first differencing [I(1)]. These findings satisfy the underlying assumptions of the ARDL model and confirm its suitability for the analysis in this study. Ensuring that no variable is I(2) helps avoid invalid test statistics and supports the robustness of the ARDL bounds test results.

Table 1. Unit Root Tests.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

The ARDL Bound Test Results

The bound test statistics presented in Table 2 indicate that the F-statistic for the ARDL model is 17.86, which exceeds the critical value of the upper bound at the 1% significance level. This result confirms the existence of a long-run cointegration relationship among the variables, suggesting that they move together over time. It further implies a stable and enduring equilibrium relationship between bank lending and economic growth in Sri Lanka, supporting the notion that these variables are interconnected in the long run.

Table 2. F-statistic of Cointegration Relationship.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

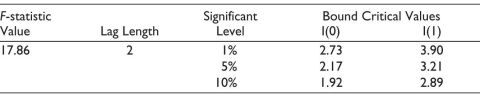

The ARDL Long-run Results

In the second step, after establishing cointegration, the conditional ARDL long-run model for ln(GDPG) is estimated. The estimated long-run coefficients are presented in Table 3. The results indicate that several factors significantly influence bank lending outcomes. Credit to the private sector exerts a positive and statistically significant effect, implying that a 1% increase in credit to the private sector raises the bank lending response by 0.06 units, highlighting the role of inclusive finance in promoting lending. The finding aligns closely with previous research in the South Asian context. For instance, Kharel et al. (2024) found that credit to the private sector positively influences GDPG in Nepal, using a similar ARDL framework. The consistency in results reinforces the view that enhancing access to credit is crucial for stimulating investment and economic activity in emerging economies.

Table 3. Long-run Results Using the ARDL Model.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Note: *, ** and *** denote the statistical significance at 1%, 5% and 10% levels, respectively.

Trade openness also positively affects lending, with a 1% increase associated with a 0.16 unit rise, suggesting that greater integration with global markets encourages credit expansion. This is consistent with findings by Sharma (2021), who argued that trade liberalisation positively impacts growth in developing countries by facilitating technology transfer and capital inflows.

Similarly, higher labour force participation significantly boosts lending, reflecting the stimulatory impact of a more active workforce on financial demand. This is in line with the endogenous growth theory, which stresses the role of labour quality and availability.

In contrast, the CDR has a strong negative effect, indicating that excessive lending relative to deposits may constrain the banking sector’s responsiveness. INF and gross capital formation show negative but statistically insignificant impacts, suggesting that short-term macroeconomic fluctuations and investment levels do not strongly determine bank lending in this model. Overall, the findings emphasise the importance of balanced credit growth, efficient financial intermediation, and favourable structural conditions in enhancing the banking sector’s contribution to economic activity.

Overall, the study’s findings not only corroborate the supply-leading hypothesis that bank credit stimulates growth but also highlight the multidimensional nature of economic expansion, influenced by both domestic financial policies and external economic conditions. Policymakers should consider these interconnections when designing interventions aimed at fostering sustainable growth in Sri Lanka.

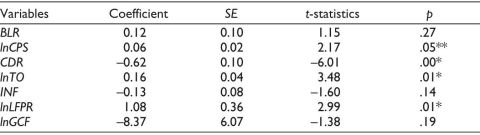

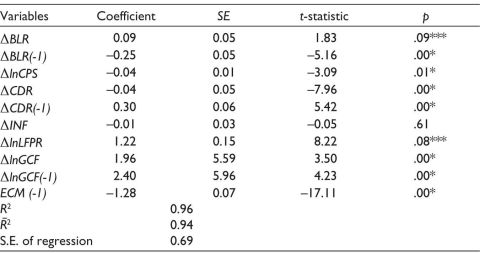

The ECM Results

The short-run dynamic coefficients are reported in Table 4. The optimal lag length for the ARDL model is determined using the SBC. This criterion helps identify the lag length that minimises the information loss while ensuring the model’s efficiency and accuracy in capturing short-term dynamics. The coefficient on the lagged error correction term (ECT) is statistically significant at the 1% level and carries the expected negative sign, further confirming the results from the bounds test for cointegration.

Table 4. Short-run Results Using the ARDL Model.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Note: *, ** and *** denote the statistical significance at 1%, 5% and 10% levels respectively.

The estimated value of the ECT is –1.28, indicating that the speed of adjustment to equilibrium after a shock is approximately 128% of the previous year’s shock. This implies that the system adjusts quickly, correcting itself at a pace faster than the shock itself. In other words, the variables involved move back toward their long-run equilibrium relatively rapidly following any deviation, ensuring a swift return to balance in the model.

