1 Department of Commerce, Raiganj University, Raiganj, West Bengal, India

2 Department of Commerce, University of North Bengal, Darjeeling, West Bengal, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

As per a report of The Economic Times, the Indian automobile industry provides direct and indirect employment to over 19 million people, thereby playing a vital role in the economic growth and development of the nation. However, to survive in the long run, a business needs to maintain its profitability level sufficient for its perpetual existence. Considering the need for profitability, it is equally important to ascertain its determinants. With this objective, this study concerns the determinants of profitability of Indian automobile companies. Based on secondary data, this study considers the financial ratios, including profitability, and performs the panel data regression analysis using secondary data of the selected Indian automobile companies. The financial parameter includes cash earnings–retention ratio (CERR), debt-to-equity ratio (DTR), inventory–turnover ratio (ITR) and price–book value ratio (PBR). All these parameters were found to have a significant impact on profitability. This study concludes that an improvement in CERR, ITR and PBR with a reduction in DTR can improve the profitability of the automobile companies. These findings will fill a gap in the existing literature regarding the financial parameter determinants of profitability.

Profitability, financial parameters, automobile companies, panel data regression analysis

Introduction

In the early 1950s, the share of the manufacturing sector in Indian GDP used to account for only about 10% but, as of 2023, it contributes about 17% (IBEF, 2023). In the automobile industry, being one of the largest industries, a boost was seen after the implementation of liberation–privatisation and globalisation (LPG) in 1992 through de-licensing and opening the sector for foreign direct investments (FDI) (Velmurugan & Annalakshmi, 2015). In India, one of the significant drivers for boosting the economic growth of the nation is the automobile industry. As per a report of The Economic Times, the automobile industry of India provides direct and indirect employment to over 19 million people, thereby playing a vital role in the economic growth and development. The automobile industry is one of the largest revenue-generating industries of the nation and the nation’s key player in employment generation (Miglani, 2019). This industry has both short-term and long-term goals; short-term goals are to improve the annual profits and value addition, while the long-term goals are to contribute to the national income, employment generation, infrastructure development and holistic development of the economy by improving the standard of living of its people (Abey & Velmurugan, 2018). The automobile industry in India is the fourth-largest by production in the world as per 2022 statistics (OICA, 2023). As of April 2022, India’s automobile industry was worth more than $100 billion and accounts for 8% of the country’s total exports and 7.1% of India’s GDP (Investindia, 2023). As of 2023, India stands as the third largest automobile market in the world in terms of sales (ETAuto, 2023).

Considering the potential of the automobile industry, the success of every key player in the industry mainly depends on the profitability of the firm. Profitability measures the earning capability of a company (Dharmaraj & Ramaswamy, 2014). To survive in the long run, a business needs to earn a profit and maintain its profitability level sufficient for perpetual existence. The estimation of future profitability and analysing the past and present profitability are vital for strategic business decisions. The systematic and specific analysis of determinants, which impact the profitability, will disclose and signal the message of its efficiency to generate profit to the concerned stakeholders (Ali, 2021). Normally, there are five parameters—that is, profitability, liquidity, solvency, efficiency and market prospect—which indicate the financial position of an industry. The comparative study of these financial parameters explains the holistic performance of the company.

Profitability is a measure of efficiency with powerful incentives for all the concerned stakeholders (Ali, 2021). Efforts have been made to study the determinants of profitability of selected listed automobile firms manufacturing four-wheelers. For a firm, its efficiency is reflected in the market value of its share, whereas the market value of shares is based on the ability of the firm to earn profits, which again depends upon its ability to generate revenue. A company which makes little profit or whose profits fluctuate from year to year will not last long. For these reasons, companies develop strategies to improve their profitability position (Abey & Velmurugan, 2018). However, profitability should not be studied as an isolated phenomenon; instead, the study should also consider other factors such as liquidity (Zubairi, 2010), solvency (Korankye & Adarquah, 2013), efficiency (Quayyum, 2012) and market prospects (Basu & Das, 2016), which impact profitability.

