1 Department of Business Administration, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

A company’s capital structure has long captured the interest of academics, industry professionals and decision-makers in corporate finance. This scientometric review carefully examines the large body of research on capital structure decisions. Co-word and co-citation analyses were used as two scientometric analytic techniques. Combining these two techniques helps the researcher understand the studied issue’s evolution and the field’s overall picture. A final dataset of 4,873 was used to synthesise and analyse the capital structure-related research. To the best of our knowledge, there is no comprehensive scientometric review of the literature on the domain of capital structure with this extensive data corpus. This review uses a scientometric approach to analyse the evolution of capital structure research, identify emergent trends and highlight areas that necessitate further investigation. This research lays the groundwork for future scholarly endeavours that resonate with the intricacies of capital structure’s role in value creation and firm sustainability, thereby improving our understanding of capital structure decisions in the contemporary financial landscape.

Capital structure decisions, financial decisions, bibliometrix-R, scientometric review, VOSviewer

Introduction

In corporate finance, the composition of a firm’s capital structure has long captivated the attention of researchers, practitioners and policymakers alike. Capital structure, the blend of debt and equity used to finance a firm’s operations, occupies a central position in financial decision-making due to its profound implications for risk, value creation and sustainable growth (Abdul Quddos & Nobanee, 2020; Myers, 1984). This review uses a scientometric approach to decipher the evolution of capital structure research, identify emergent trends and illuminate areas that necessitate further investigation.

The Complex Landscape of Capital Structure Decisions

Capital structure choice embodies a pivotal strategic decision for firms across industries. The composition of debt and equity financing not only shapes a firm’s financial risk but also impacts its ability to seize growth opportunities, navigate economic fluctuations and optimise shareholder wealth (Harris & Raviv, 1991). The seminal work of Modigliani and Miller (1958), founded on the premise of perfect markets and costless information, initially proposed the notion of capital structure irrelevance in determining firm value. However, the real-world complexities of taxation, agency conflicts, asymmetric information and market imperfections have compelled scholars to re-examine and refine these fundamental principles (Myers, 1984).

Evolution of Capital Structure Research

An evolution marks the trajectory of capital structure research through various theoretical paradigms, methodological shifts and contextual refinements. The initial theoretical groundwork of (Modigliani & Miller, 1958, 1963) provided a launching pad for a burgeoning field of inquiry. Subsequent research illuminated the significance of taxes (Modigliani & Miller, 1963), agency costs (Jensen & Meckling, 1976), financial distress (Frank & Goyal, 2007) and information asymmetry (Myers & Majluf, 1984) in shaping capital structure decisions. The discipline witnessed the development of intricate models that capture the intricate interplay between these elements and their consequences on financing choices.

Scientometrics, a quantitative methodology encompassing bibliometric and network analysis, offers a powerful lens to discern and analyse patterns within the scholarly literature. By applying this approach to the domain of capital structure, this scientometric review seeks to unveil the underlying dynamics of research development (Ramy et al., 2018). Through rigorous analysis of publication patterns, co-citation networks and collaborative authorship, this review intends to portray the intellectual evolution of capital structure research and identify the scholarly beacons that have shaped its course. Employing scientometrics allows for identifying distinct research clusters within the capital structure landscape. These clusters, arising from shared themes and methodologies, mirror the progression of research directions and the cumulative accumulation of knowledge (Owusu et al., 2023). By delineating these clusters, this review offers a visual map of the dominant trajectories that have guided capital structure research, shedding light on the ebb and flow of scholarly interest.

As the capital structure landscape continues to evolve in parallel with the dynamic financial environment, emerging trends beckon researchers to delve into previously uncharted territories. As financial technology permeates the realm of finance, investigating its impact on capital structure decisions and the emergence of alternative financing mechanisms becomes paramount (Asimakopoulos et al., 2009). Furthermore, the evolving importance of environmental, social and governance considerations prompts an exploration of their integration into capital structure frameworks (Cantino et al., 2017). In sum, this scientometric review embarks on an intricate journey through the annals of capital structure research, guided by the scientometric compass. By illuminating the historical evolution, identifying prevalent trends and illuminating knowledge gaps, this review lays the groundwork for a dynamic and forward-looking research agenda. To enhance our understanding of capital structure decisions in the contemporary financial landscape, this review paves the way for future scholarly endeavours that resonate with the complexities of capital structure’s role in value creation and firm sustainability.