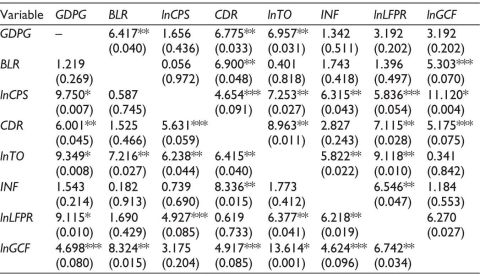

Granger Causality Test Results

Table 5 presents the results of the Granger causality analysis, which examines the direction and significance of relationships between bank lending, macroeconomic indicators, and GDPG in Sri Lanka over the period 1991–2023. The Granger causality analysis reveals nuanced interrelationships among macroeconomic and financial variables in Sri Lanka. GDPG is significantly influenced by credit to the private sector and labour force participation rate in a unidirectional manner, while showing bidirectional causality with gross capital formation and trade openness; its relationship with BLR is unidirectional from GDPG to BLR, and with gross capital formation, it is not significant. BLR is unidirectionally affected by the CDR, while its connection with gross capital formation is insignificant. Credit to the private-sector exerts a unidirectional effect on GDPG and is influenced by gross capital formation, while demonstrating bidirectional linkages with trade openness and a weak bidirectional association with INF.

Table 5. Granger Causality Test Results.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Note: *, ** and *** denote the statistical significance at 1%, 5% and 10% levels, respectively.

CDR and INF exhibit mutual bidirectional causality, reflecting the interplay between monetary conditions and credit allocation. Trade openness has bidirectional relationships with GDPG, credit to the private sector, CDR, and labour force participation rate, but is unidirectionally affected by INF. Labour force participation rate shows bidirectional links with trade openness, INF, and gross capital formation but unidirectionally influences GDPG. Gross capital formation is unidirectionally influenced by BLR and trade openness, unidirectionally affects credit to the private sector, and shares a bidirectional relationship with labour force participation rate. These results underscore the complex feedback mechanisms between financial, trade, labour, and macroeconomic variables in shaping Sri Lanka’s economic dynamics.

Diagnostic and Stability Tests Results

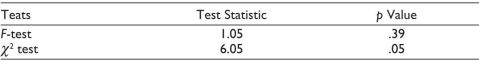

Breusch-Godfrey Serial Correlation LM Test Results

The Breusch-Godfrey serial correlation LM test was employed to examine whether the residuals of the regression model are serially correlated, which is a crucial diagnostic check to ensure the validity of the model’s estimates.

As presented in Table 6, the F-statistic is 1.05 with a corresponding p value of .39, while the χ2 statistic is 6.05 with a p value of .05. The F-test result, which is generally more reliable in small samples, suggests that the null hypothesis of no serial correlation cannot be rejected, as the p value exceeds the conventional significance levels. This implies that the residuals are independent and not correlated over time. Although the χ2 test yields a p value that lies exactly on the 5% significance threshold, the stronger support from the F-test allows us to conclude that there is no substantial evidence of serial correlation in the model. Hence, the regression results can be considered robust in terms of error independence, enhancing the credibility of the estimated coefficients.

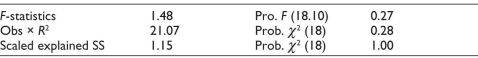

The Breusch-Pagan-Godfrey Test Results

The Breusch-Pagan-Godfrey test was conducted to assess the presence of heteroskedasticity in the residuals of the estimated model, which is essential for ensuring that the variance of the error terms remains constant across observations.

As shown in Table 7, the F-statistic is 1.48 with a corresponding probability (Prob. F) of 0.27, while the Obs × R2 value is 21.07 with a p value of .28. Additionally, the Scaled Explained Sum of Squares (SS) yields a value of 1.15 with a p value of 1.00. Since all p values are well above the conventional significance levels (i.e., 0.05 or 0.10), we fail to reject the null hypothesis of homoskedasticity. This indicates that there is no significant evidence of heteroskedasticity in the model, meaning that the variance of the residuals is constant. As a result, the model satisfies the classical linear regression assumption of homoskedasticity, supporting the reliability of standard errors and statistical inference.

Table 6. Summary of Results for Breusch-Godfrey Serial Correlation LM Test.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Table 7. Summary of Results for Breusch-Pagan Godfrey Heteroscedasticity Test.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Normality Test Results

As illustrated in Figure 1, the model successfully passes the key diagnostic tests at both the level and first-difference stages. The results indicate no evidence of serial correlation, confirming that the residuals are not autocorrelated. Additionally, the model satisfies the normality assumption, as shown by the results of the Jarque-Bera test.