The motive behind the analysis of profitability determinants of the automobile industry arises with the fact that the automobile industry remains an important driver behind overall economic development of every emerging economy by contributing significantly towards employment and production (Tyagi & Mahajan, 2022). This industry generates employment for both skilled and semi-skilled workers at a large scale (Jaisinghani et al., 2018) with potential to cater to domestic and international markets (Athukorala & Veeramani, 2019). Considering the position of India as an emerging global automobile market (IBEF, 2023) backed by an emerging high-income group with an increasing population, India holds a thriving environment for the automotive market, with its profitability controlled by several determinants. Considering this issue as a research avenue, an attempt is made to study the determinants of profitability with special reference to the selected Indian automobile companies.

Literature Review

Profitability has always been a primary objective for all industries. The industries will not be able to survive in the long run without profitability. Over time, scholars have analysed profitability through various proportions, firm-specific, financial metrics, operational efficiency, capital structure, liquidity, working capital ratios and the role of macroeconomic and policy variables where the conclusion has often been divergent and contradictory. Samuels and Smyth (1968) claimed that the size of the firm and net assets regulate the profit-earning capacity, highlighting that larger enterprises enjoy economies of scale and resource advantages that smaller ones cannot replicate. Mcdonald (1999) emphasised the importance of lagged profitability, establishing that past profit performance serves as a strong predictor of current-year profits, thereby underlining the path-dependent nature of profitability. Agarwal (1991) further found that structural and institutional factors such as the legacy of the firm, perpendicular combination, expansion and government policy, all of which have a prominent contribution to profitability outcomes. Vijayakumar and Kadirvelu (2003) found that legacy is the robust factor of profitability, followed by determinants like perpendicular combination, leverage, dimension, operating expenses to sales ratio, current ratio, growth rate and inventory turnover ratio, thereby providing a multi-dimensional understanding of financial performance determinants. The emphasis on operational performance and market expansion as profitability drivers was reinforced by Tahir and Anuar (2011), who argued that progression in sales clearly influences industry profitability. Jamali (2012) studied the Indian automobile sector and witnessed a strong positive association between management efficiency and profitability. Similarly, Dharmendra (2012) highlighted that debt–equity ratio, size and inventory turnover are the determinants that influence an enterprise’s profitability in Indian enterprises. Some studies have focused specifically on liquidity and leverage. Attari and Raza (2012) found that the length of the cash retention cycle and the return on owners’ funds negatively impact profitability in the Indian automobile industry. Similarly, Paliwal and Chouhan (2017) found that the profitability and liquidity of the Indian automobile industry have a positive relationship. The study also suggested that a trade-off exists between liquidity and profitability. Mathuva (2009) observed that the profitability and the average payment period have a significant relationship between them; the longer the time taken to pay creditors, there is increase in profitability. Kaur and Kaur (2016), in their study of Indian automobile firms listed in the Bombay Stock Exchange from 2003–2004 to 2013–2014, found that the profitability of Indian automobile sector companies is mainly ruled by the liquidity, operational efficiency, growth of the firm manufacturing velocity, proprietary position and payment to creditors.

The relationship between profitability and capital structure has also generated substantial debate. Suresh and Sengottaiyan (2015) establish a mixed relationship between profitability and capital structure in Indian automobile firms, which suggests that debt can provide tax rebate and leverage benefits. Simlai and Guha (2019) studied the Indian automobile companies arrange funding from their sources, as the debt–equity ratio is not as per the standard, that is, 2:1, pointing to unique financing structures that may influence profitability outcomes in the sector. Aggarwal and Singla (2001) found that inventory turnover ratio, interest coverage ratio, net profit to total assets and earnings per share are important parameters of financial performance. Gandhi (2017) studied two Indian automobile companies, Tata Motors Ltd and Mahindra and Mahindra Ltd, for the period 2005–2006 to 2014–2015, and found differences in profitability among the companies. Both gross profitability and operating profit were satisfactory, except in the case of Tata Motors Ltd. The role of working capital management and cash flow efficiency has attracted substantial attention in profitability research. The firm’s earning capacity can be maximised by minimising the number of days in inventories, cash retention cycle, and net trade cycle, as identified by Raheman et al. (2011). A negative relationship between cash retention cycle, inventory maintenance and the firm’s performance measures was found by Aloy (2012). Hiran (2016) found a negative relationship between operating profit and the inventory turnover ratio. On the other hand, a positive correlation was observed between the quick ratio and both operating profit and net profit. Ganesamoorthy and Rajavathana (2012) observed that profitability had a positive relationship with current ratio and cash conversion cycle, whereas average payment period and average collection period had a negative relationship with profitability.