Review Methodology

Our goal was to compile as many papers as possible related to capital structure using a rigorous and repeatable process. This analysis adheres to the preferred reporting items for systematic reviews and meta-analyses (PRISMA) procedure, adhering to a four-step process flow for finding pertinent articles, comprising identification, screening, eligibility evaluation and inclusion, as well as a 27-point checklist on good practice for systematic reviews (Liberati et al., 2009). The investigation, which took a procedural approach influenced by earlier research in the capital structure literature, expanded on earlier literature reviews using the PRISMA methodology (Raisch & Birkinshaw, 2008; Tranfield et al., 2003).

Selection of Sample

Researchers can use a number of online databases, including Google Scholar, Scopus, WoS and Dimensions, to collect data for bibliometric study. However, taking into account the articles’ broader scope, especially in the sciences (Hallinger & Nguyen, 2020; Mongeon & Paul-Hus, 2016), in this study, we searched and retrieved data for our analysis using the Scopus database (Anas et al., 2023; Khan et al., 2023; Khan & Khan, 2022), which provided reasonably reliable search results when compared to other databases.

In the initial phase, the search string included ‘Capital Structure’ OR ‘Capital Structure Decisions’. In order to find literature that matched the goals of the current study, researchers looked for combinations of these terms in the titles, abstracts and authors’ keywords.

There were 6,847 entries found in total from the first search. Next, we used PRISMA (Moher et al., 2009) while choosing the last set of data to be screened and examined further (Figure 1). After limiting the results by document types to include journal articles and review papers, we received 4,882 articles overall. Ultimately, we ruled out nine publications since they were written in languages other than English. Therefore, 4,873 results remained for further investigation.

Figure 1. Review Procedure as per the PRISMA Protocol.

Data Analysis

The quantitative approach (scientometric analysis) of capital structure-related research is explained in this section. The Scopus database conducted a subclass of bibliometric analysis known as scientometric analysis (Boloy et al., 2021). With the help of bibliometric data analysis, scientometrics create a network visualisation technique called knowledge mapping or scientific mapping (van Eck & Waltman, 2010). By extracting research topics from influential scholars, publications and institutions, the scientometric analysis seeks to evaluate the scientific community (Cobo et al., 2011; Sharma & Lenka, 2022). Through visualisation patterns in bibliographical databases, scientometrics assist researchers in analysing large volumes of scientific networks (Donthu et al., 2022). The scientometric analysis is built, examined and visualised using the bibliomtrix-R and VOSviewer software. It is a straightforward tool that visualises bibliometric networks (Fauzi, 2023; Rasul et al., 2022).

Co-word and co-citation analyses were used as two scientometric analytic techniques. By combining the two studies, the researcher can better comprehend the field’s overall image and the development of the study issue (Tan Luc et al., 2022).

Co-word Analysis

Co-word analysis, sometimes referred to as keyword co-occurrence analysis, examines the connections between the terms in the current field (van Eck & Waltman, 2010). It gives experts in a field an overview so they may see the knowledge structure from many angles made possible by the articles that have been published (Su & Lee, 2010). Regarding the network actor, the knowledge structure can be extracted from the macro-, meso- and micro-levels in the form of author, institute and country keywords. Additionally, the study can be used to forecast emerging trends and the development of connected topics (Tan Luc et al., 2022). This analysis can comprehensively summarise current capital structure research in the broader organisational context.

Co-citation Analysis

The co-citation analysis is the second scientometric analysis. Co-citation analysis seeks to determine how prior research influenced the growth of capital structure research (Bernatovic et al., 2022). Particularly in the current setting, the results would make it easier for researchers to find the most pertinent materials for capital structure research. When two items are cited together, co-citation analysis offers helpful information. It highlights two closely connected articles frequently mentioned and shared the same substance, theme and research stream (Pandey et al., 2023).

Results of Scientometric Analysis

Descriptive Analysis

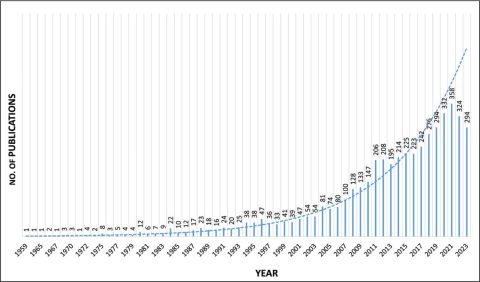

The rapid expansion of published works directly reflects the expanding body of scientific knowledge. Therefore, it is important to examine this pattern and its origins (see Table 1). There was a total of 6,847 items found in the first search. About 4,873 publications were selected for the study after being whittled down based on criteria such as being peer-reviewed, subject area, source type and article published in English. There were a total of 15,125 citations and 8,400 (without self-citations). The h-index was 84, and the average number of citations per item was 3.13. The h-index, or Hirsch index, is a metric commonly used to assess scholars’ research impact and productivity in various academic fields, including finance. Understanding the h-index is vital, as it allows us to evaluate the influence and reach of finance scholars whose work informs the framework of our study. Figure 2 shows that interest in capital structure studies increased tremendously after 2006. The number of studies has increased from 926 articles (1959–2006) to 3,899 articles in the past 17 years (2007–2023). This growth demonstrates scholars’ curiosity about how capital structure choices affect businesses.