Figure 1. Histogram and Normality Test.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

The test yields a statistic of 1.72 with a p value exceeding the .05 threshold, implying that the residuals follow a normal distribution. This supports the overall robustness and reliability of the model, as the underlying assumptions of classical linear regression—particularly regarding the normality of error terms—are not violated.

CUSUM and CUSUMSQ Tests Results

Figure 2 and Figure 3 visually illustrate the results of the CUSUM and CUSUM of Squares (CUSUMSQ) tests, which are essential for assessing the stability of the estimated parameters over time. These figures display the cumulative sum of recursive residuals and their squares, plotted alongside the 5% critical bounds, represented by the straight lines.

Figure 2. Plot of Cumulative Sum of Recursive Residuals.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

Figure 3. Plot of Cumulative Sum of Squares of Recursive Residuals.

Sources: Central Bank of Sri Lanka (2024), International Labour Organization (2024), International Monetary Fund (2024b), World Bank (2024).

In both cases, the test statistics remain well within these bounds throughout the sample period. This outcome strongly suggests the absence of structural instability or any significant break in the underlying data-generating process of the GDPG equation. The stability of the coefficients over time reinforces the reliability and robustness of the model. In practical terms, this implies that the model’s estimated parameters do not fluctuate erratically due to changes in the underlying economic structure, making it suitable for both short-run and long-run policy analysis. The confirmation of parameter stability through these tests enhances confidence in the empirical findings and supports the validity of the conclusions drawn from the model.

Conclusion and Policy Implications

Conclusion

This study investigated the role of bank lending in driving economic growth in Sri Lanka over the period 1991–2023 using the ARDL model to capture both short- and long-term dynamics, complemented by Granger causality analysis to determine the direction of relationships. The Granger causality test results indicate a unidirectional causal relationship from credit to the private sector to GDPG, suggesting that financial sector development plays an important role in driving the real economy. This finding is consistent with the finance-led growth hypothesis and supports evidence from Sri Lanka’s post-liberalisation period, where credit expansion was found to significantly stimulate investment and output growth (Ganepola & Jayasinghe, 2023). However, our result differs from Perera and Liyanage (2012), who argued that bank lending had a limited role in influencing GDP once broader macroeconomic factors were controlled for. This divergence can be attributed to methodological differences, as our study employs dynamic causality testing, which better captures the directionality of relationships and the short-run versus long-run dynamics often overlooked in static regression models. The results also reveal a bidirectional causal relationship between trade openness and GDPG, underscoring the mutually reinforcing role of global integration and domestic economic expansion. This finding echoes international evidence from Shan and Jianhong (2006), who identified similar bidirectional dynamics in emerging economies. In the Sri Lankan context, this result highlights how greater trade integration both supports and is supported by economic growth, reflecting the importance of export-oriented industrialisation and global value chain participation in sustaining development.

Another important result is the strong interaction between labour force participation and GDPG, which emphasises the role of human capital in driving long-term growth. This is in line with the Asian Development Bank (2020), which highlighted that South Asian economies derive significant growth dividends from higher female and youth labour participation. In Sri Lanka, where labour market underutilisation remains a challenge, this finding reinforces the argument that structural reforms in education, skills development, and gender equality are essential to fully unlock growth potential.

Interestingly, the study found no significant long-run causal relationship between BLR, gross capital formation, and GDPG. This result suggests that inefficiencies in capital allocation, coupled with structural rigidities in the financial system, may constrain the effectiveness of these variables in stimulating growth. This observation resonates with Edirisuriya (2007), who warned that financial deepening in Sri Lanka may not automatically lead to growth if credit is misallocated or tied to non-productive activities. The absence of strong causality from GCF to GDP also challenges traditional growth theories, implying that capital accumulation alone is insufficient without complementary improvements in productivity, institutional quality, and innovation capacity.

The CDR and INF also display bidirectional relationships with GDP, reflecting complex feedback mechanisms in the economy. Although empirical studies directly examining bidirectional Granger causality between CDR, INF, and GDP remain limited—particularly in Sri Lanka—our findings resonate with broader macro-financial evidence. For instance, Miguel et al. (2022) studied in sub- Saharan Africa documented two-way causal dynamics between INF and bank credit, suggesting similar interactions in other developing contexts.

Taken together, these findings reinforce the importance of credit-driven growth while highlighting the need for complementary reforms in trade, labour markets, and financial sector governance. By comparing our results with existing literature, the study not only validates the finance-growth nexus in Sri Lanka but also provides new evidence that contextual factors, such as institutional quality and labour participation, shape how financial development translates into sustained economic growth.