Within the Indian automobile industry, which plays a vital role in driving economic growth and employment, profitability has been a subject of deep inquiry by researchers, policymakers and professional institutions. Swalih et al. (2021) explored the financial soundness of the Indian automobile industry. It was ascertained that they will be able to pay off their debt smoothly in the near future. A strong and positive relationship between management efficiency and profitability in the Indian automobile industry was explored by Jamali (2012) and suggesting the heightening of the management efficiency to improve the profitability. However, across studies, findings remain mixed, with some highlighting the positive role of liquidity and operational efficiency (Kaur & Kaur, 2016; Paliwal & Chouhan, 2017), while others point out negative correlations with certain ratios like inventory turnover and leverage (Attari & Raza, 2012; Hiran, 2016), thus indicating the lack of a consistent and universally accepted framework to explain profitability in the automobile sector. Among the most recent studies, Tyagi and Mahajan (2022) observed the determinants of profitability in Indian automobile firms and offered important insights into the relationships between profitability and firm-level financial ratios. Their work contributes to the growing body of knowledge on sector-specific profitability determinants and provides valuable empirical evidence for specialists and policymakers. However, their analysis was constrained by certain limitations, including the use of a relatively narrow dataset, limited financial ratios, and reliance on conventional regression methods that do not adequately address firm-level heterogeneity or temporal variations. As a result, while their study is foundational, it leaves room for further exploration and methodological advancement.

The role and importance of the automobile sector in the economic development of a country, keenly in a developing nation like India, has fascinated many academicians, professional institutions, researchers and administration to undertake differentiated studies in this sector. Thus, in this study, an attempt has been made to obtain the financial parameter determinants of the profitability of listed Indian automobile four-wheeler manufacturers. By concentrating on this specific subset, the study avoids the dilution of results that arises from analysing heterogeneous groups of firms and provides sharper, more context-specific insights. Furthermore, the study extends the scope of variables by including not only traditional determinants such as liquidity, leverage and growth ratios but also underexplored indicators such as cash flow–based measures, proprietary position and advanced working capital efficiency indicators, thereby offering a more comprehensive and holistic framework for understanding profitability. The study is to check the relationship between financial parameter determinants and profitability in the selected Indian automobile companies. The research will help the stakeholders to get an overview of the relationship between financial parameters and profitability in selected Indian automobile companies for the period of study. The study will also fill the gap in the existing literature, as it provides a sector-specific and segment-focused analysis, expands the set of explanatory variables beyond those traditionally considered, employs advanced econometric techniques for more robust inference and contextualises the analysis within a rapidly evolving policy and economic environment. While earlier research laid the groundwork for understanding profitability, this study advances the discourse by offering a more nuanced, comprehensive and timely analysis that reflects the complexities of today’s dynamic industrial environment.

Objectives of the Study

The primary objective of this article is to analyse the impact of companies’ financial parameters, namely their liquidity/retention, solvency, efficiency/turnover and the market prospects on the profitability of selected Indian automobile companies by using panel data analysis. So, the objectives are:

Research Methodology

This section explains the tools and techniques used in research methodology, along with reliability and validity for robustness of the study.

Data

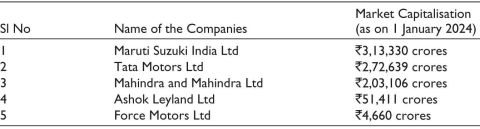

To examine the overall significant impact of financial parameter determinants on the profitability of selected automobile companies in India, secondary data were extracted from the respective companies’ annual reports and from www.moneycontrol.com. For this study, five listed automobile companies which manufacture only four-wheelers have been selected on the basis of their market capitalisation and products manufactured. Selected companies are given in Table 1.

Table 1. Companies Selected for the Study.

Source: Extracted from moneycontrol.com.

The study period of this study is spread over 10 years, from financial year 2013–2014 to 2022–2023, so that the analysis immediately follows the year of enactment of the Companies Act, 2013, as this legislation introduced significant reforms in corporate governance, financial reporting and accountability standards for Indian companies. These regulatory changes, including enhanced disclosure requirements, audit committee provisions and corporate social responsibility mandates, are likely to influence managerial decisions regarding liquidity, debt management and operational efficiency. Considering this period allows the analysis to capture the impact of these reforms on the profitability of Indian automobile companies, ensuring that the findings are both contemporary and relevant for managers, policymakers and researchers.