Figure 2. Number of Publications from 1959 to 2023.

Co-word Analysis

Thematic Cluster 1: The Relationship Between Capital Structure and Profitability

The first cluster of keywords includes terms that express the connection between the firm’s capital structure, profitability and speed of adjustments. The most common keywords in this cluster are ‘profitability’ (occurrences (OC): 193) and ‘speed of corrections’ (101). The publications in this cluster with the widely used keywords analyse the various connections between a firm’s capital structure and its profitability both domestically and internationally (Alghifari et al., 2022; Ilie & Vasiu, 2022), the importance of capital structure dynamics by looking at how quickly firm reach their ideal capital structure (Ghose & Kabra, 2019) as well as asymmetric information’s impact on a firm’s financing decisions, capital structure modifications’ feedback on asymmetric information and capital structure adjustments’ speed on target leverage (Ahmad et al., 2021; Haron, 2016).

Thematic Cluster 2: Leverage and Corporate Governance

The second cluster contains keywords: capital structure decisions, leverage and corporate governance. The most common keywords in this cluster are capital structure decisions (OC: 2,345), leverage (OC: 391) and corporate governance (OC: 228). Fischer et al. (1989) create a theoretical model of pertinent capital structure choice in a dynamic setting, considering the presence of recapitalisation costs and revealing that firms’ debt ratio ranges to firm-specific variables that substantially support the model. The importance of capital structure or leverage with the interplay of the prevailing theories on SMEs has been the subject of many debates (Harasheh & De Vincenzo, 2023; Paulo Esperança et al., 2003; Seppa, 2014). Financial and non-financial aspects of a company’s performance were studied concerning its capital structure, corporate leverage and corporate governance structures (Miloud, 2022; Zeitun & Goaied, 2022).

Thematic Cluster 3: Trade-off Theory (TOT) and Pecking Order Theory (POT)

The second cluster contains keywords that are debt and the application theories of the firm, that is, TOT and POT. The most common keywords in this cluster are debt (OC: 219), TOT (OC: 145) and POT (OC: 137). The research in this cluster contends that, when taking into account the ideal time to issue debt, zero leverage is optimally consistent with even elementary static TOT (Haddad & Lotfaliei, 2019), as well as analysed whether or not companies’ debt choices adhere to the pecking order hypothesis. Using cross-country and within-country-year variation, we show that treated businesses issue more external financing and invest more after the new regime (Naranjo et al., 2022). In addition, many studies put forward the POT and TOT to examine their respective hypotheses in relation to corporate debt (Adair & Adaskou, 2015; Serrasqueiro & Caetano, 2014).

Thematic Cluster 4: Corporate Finance and Cost of Bankruptcy

The fourth cluster reflects on corporate finance and the bankruptcy of the firm. The widely used keywords are corporate finance (OC: 73), bankruptcy (OC: 58) and risk (OC: 38). The research in this cluster elucidates the interrelationship between corporate finance, bankruptcy and various types of risk of the firm. Castanias (1983) investigated the bankruptcy or failure rate in corporate finance. There was evidence against the non-significance hypothesis. The study also compares Moroccan enterprises’ corporate finance practices to those in other nations in Morocco’s frontier market (Baker et al., 2017). The myriad of research in this cluster also delineates the impact of various risks like a firm’s risk of rollover (Haque & Varghese, 2023), systematic political risk (Chuliá et al., 2023), environmental risk (Shu et al., 2023; Zhou & Wu, 2023) and so on that a firm face in its capital structure decisions-making.

Thematic Cluster 5: Dividend Policy and Financial Markets

The fifth and final cluster contains keywords emphasising dividend policy and financial markets. The widely used keywords are dividend policy (OC: 48), financial markets (OC: 43), stock market and corporate strategy (OC: 32). Importantly, this grouping of publications delineates the dividend policy’s determinants (Ranti, 2013), the analysis of dividend policy in tandem with corporate governance (Roy, 2015) and dividend policy in tandem with defaultable firm’s capital structure (Tse, 2020). The noteworthy research also focuses on the firm ownership, capital structure decisions and stock market (Campello et al., 2014), behaviour of stock market (Rajagopalan & Shankar, 2012), the effect of corporate strategy on the decisions of capital structure (Barton & Gordon, 1988; Cappa et al., 2020), in tandem with firm performance (Su & Vo, 2010), as well as with financial strategy (Korwar, 1996).