Policy Recommendations

To enhance the contribution of bank lending to sustainable growth, several measures are essential. First, expanding access to productive credit—particularly for SMEs, agriculture, and underserved regions—can maximise the growth effects of inclusive finance. Second, strengthening credit risk management and improving lending efficiency will reduce NPLs and enhance sector resilience. Third, maintaining macroeconomic and interest rate stability ensures that credit growth translates into real economic gains. Finally, integrating credit policies with broader national development goals, including employment creation and industrial upgrading, ensures that financial deepening contributes to sustainable growth.

Policy Implications

The findings of this study highlight that sustained economic growth in Sri Lanka requires coordinated policy measures that extend beyond simple credit expansion. While credit provision contributes positively to growth in the short term, the evidence suggests that its long-run effectiveness depends heavily on the quality of institutions, the efficiency of resource allocation, and the stability of the macroeconomic environment. This underscores the need for policies that strengthen financial intermediation while simultaneously addressing structural weaknesses in the economy.

The bidirectional linkages between GDP, trade openness, and labour force participation point to the necessity of harmonised economic strategies. Liberal trade policies and export diversification are critical for enhancing competitiveness and reducing vulnerability to external shocks, while investments in education, skills training, and labour market reforms—particularly targeting women and youth—are essential for unlocking human capital potential. Credit, trade, and labour policies must therefore be coordinated within a unified framework that balances immediate growth stimuli with long-term structural transformation.

For the financial sector, the study emphasises the importance of directing credit toward productive sectors rather than consumption-driven borrowing. Expanding access to affordable finance for SMEs, agriculture, and technology-based industries could yield stronger multiplier effects on growth. At the same time, regulatory reforms that reduce NPLs, strengthen risk management, and enhance financial inclusion will help ensure that credit contributes to sustainable development.

Finally, the results suggest that Sri Lanka’s growth strategy must move from short-term, credit-driven cycles to a more resilient and inclusive growth path. This requires embedding credit policy within a broader development agenda that incorporates industrial policy, infrastructure development, and digital financial innovation. By strategically aligning bank lending with national development priorities, Sri Lanka can foster an inclusive financial ecosystem that supports economic diversification, enhances resilience to shocks, and drives sustainable growth.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Ravinthirakumaran Navaratnam  https://orcid.org/0000-0002-8885-1015

https://orcid.org/0000-0002-8885-1015

Arestis, P., & Demetriades, P. O. (1997). Financial development and economic growth: Assessing the evidence. The Economic Journal, 107(442), 783–799.

Asian Development Bank. (2020). Enhancing Small and Medium-Sized Enterprises finance project. Retrieved, 25 September 2025, from https://www.adb.org/projects/50349-002/main

Awdeh, A. (2012). Banking sector development and economic growth in Lebanon. International Research Journal of Finance and Economics, 100, 53–62.

Bernanke, B. S., & Gertler, M. (1995). Inside the black box: The credit channel of monetary policy transmission. Journal of Economic Perspectives, 9(4), 27–48.

Boyd, J. H., & Prescott, E. C. (1986). Financial intermediary-coalitions. Journal of Economic Theory, 38(2), 211–232.

Bumann, S., Hermes, N., & Lensink, R. (2013). Financial liberalization and economic growth: A meta-analysis. Journal of International Money and Finance, 33, 255–281.

Central Bank of Sri Lanka. (2022). Annual report 2021. Retrieved, 25 September 2025, from https://www.cbsl.gov.lk/

Central Bank of Sri Lanka. (2024). Annual report 2023. Retrieved, 25 September 2025, from https://www.cbsl.gov.lk/

Chirwa, T. G., & Odhiambo, N. M. (2016). Macroeconomic determinants of economic growth: A review of international literature. South East European Journal of Economics and Business, 11(2), 33–47.

Diamond, D. W. (1984). Financial intermediation and delegated monitoring. Review of Economic Studies, 51(3), 393–414.

Edirisuriya, P. (2007). Effects of financial sector reforms in Sri Lanka: Evidence from the banking sector. Asia Pacific Journal of Finance and Banking Research, 1(1), 45–64.

Financial Stability Review. (2024). Digital financial inclusion in Sri Lanka. Central Bank of Sri Lanka Research Division. https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/financial-system-stability-review

Ganepola, G., & Jayasinghe, P. (2023). The impact of financial sector development on economic growth: Evidence from Sri Lanka. Vidyodaya Journal of Management, 9(2), 28–56.