Empirical Model of the Study

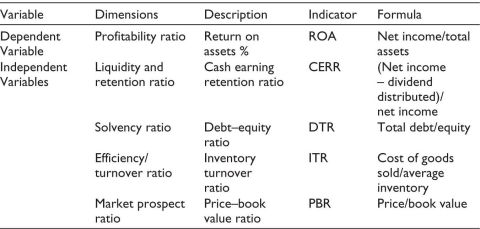

The analysis is based on the multivariate regression method through a quantitative research approach. The study is apprehensive with the performance of the four-wheeler manufacturing automobile companies in India by examining the relationship between profitability and other financial parameters such as liquidity and retention, solvency, efficiency and market prospect, which reflect their financial position. The study integrates the ordinarily used financial parameters from the company’s annual report and includes the parameters published on moneycontrol.com. The financial parameter return on assets (ROA), which indicates profitability, has been used as a dependent variable (Gurung & Sarkar, 2022; Suresh & Sengottaiyan, 2015; Vijayakumar & Kadirvelu, 2003). Cash earning–retention ratio (CERR) has been used as a liquidity and retention parameter, debt-to-equity ratio (DTR) has been used as a solvency parameter, inventory–turnover ratio (ITR) has been used as an efficiency/turnover parameter and price-to-book value ratio (PBR) has been used as a market prospect parameter. Among these parameters, ROA has been used as the dependent variable, representing the profitability of the automobile companies. The remaining parameters have been used as independent variables, as described in Table 2.

Table 2. Description of the Variables.

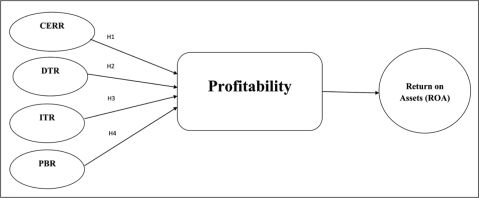

The conceptual framework to explain the relationship between profitability and other financial parameters, which is the objective of the study, has been represented in Figure 1.

Figure 1. Conceptual Framework of the Study.

This conceptual framework, along with the objectives of the study, resulted in the following hypotheses:

H01: There is no significant impact of liquidity and retention ratio on profitability.

H02: There is no significant impact of solvency ratio on profitability.

H03: There is no significant impact of the efficiency ratio on profitability.

H04: There is no significant impact of market prospect ratio on profitability.

To test these hypotheses, the static panel data are modelled, and multivariate panel regression is performed as shown and discussed in the following sections.

Model Specification

The multi-dimensional panel data are obtained by including both time-series and cross-sectional data, looking at several individual firms taken over a period, giving special attention to firm-specific heterogeneity with low collinearity and adequate variation of data for superior dimensions and precise effects.

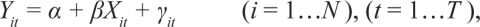

So, the panel data regression model takes the form of:

with γit = µi + εit,

where i is the cross-section identifier for the individual company, t is the time identifier for the individual company, γit is the composite error of the specification, µi is the individual-specific time-invariant unobserved effect and εit is the idiosyncratic error term.

To estimate the regression model and the model stated below, the panel least squares method is being used:

The fixed effects model (FEM) and the random effects model (REM) are included in the panel data analysis. The basic assumption is that if an individual-specific unobserved error term correlates with any of the explanatory variables included in the specification, the omitted variable bias is treated using FEM and on the divergent when the assumption is that if an individual-specific unobserved error term has no correlation with the explanatory variable REM is used, but the omitted variable may prompt sequential correlation in the time-variant error component. Thus, in order to understand the appropriate and suitable model, the Hausman test comes to the rescue, whose null hypothesis supports REM while the alternative supports the FEM.

Empirical Results and Discussion

Descriptive Analysis

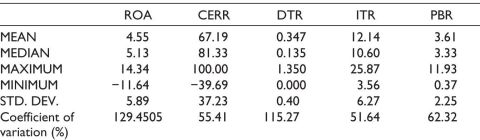

Descriptive analysis of the study is a statistical approach to summarise and present a clear overview of a dataset. Table 3 presents the analysis where the mean value of ROA is 4.5522, testified to be positive but ranges from -11.64 to 14.34, denoting average performance. As the median is higher than the mean, it indicates few automobile companies have moved towards positive significance of ROA for the period of study. The mean value of CERR is 67.1922, and the median is 81.33, indicating a negative skew as the mean is less than the median, while DTR, ITR and PBR are positively skewed, which indicates only a few companies have lower values which are less common but have a larger impact on the mean value indicating the variability in the dataset.