Co-citation Analysis

Document co-citation is a bibliographic technique that examines the number of times key studies or articles have been cited in other works to pinpoint the study in a field that those studies or publications have inspired. Using this bibliometric technique, we can identify the main research issues and hot topics in capital structure. This approach was first suggested by Small (1973), who suggested analysing the network of referenced references. The network analysis unit in an overlay visualisation is the article. Our goal in using this bibliometric study was to identify the organisational framework of the most significant contributions to capital structure research.

The network of document co-citations created by the VOS viewer is shown in Figure 3. High co-citation article pairs are represented with bigger node sizes, as seen. When two papers are listed together in the references of other research projects, they are said to be co-cited. Each node in the figure represents an article referenced at least twice. The graphic only shows the 33 clusters of the 59 publications with the highest number of co-citations. The node’s radius indicates a document’s citation frequency in other research. Four clusters were discovered by VOSviewer automatically because highly co-cited documents are frequently grouped. The red cluster, the most prominent cluster, provides several insights into the ideal capital structure choice of debt and equity, its determinants, corporate finance’s theory and practice and capital structure adjustments. Titman’s (1984) article received the highest citation count in 1926 and proposes that capital structure can act as a bonding or prepositioning device to manage this relationship’s incentive/conflict issue. When the capital structure is appropriately chosen, incentives are balanced, and the company can adopt a liquidation strategy that maximises value ex ante. The pecking order hypothesis, or the theory of firm leverage on a large sample of publicly traded firms from 1971 to 1998, was tested by Frank and Goyal (2003).

Figure 3. Co-word Analysis of Capital Structure.

Source: Bibliometrix-R.

Figure 4. Co-citation Analysis of the Capital Structure Research.

Source: Bibliometrix-R.

The green cluster reflects the irrelevancy and relevancy of capital structure to the firm value, agency theory and factors of capital structure. Modigliani and Miller (1958) proposed the irrelevance of capital structure on firm value in a perfect market, suggesting that how a company finances its operations (through debt or equity) does not affect its overall value under certain assumptions. This forms a foundational concept in modern corporate finance theory. In 1963, Modigliani and Miller (1963) extended their theory by introducing taxes and financial distress costs, acknowledging that under certain conditions, capital structure decisions can impact firm value due to tax shields and the potential costs of financial distress. The agency theory was pioneered by Jensen and Meckling (1976) and defined the concept of agency costs, showing its relationship to the firm’s separation and control issue. The blue cluster focuses on investigating capital structure decisions in emerging countries, debt maturity and financial institutions for accessing sources of finance. In this cluster, Booth et al. (2001) evaluated the applicability of capital structure theory to nations with various institutional setups. He proved that the same factors influencing decisions in affluent nations also influence those in developing nations. However, consistent disparities between nations suggest that particular nation-specific forces are at play. Booth and Deli (1999) offered the first empirical support for a specific group of outside directors, specifically executives from insurance companies, commercial banks or investment banks. They provide light on these executives’ services by studying how their presence is related to borrowing. The last cluster, yellow, delineates the dilemma in choosing the ideal capital structure for the firm, investment decisions and the impact of corporate taxes on capital structure.

Myers (1984) addressed the complex relationship between a firm’s optimal capital structure and value, considering factors such as taxes, bankruptcy costs and agency issues, which influence the trade-off between debt and equity financing. The investigation of how information asymmetry between firms and investors affects financing and investment choices was explored by Myers and Majluf (1984). They analyse the impact of undervaluation due to asymmetric information on firms’ decisions to issue equity or debt and their subsequent investment strategies. Kraus and Litzenberger (1973) presented a model integrating investor preferences for risk and return with a firm’s optimal financial leverage decision. The model considers how different states of the economy influence the choice between debt and equity financing, highlighting the trade-offs involved in capital structure decisions.