International Labour Organization. (2024). ILOSTAT database: Labour force participation rate. Retrieved, 25 September 2025, from https://ilostat.ilo.org/

International Monetary Fund. (2023). Governance diagnostic assessment in: IMF staff country report – Sri Lanka (Issue 340). https://www.elibrary.imf.org/view/journals/002/2023/340/002.2023.issue-340-en.xml

International Monetary Fund. (2024a). Sri Lanka: 2024 Article IV consultation and second review under the extended fund facility, request for modification of performance criterion, and financing assurances review (Asia and Pacific Dept., IMF Staff Country Report No. 2024/161). Retrieved, 25 September 2025, from https://doi.org/ 10.5089/9798400279478.002

International Monetary Fund. (2024b). International financial statistics. Retrieved, 25 September 2025, from https://www.imf.org/en/Data

Khan, M. A. (2008). Financial development and economic growth in Pakistan: Evidence based on autoregressive distributed lag (ARDL) approach. South Asia Economic Journal, 9(2), 375–391.

Kharel, K., Poudel, O., Upadhyaya, Y., & Nepal, P. (2024). Effect of private sector credit on economic growth in Nepal. Financial Markets, Institutions and Risks, 8(1), 142–157. http://doi.org/10.61093/fmir.8(1).142-157.2024.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737.

Levine, R. (2005). Finance and growth: Theory and evidence. In P. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth (Vol. 1, pp. 865–934). Elsevier.

Levine, R. (2021). Finance, growth, and inequality [IMF Working Paper No. 2021/164]. Retrieved, 25 September 2025, from https://ssrn.com/abstract=4026360

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31–77.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42.

McKinnon, R. I. (1970). Money and capital in economic development. Brookings Institution Press.

Miguel, Á. T., Víctor, H. T., & Francisco, V. (2022). Inflation and bank credit. Investigación Administrativa, 51(129), 1–20.

Mishra, P. K., Das, K. B., & Pradhan, B. B. (2009). Credit market development and economic growth in India. Middle Eastern Finance and Economics, 5, 92–106.

Patrick, H. T. (1966). Financial development and economic growth in underdeveloped countries. Economic Development and Cultural Change, 14(2), 174–189.

Perera, S., & Liyanage, S. (2012). An empirical investigation of the twin deficit hypothesis: Evidence from Sri Lanka. Staff Studies, 41(1–2), 41–87.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Ramya, S., Kengatharan, L., & Luxan, K. (2021). Impact of commercial banks’ lending on economic growth: Evidence from Sri Lanka. In Proceedings of the 6th International Conference on Contemporary Management. University of Jaffna.

Rathnayake, R. M. S. S., & Dissanayake, D. M. R. U. (2022). Determinants of non-performing loans: Evidence from Sri Lanka. South Asian Journal of Finance, 2(1), 14–27.

Ravinthirakumaran, K., & Ravinthirakumaran, N. (2018). The impact of foreign direct investment on income inequality: A panel autoregressive distributed lag approach for the Asia-Pacific Economic Cooperation developing economies. Asia-Pacific Development Journal, 25(1), 56–83.

Ravinthirakumaran, N. (2014). Applicability of openness-led growth hypothesis in Sri Lanka. South Asia Economic Journal, 15(2), 241–263.

Rexiang, W., & Rathanasiri, R. A. (2011). Financial intermediation and economic growth: A lesson from Sri Lanka. In International Conference on Business and Information 2011. Faculty of Commerce and Management, University of Kelaniya.

Robinson, J. (1952). The generalization of the general theory. In The rate of interest and other essays. Macmillan.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037.

Shan, J., & Jianhong, Q. (2006). Does financial development lead economic growth? The case of China. Annals of Economics and Finance, 1, 197–216.

Sharma, H. (2021). Trade liberalization and economic growth on Indian economy using ARDL model. International Journal for Research Publication and Seminar, 12(1), 139–146.

Shaw, E. S. (1973). Financial deepening in economic development. Oxford University Press.

Wicksell, K. (1936). Interest and prices. Macmillan.

World Bank. (2021). Domestic credit to private sector by banks (% of GDP) – Sri Lanka. Retrieved, 25 September 2025, from https://data.worldbank.org/indicator/FD.AST.PRVT.GD.ZS?locations=LK

World Bank. (2024). World development indicators (WDI). Retrieved, 25 September 2025, from https://databank.worldbank.org/source/world-development-indicators

Zhang, J., Wang, L., & Wang, S. (2012). Financial development and economic growth: Recent evidence from China. Journal of Comparative Economics, 40(3), 393–412