Table 3. Descriptive Statistics of Automobile Companies for the Period 2013–2022.

Correlation Analysis

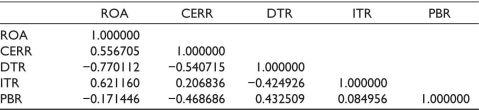

Table 4 presents the correlation matrix for all the variables included in the specification for the period 2013–2022.

Table 4. Correlation Matrix of the Variables.

The correlation matrix for the period of study clearly shows that ITR and CERR are positively correlated with ROA, while PBR and DTR are negatively correlated with ROA. In the study, it is also found that DTR is moderately correlated with PBR with a correlation coefficient of 0.432, indicating that debt to equity is correlated with price and book value. ITR is slightly correlated with PBR, and CERR is negatively correlated with PBR, indicating that cash retention and price to book value cannot go side by side.

Regression Analysis

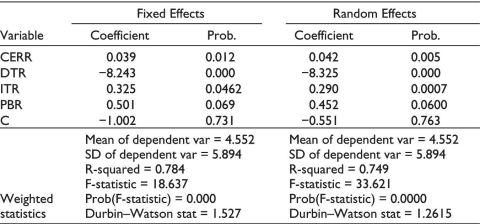

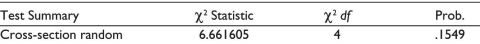

The secondary data extracted from the annual report and moneycontrol.com are the basis of the study to know the significant impact of other financial parameters on the profitability of automobile companies after the enactment of the Companies Act 2013. Table 5 presents the results obtained from the panel data regression analysis. The random effect (REM) and fixed effect (FEM) of the panel data analysis are applied to express the effect of omitted variables. The analyses of the results from REM and FEM for the period of study are made, and the Hausman specification test at a significance level of 5% (α = 0.05) is applied to obtain the appropriate result for the study (see Table 6). The result has selected the random effect model for the study.

Table 5. Panel Data Regression Results.

Table 6. Hausman Specification Test.

The Hausman test (Table 6) has selected the random effect model for the period, which reports an R-squared value of 74.92% and an adjusted R-squared of 72.70% with an F-statistic value of 33.62% and probability (F-statistics) is 0.00, indicating that the coefficient of determination resulting from the model is significant, where 74.92% of the variation in ROA, used as a proxy for profitability, is explained by the significant explanatory variables included in the model. As per the results shown in Table 5, CERR, ITR and PBR have a positive and significant impact on ROA at a significance level of 5%, 5% and 10%, respectively. DTR has a negative and significant impact on ROA at a significance level of 5%.

The other financial parameters for the period of study, namely CERR, ITR and PBR, have a significant impact on the ROA results. The study shows that CERR has a significant impact on the ROA, where a 1 unit increase in CERR would increase the profitability by 0.05 units, indicating that the profitability of the companies is slightly affected by CERR. The significant relationship between liquidity and profitability leads to the rejection of H01, which posited no significant relationship. The presence of a significant relation between liquidity and retention and profitability rejects the first hypothesis (H01) to report that there exists no significant relationship between liquidity and retention and profitability. The DTR having a negative significant impact at the 1% significance level indicates that a 1 unit increase in DTR would reduce profitability by 8.325 units, implying that the profitability of automobile companies was highly reactive towards DTR. The results for the DTR lead to the rejection of the second hypothesis (H02), which stated that the solvency parameter has no significant impact on profitability. The efficiency parameter, inclusive of ITR, has a positive and significant impact at a 1% level, where a 1 unit increase in ITR would increase profitability by 0.29 units, which also signifies the dependence of profitability on ITR. These results also lead to the rejection of the third hypothesis (H03), which posited that the efficiency ratio has no significant impact on profitability. The market prospect parameter, including the PBR, has a positive and significant impact at the 5% level. A one-unit increase in PBR would increase profitability by 0.45 units, indicating that the profitability of automobile companies is influenced by PBR. These results also lead to the rejection of the fourth hypothesis (H04), which stated that the market prospect ratio has no significant impact on profitability. Thus, the study found that profitability is determined by several other financial parameters.