Key Implications

Theoretical Contributions

This study’s goal was to use the right research approach to undertake a scientometric examination of selected publications’ capital structure-related research. The analysis of 74 journal articles was thorough. Despite increased publications over the past several decades, this review’s findings showed that capital structure is still a relatively new topic of study. The review’s initial objectives included identifying descriptive analyses of capital structure-related research, the key producing nations, total citations, self-citations, h-index and publishing trends—secondly, a substantial portion of the studies using empirical methods employed a secondary database methodology. An authors’ network of document co-citations and keyword co-occurrence was used to conduct the scientometric analysis. Third, the existing literature shows that studies on capital structure have mainly concentrated on the economic elements, while the overlap in social dimensions has received less attention. This study provides a relevant and thorough assessment of capital structure, making substantial theoretical additions to the literature.

Lastly, our findings suggest that the industry may benefit from carefully deploying various funding sources in the long run. Choosing which type of funding to use first would be an issue, but businesses can adjust and match the proportionate debt and equity to lower their financing costs and boost their firm worth. Future research may also develop a direct assessment of the bankruptcy cost to demonstrate whether and how the assessment channel works with various funding sources. Moreover, further studies could examine the informative utility of the complete term structures of capital structure decisions spreads and stock options for realised short- and long-term asset/equity volatility. The findings of this review represent one of the earliest initiatives to advance the idea of capital structure and its connection to current interactions.

Implications for Researchers

The paper underscores the importance of empirical rigour and comprehensive analysis for academia in understanding complex financial concepts. The study showcases how quantitative methods can contribute to a deeper understanding of capital structure theories and their applications by employing a scientometric approach. This encourages researchers to explore similar methods in studying other intricate financial concepts. Furthermore, the research suggests that a scientometric approach can bridge the gap between theory and practice, facilitating more effective communication between academia and the business community. The paper encourages a collaborative approach that could lead to more relevant and actionable research outcomes by aligning theoretical insights with empirical findings. This, in turn, benefits firms seeking to optimise their capital structure for sustainable growth and resilience in dynamic market environments.

Implications for Practitioners/Managers

The managerial implications for a paper on the capital structure using a scientometric approach might include the following:

First, managers can benefit from the insights gained through scientometric analysis of existing literature, helping them make more informed decisions regarding the optimal capital structure for their company. Second, managers can identify areas where further research is needed by understanding the trends and gaps in the literature. This can help them anticipate emerging issues and consider potential implications for their firm’s capital structure decisions. Third, scientometric analysis can highlight how various factors impact capital structure decisions in different industries and economic conditions. This understanding can aid managers in developing risk management strategies aligned with industry best practices. Fourth, the analysis might shed light on how firms with more flexible capital structures successfully navigated economic fluctuations. Managers can learn from these examples and design capital structures for greater flexibility in uncertain times. Finally, managers can use insights from scientometric analysis to communicate with investors more effectively about their capital structure decisions. This communication could include discussing the rationale behind specific financing choices based on the trends and findings from the research.

Conclusion

The journey through the landscape of capital structure research, guided by the scientometric compass, has provided us with a panoramic view of the past, a comprehensive understanding of the present and a visionary outlook towards the future. This scientometric review has delved into the intricate fabric of capital structure decisions, offering insights that span theoretical underpinnings, methodological trajectories and emerging trends. As we conclude this exploration, several overarching themes emerge, underscoring the significance of this review and the fertile ground it lays for future scholarship. The scientometric analysis has enabled us to retrace the footsteps of capital structure research, revealing the intellectual evolution of the field. From the foundational propositions of Modigliani and Miller (1958) to the dynamic interplay of market imperfections elucidated by subsequent scholars, the journey through time and thought has highlighted the adaptability of financial theory to changing economic landscapes. This review acknowledges the foundations upon which current and future studies are built by recognising the pivotal contributions of pioneering researchers. Beyond retrospect, this review peers into the future of capital structure research, where emerging trends beckon scholars to explore uncharted territories. The infusion of financial technology into finance brings forth novel avenues for investigation, with digital innovations reshaping the landscape of capital structure decisions.

As we gaze towards the horizon of scholarship, this review’s overarching aspiration is to foster a dynamic and impactful research agenda. By discerning research gaps and identifying emerging themes, this review provides a compass for future explorations that resonate with the complexities of capital structure decisions. The chasm between theory and practice has been a perennial challenge in finance. However, this review advocates for a symbiotic relationship where theoretical insights catalyse actionable decisions. By aligning theoretical paradigms with real-world complexities, future research endeavours can address the nuanced considerations that firms confront when navigating the labyrinth of capital structure decisions. The interplay of academia and industry promises to generate insights that transcend the confines of the ivory tower and resonate within boardrooms.

Recent Publications Induced Future Research Agenda

Four additional interesting avenues for future research are available based on recent publications.