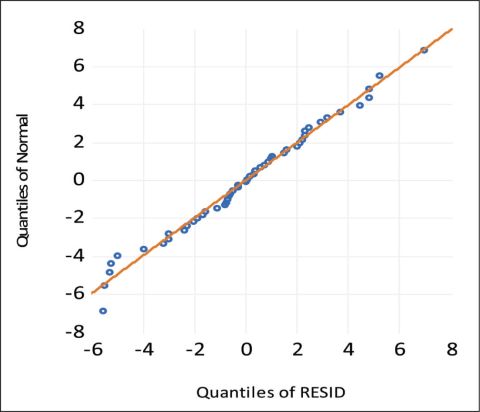

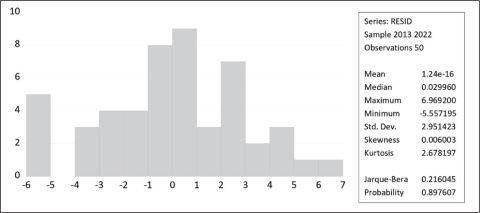

For the above panel data regression analysis, the normality of residuals is examined with the help of normal quantile–quantile plots (Q–Q plots), and it is presented in Figure 2. Further, the robustness of the normality of data is performed through the Jarque–Bera test in Figure 3, which favours the null hypothesis indicating the sample to be normally distributed (Jarque & Bera, 1987), a normal distribution as presented for the residual, along with the residual of the specification conform and along with it the normal Q–Q plots of the residuals.

Figure 2. Normal Q–Q Plots of Residual.

Figure 3. Histogram and Jarque–Bera Test.

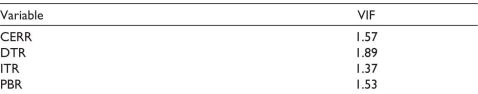

Once the normality check was conducted, the presence of multicollinearity between the variables was studied using the variance inflation factor (VIF) in Table 7.

Table 7. Variance Inflation Factor (VIF).

The VIF above 10 will reflect the existence of multicollinearity between the explained variables included in the specification (Hair et al., 2009), and in this study, the problem of multicollinearity is not encountered as the stats of VIF are found to be less than 10 for all the independent variables.

Conclusion

The quantitative research has been conducted in this study using descriptive analysis, correlation analysis and panel data regression analysis to know the significant impact of selected financial parameters on the profitability of four -wheeler manufacturing automobile companies listed in the NSE. The financial parameter is inclusive of CERR, DTR, ITR and PBR. All these parameters were found to have a significant impact on profitability. The correlation analysis showed that ITR and CERR are positively correlated with ROA, while PBR and DTR are negatively correlated with ROA. The study further found that CERR, ITR and PBR have a positive impact, while DTR has a negative impact on profitability, which states that improving this parameter will have a significant impact on the profitability of the selected companies.

The result presented through panel data analysis shows that the CERR has a moderate impact on profitability, indicating that if the profit earned is ploughed back into companies, it will have a moderate growth in profitability and performance, as internal sources of funding are less costly than external ones. This finding is similar to the findings of Paliwal and Chouhan (2017) that the profitability and the liquidity of the Indian automobile industry have positive relationship between the profitability and liquidity. Another vital finding of the study is the inverse relationship between DTR and ROA, which indicates that the preference for debt funding, should be reduced to improve profitability, as higher debt preference induces higher risk with higher leverage resulting in more cash outflows as interest payments. This finding is similar to the findings of Abey and Velmurugan (2018). The analysis of the report of the panel shows that ITR is reasonable and vital for making decisions by management. The result indicates that management must improve its ITR to obtain growth in profitability, because if ITR is not improved, then the finished stock gets piled up in the warehouse, and will not be converted to sales in the required period. Higher ITR is preferred as the automobile industry is a sector where new features and modifications of the variant produced is practised at a higher frequency. This finding is similar to the findings of Dharmaraj and Ramaswamy (2014). Further, the PBR has a positive and significant impact on profitability, suggesting that a higher market price induces an increased prosperity for profitability. This finding is similar to the findings of Noviana et al. (2022).

The study concludes that an improvement in CERR, ITR and PBR with a reduction in DTR can improve the profitability of the selected automobile companies. These findings impactfully contribute to the existing literature on profitability and its determinants.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iDs

Rakesh Sharma  https://orcid.org/0009-0004-9500-406X

https://orcid.org/0009-0004-9500-406X

Prasid Gurung  https://orcid.org/0000-0002-4424-6630

https://orcid.org/0000-0002-4424-6630

Abey, J., & Velmurugan, R. (2018). Determinants of profitability in Indian automobile industry. International Journal of Pure and Applied Mathematics, 119(12), 15301–15313.

Agarwal, R. N. (1991). Profitability and growth in Indian automobile manufacturing Industry. Indian Economic Review, 26(1), 81–97.

Aggarwal, N., & Singla, S. K. (2001). How to develop a single index for financial performance. Indian Management, 12(5), 59–62.

Ali, A. (2021). Profitability variations and disparity in automobile sector: A case of leading Indian automobile companies. Accounting, 7(6), 1455–1462. https://doi.org/10.5267/ j.ac.2021.3.019

Aloy, N. (2012). Working capital management and financial performance of manufacturing sector in Sri Lanka. European Journal of Business and Management, 4(15), 23–30.

Athukorala, P. C., & Veeramani, C. (2019). From import substitution to integration into global production networks: The case of the Indian automobile industry. Asian Development Review, 36(2), 72–99.

Attari, M. A., & Raza, K. (2012). The optimal relationship of cash conversion cycle with firm size and profitability. International Journal of Academic Research in Business and Social Sciences, 2(4), 189–203.

Basu, D., & Das, D. (2016). Profitability and investment: Evidence from India’s organized manufacturing sector. Metroeconomica, 68(1), 47–90. https://doi.org/10.1111/meca.12126

Dharmaraj, A., & Ramaswamy, V. (2014). Determinants profitability in Indian automobile industry: Using multiple regression analysis. International Journal of Innovative Research and Studies, 3(4), 992–1003.

Dharmendra, M. S. (2012). Determinants of profitability in Indian automotive industry. Tecnia Journal of Management Studies, 7(1), 20–23.

Dicu, C., Bondoc, M. D., & Popescu, M. B. (2019). A quantitative approach to profitability ratios. Scientific Bulletin – Economic Sciences, 18(1), 57–65.

ETAuto. (2023, January 6). India surpasses Japan to become 3rd largest auto market globally. ETAuto.com. https://auto.economictimes.indiatimes.com/news/industry/india-surpasses-japan-to-become-3rd-largest-auto-market-globally/96786895

Gandhi, K. (2017). Profitability analysis of select automobile companies in India: With special reference to Tata Motors and Mahindra and Mahindra. SJCC Management Research Review, 7(2), 82–90.

Ganesamoorthy, L. G., & Rajavathana, R. R. (2012). Effects of working capital management on profitability of select automobile companies in India. International Journal of Scientific Research, 2(2), 159–160. https://doi.org/10.15373/22778179/feb2013/53

Gurung, P., & Sarkar, S. (2022). Performance analysis of microfinance institutions: An empirical evidence from MFIs of West Bengal. International Journal of Indian Culture and Business Management, 1(1), 1. https://doi.org/10.1504/ijicbm.2022.10049513

Hair, J., Black, W., Babin, B., & Anderson, R. (2009). Multivariate data analysis. Prentice-Hall.

Hiran, S. (2016). Financial performance analysis of Indian companies belongs to automobile industry with special reference to liquidity and leverage. International Journal of Multidisciplinary and Current Research, 4, 39–51.

IBEF. (2023). Manufacturing sector in India: Market size, FDI, Govt initiatives: IBEF. India Brand Equity Foundation. https://www.ibef.org/industry/manufacturing-sector-india

Investindia. (2023). Invest in Indian automobile industry, auto sector growth. https://www.investindia.gov.in/sector/automobile

Jaisinghani, D., Tandon, D., & Batra, D. K. (2018). Capital expenditure and persistence of firm performance: An empirical study for the Indian automobiles industry. International Journal of Indian Culture and Business Management, 16(1), 39–56.