First, future research may conduct interviews, surveys or case studies to collect primary data rather than depending on secondary data sources. This would guarantee reliable information for studying the connection between capital for the firm, board diversity and board composition (Yakubu & Oumarou, 2023).

Second, future studies may investigate creating a direct assessment of the cost of bankruptcy to show whether and how the assessment channel functions with different sources of finance (Agarwal & Singhvi, 2023).

Third, further studies could examine the informative utility of the complete term structures of capital structure decisions spreads and stock options for realised short- and long-term asset/equity volatility (Forte & Lovreta, 2023).

Lastly, future studies can examine how job protection affects leverage adjustment speed in developed nations. Also worth discussing is how employment protection affects firm-level information sharing and earning management (Li et al., 2023).

Thematic Clusters Induced Future Research Agenda

The majority of the study’s data set exclusively includes listed companies. Because there are not enough data available, unlisted companies are overlooked. Therefore, the study’s conclusions may not be applied to privately held companies, leaving room for further investigation (Ghose & Kabra, 2019). New methods may be used in the future of study, as suggested by Zeitun and Goaied (2022), to uncover additional elements that affect leverage via threshold effects. Future research could expand to incorporate more managerial ownership and board composition proxies to confirm these results. Furthermore, future studies can examine the justification for current corporate finance practices and potential barriers to adopting more theoretically sound strategies in emerging and developing countries (Baker et al., 2017). Lastly, future research will focus on widening the research horizon at the listed companies in central and eastern Europe and uncovering other influencing elements on the relationship between the capital structure and the profitability of businesses (Ilie & Vasiu, 2022).

Overcome Limitations and the Future Research Agenda

The limitation considered in this study is threefold. First, despite a thorough search for the plausibility of pertinent capital structure studies in this review, it is still possible that some pertinent studies were missed due to the changing nature of the research field (Rejeb et al., 2021). Second, the fluctuation of papers in Scopus is concerning because it is possible that excellent capital structure research published in journals, books or book chapters is not indexed (Rasul et al., 2022). Finally, despite the groundbreaking ideas presented here, this review’s range of scientometric insights remains constrained. Future reviews can, therefore, expand on the themes raised here by doing a thorough literary analysis of the data corpus (Fauzi, 2023).

Declaration of Conflicting Interests

The authors have no conflict to declare for this paper.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Umra Rashid  https://orcid.org/0000-0003-0639-3813

https://orcid.org/0000-0003-0639-3813

References

Abdul Quddos, M., & Nobanee, H. (2020). Sustainable capital structure: A mini-review. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3538839

Adair, P., & Adaskou, M. (2015). Trade-off-theory vs. pecking order theory and the determinants of corporate leverage: Evidence from a panel data analysis upon French SMEs (2002–2010). Cogent Economics & Finance, 3(1). https://doi.org/10.1080/23322039.2015.1006477

Agarwal, S., & Singhvi, B. (2023). Creditor-controlled insolvency and firm financing– Evidence from India. Finance Research Letters, 54, 103813. https://doi.org/10.1016/j.frl.2023.103813

Ahmad, M. M., Hunjra, A. I., Islam, F., & Zureigat, Q. (2021). Does asymmetric information affect firm’s financing decisions? International Journal of Emerging Markets, 18(9). https://doi.org/10.1108/IJOEM-01-2021-0086

Alghifari, E. S., Solikin, I., Nugraha, N., Waspada, I., Sari, M., & Puspitawati, L. (2022) Capital structure, profitability, hedging policy, firm size, and firm value: Mediation and moderation analysis. Journal of Eastern European and Central Asian Research (JEECAR), 9(5), 789–801. https://doi.org/10.15549/jeecar.v9i5.1063

Anas, M., Khan, M. N., & Uddin, S. M. F. (2023). Mapping the concept of online purchase experience: A review and bibliometric analysis. International Journal of Quality and Service Sciences 15(2), 168–189. https://doi.org/10.1108/IJQSS-07-2022-0077

Asimakopoulos, I., Samitas, A., & Papadogonas, T. (2009). The impact of capital intensity, size of firm and profitability on debt financing, case study in textile industry of Pakistan. Interdisciplinary Journal of Contemporary Research in Business, 3(10), 1061–1066.