Jarque, C. M., & Bera, A. K. (1987). A test for normality of observations and regression residuals. International Statistical Review, 55(2), 163–172. https://doi.org/10.2307/1403192

Jamali, A. H. (2012). Management efficiency and profitability in Indian automobile industry: From theory to practice. Indian Journal of Science and Technology, 5(5), 1–3. https://doi.org/10.17485/ijst/2012/v5i5.21

Kaur, N., & Kaur, J. (2016). Determinants of profitability of automobile industry in India. Journal of Commerce and Accounting Research, 5(3). https://doi.org/10.21863/jcar/2016.5.3.034

Korankye, T., & Adarquah, R. S. (2013). Empirical analysis of working capital management and its impact on the profitability of listed manufacturing firms in Ghana. Research Journal of Finance and Accounting, 4(1), 124–131.

Mathuva, D. M. (2009). The influence of working capital management components on corporate profitability: A survey on Kenyan listed firms. Research Journal of Business Management, 4(1), 1–11. https://doi.org/10.3923/rjbm.2010.1.11

Mcdonald, J. T. (1999). The determinants of firm profitability in Australian manu-facturing. Economic Record, 75(2), 115–126. https://doi.org/10.1111/j.1475-4932.1999.tb02440.x

Miglani, S. (2019). The growth of the Indian automobile industry: Analysis of the roles of government policy and other enabling factors. In K.-C. Liu & U. S. Racherla (Eds.), Innovation, economic development, and intellectual property in India and China (pp. 439–463). Springer Nature Singapore. https://doi.org/10.1007/978-981-13-8102-7_19

Noviana, N., Toni, N., Simorangkir, E. N., & Angelia, N. (2022). The effect of profitability and capital structure on price–book value with dividend pay-out ratio as moderating variables in the consumer goods industry listed on the stock exchange Indonesia for 2017–2020. International Journal of Social Science Research and Review, 5(10), 142–150. https://doi.org/10.47814/ijssrr.v5i10.581

OICA. (2023). Production statistics. https://www.oica.net/category/production-statistics/ 2022-statistics/

Paliwal, R., & Chouhan, V. (2017). Relationship between Liquidity and Profitability in Indian Automobile Industry. International Journal of Science and Research (IJSR), 6(5), 2259–2263.

Quayyum, S. T. (2012). Effects of working capital management and liquidity: Evidence from the cement industry of Bangladesh. Journal of Business and Technology (Dhaka), 6(1), 37–47. https://doi.org/10.3329/jbt.v6i1.9993

Raheman, A., Qayyum, A., & Afza, T. (2011). Sector-wise performance of working capital management measures and profitability using ratio analysis.. Interdisciplinary Journal of Contemporary Research in Business, 3(8), 285–299.

Samuels, J. M., & Smyth, D. J. (1968). Profits, variability of profits and firm size. Economica, 35(138), 127. https://doi.org/10.2307/2552126

Simlai, D., & Guha, M. (2019). Financial stability, profitability and growth analysis: A study on select Indian automobile companies. Journal of Commerce and Accounting Research, 8(1), 21–34.

Suresh, S., & Sengottaiyan, A. (2015). Does capital structure decision affects profitability? A study of selected automobile companies in India. International Journal of Research in Social Sciences, 5(4), 113–123.

Swalih, M. M., Adarsh, K. B., & Sulphey, M. M. (2021). A study on the financial soundness of Indian automobile industries using Altman Z-score. Accounting, 7, 295–298. https://doi.org/10.5267/j.ac.2020.12.001

Tahir, M., & Anuar, M. B. A. (2011). The effect of working capital management on firm’s profitability. Interdisciplinary Journal of Contemporary Research in Business, 3(4), 365–369.

Tyagi, S., & Mahajan, V. (2022). What determines profitability in the Indian automobile industry? The Indian Economic Journal, 70(1), 71–87. https://doi.org/10.1177/00194662 211063574

Velmurugan, R., & Annalakshmi, S. (2015). Determinants of profitability in select Indian Motor Cycle companies. Indian Journal of Research, 4(4), 4–6.

Vijayakumar, D. A., & Kadirvelu, S. (2003). Determinants of profitability in Indian public sector petroleum industries. Management and Labour Studies, 28(2), 170–182. https://doi.org/10.1177/0258042x0302800206

Zubairi, H. J. (2010). Impact of working capital management and capital structure on profitability of automobile firms in Pakistan. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1663354