Baker, H. K., Jabbouri, I., & Dyaz, C. (2017). Corporate finance practices in Morocco. Managerial Finance, 43(8), 865–880. https://doi.org/10.1108/MF-12-2016-0359

Barton, S. L., & Gordon, P. J. (1988). Corporate strategy and capital structure. Strategic Management Journal, 9(6), 623–632. https://doi.org/10.1002/smj.4250090608

Bernatovic, I., Slavec Gomezel, A., & Cerne, M. (2022). Mapping the knowledge-hiding field and its future prospects: A bibliometric co-citation, co-word, and coupling analysis. Knowledge Management Research & Practice, 20(3), 394–409. https://doi.org/10.1080/14778238.2021.1945963

Boloy, R. A. M., da Cunha Reis, A., Rios, E. M., J. de Araújo Santos Martins, Soares, L. O., de Sá Machado, V. A., & de Moraes, D. R. (2021). Waste-to-energy technologies towards circular economy: A systematic literature review and bibliometric analysis. Water, Air, & Soil Pollution, 232(7), 306. https://doi.org/10.1007/s11270-021-05224-x

Booth, J. R., & Deli, D. N. (1999). On executives of financial institutions as outside directors. Journal of Corporate Finance, 5(3), 227–250. https://doi.org/10.1016/S0929-1199(99)00004-8

Booth, L., Aivazian, V., Demirguc-Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. Journal of Finance, 56(1), 87–130. https://doi.org/10.1111/0022-1082.00320

Campello, M., Ribas, R. P., & Wang, A. Y. (2014). Is the stock market just a side show? Evidence from a structural reform. Review of Corporate Finance Studies, 3(1–2), 1–38. https://doi.org/10.1093/rcfs/cfu006

Cantino, V., Devalle, A., & Fiandrino, S. (2017). ESG sustainability and financial capital structure: Where they stand nowadays. International Journal of Business and Social Science, 8(5), 116–126.

Cappa, F., Cetrini, G., & Oriani, R. (2020). The impact of corporate strategy on capital structure: Evidence from Italian listed firms. The Quarterly Review of Economics and Finance, 76, 379–385. https://doi.org/10.1016/j.qref.2019.09.005

Castanias, R. (1983). Bankruptcy risk and optimal capital structure. The Journal of Finance, 38(5), 1617–1635. https://doi.org/10.1111/j.1540-6261.1983.tb03845.x

Chuliá, H., Estévez, M., & Uribe, J. M. (2023). Systemic political risk. Economic Modelling, 125, 106375. https://doi.org/10.1016/j.econmod.2023.106375

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology, 62(7), 1382–1402. https://doi.org/10.1002/asi

Donthu, N., Lim, W. M., Kumar, S., & Pattnaik, D. (2022). A scientometric study of the Journal of Advertising Research. Journal of Advertising Research, 62(2), 105–117. https://doi.org/10.2501/JAR-2022-002

Fauzi, M. A. (2023). Knowledge hiding behavior in higher education institutions: A scientometric analysis and systematic literature review approach. Journal of Knowledge Management, 27(2), 302–327. https://doi.org/10.1108/JKM-07-2021-0527

Fischer, E. O., Heinkel, R., & Zechner, J. (1989). Dynamic capital structure choice: Theory and tests. The Journal of Finance, 44(1), 19–40.

Forte, S., & Lovreta, L. (2023). Credit default swaps, the leverage effect, and cross-sectional predictability of equity and firm asset volatility. Journal of Corporate Finance 79, 102347. https://doi.org/10.1016/j.jcorpfin.2022.102347

Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217–248. https://doi.org/10.1016/S0304-405X(02)00252-0

Frank, M. Z., & Goyal, V. K. (2007). Trade-off and pecking order theories of debt. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.670543

Ghose, B., & Kabra, K. C. (2019). Firm profitability and adjustment of capital structure: Indian evidence. Vision: The Journal of Business Perspective, 23(3), 297–308. https://doi.org/10.1177/0972262919855804

Haddad, K., & Lotfaliei, B. (2019). Trade-off theory and zero leverage. Finance Research Letters, 31,165–170. https://doi.org/10.1016/j.frl.2019.04.011

Hallinger, P., & Nguyen, V.-T. (2020). Mapping the landscape and structure of research on education for sustainable development: A bibliometric review. Sustainability, 12(5), 1947. https://doi.org/10.3390/su12051947

Haque, S., & Varghese, R. (2023). Firms’ rollover risk, capital structure and unequal exposure to aggregate shocks. Journal of Corporate Finance, 80,102416. https://doi.org/10.1016/j.jcorpfin.2023.102416

Harasheh, M., & De Vincenzo, F. (2023). Leverage-value nexus in Italian small-medium enterprises: Further evidence using dose-response function. EuroMed Journal of Business, 18(2), 165–183. https://doi.org/10.1108/EMJB-11-2021-0166

Haron, R. (2016). Do Indonesian firms practice target capital structure? A dynamic approach. Journal of Asia Business Studies, 10(3), 318–334. https://doi.org/10.1108/JABS-07-2015-0100

Harris, M., & Raviv, A. (1991). The theory of capital structure. The Journal of Finance. https://doi.org/10.1111/j.1540-6261.1991.tb03753.x

Ilie, L., & Vasiu, D. (2022). Capital structure and profitability. The case of companies listed in Romania. Studies in Business and Economics, 17(3), 100–112. https://doi.org/10.2478/sbe-2022-0049

Khan, F. M., Anas, M., & Uddin, S. M. F. (2023). Anthropomorphism and consumer behaviour: A SPAR-4-SLR protocol compliant hybrid review. International Journal of Consumer Studies, 1–37. https://doi.org/10.1111/ijcs.12985

Khan, N. F., & Khan, M. N. (2022). A bibliometric analysis of peer-reviewed literature on smartphone addiction and future research agenda. Asia-Pacific Journal of Business Administration, 14(2), 199–222. https://doi.org/10.1108/APJBA-09-2021-0430

Korwar, A. (1996). On corporate strategy and financial strategy. Vikalpa: The Journal for Decision Makers, 21(1), 3–13. https://doi.org/10.1177/0256090919960101

Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The Journal oj Finance, 28, 911–922.

Li, M., Chiang, Y.-M., & Liu, H. (2023). Employment protection and leverage adjustment speed: Evidence from China. Research in International Business and Finance, 64(40), 101894. https://doi.org/10.1016/j.ribaf.2023.101894

Liberati, A., Altman, D. G., Tetzlaff, J., Mulrow, C., Gøtzsche, P. C., Ioannidis, J. P. A., Clarke, M., Devereaux, P. J., Kleijnen, J., & Moher, D. (2009). The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: explanation and elaboration, Journal of Clinical Epidemiology, 62(10), e1–34. https://doi.org/10.1016/j.jclinepi.2009.06.006

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Miloud, T. (2022). Corporate governance and the capital structure behavior: Empirical evidence from France. Managerial Finance, 48(6), 853–878. https://doi.org/10.1108/MF-12-2021-0595

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297.

Modigliani, F., & Miller, M. H. (1963). Corporate income taxes and the cost of capital: A correction. American Economic Association, 53(3), 433–443.

Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine, 6(7), e1000097. https://doi.org/10.1371/journal.pmed.1000097

Mongeon, P., & Paul-Hus, A. (2016). The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics, 106(1), 213–228. https://doi.org/10.1007/s11192-015-1765-5

Myers, S. C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 575–592.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13, 187–221.

Naranjo, P., Saavedra, D., & Verdi, R. S. (2022). The pecking order and financing decisions: Evidence from changes to financial-reporting regulation. Journal of Accounting, Auditing & Finance, 37(4), 727–750. https://doi.org/10.1177/0148558X20945066

Owusu, G. M. Y., Koomson, T. A. A., & Donkor, G. N. A. (2023). A scientometric analysis of the structure and trends in corporate fraud research: A 66-year review. Journal of Financial Crime. https://doi.org/10.1108/JFC-05-2023-0121

Pandey, D. K., Hunjra, A. I., Hassan, M. K., & Rai, V. K. (2023). Venture capital financing during crises: A bibliometric review. Research in International Business and Finance 64(C), 101856. https://doi.org/10.1016/j.ribaf.2022.101856

Paulo Esperança, J., Matias Gama, A. P., & Azzim Gulamhussen, M. (2003). Corporate debt policy of small firms: An empirical (re)examination. Journal of Small Business and Enterprise Development, 10(1), 62–80. https://doi.org/10.1108/14626000310461213

Raisch, S., & Birkinshaw, J. (2008). Organizational ambidexterity: Antecedents, outcomes, and moderators. Journal of Management, 34(3), 375–409. https://doi.org/ 10.1177/0149206308316058

Rajagopalan, N. V. R., & Shankar, H. (2012). Stock market behaviour around buyback announcements in India: An empirical justification for preferring the open market repurchase mode. Indian Journal of Finance, 6(12), 608002.https://doi.org/10.17010/ijf/2012/v6i12/72364

Ramy, A., Floody, J., Ragab, M. A. F., & Arisha, A. (2018). A scientometric analysis of knowledge management research and practice literature: 2003–2015. Knowledge Management Research and Practice, 16(1), 66–77. https://doi.org/10.1080/14778238. 2017.1405776

Ranti, U. O. (2013). Determinants of dividend policy: A study of selected listed firms in Nigeria. Change and Leadership, 15(17), 107–119.

Rasul, T., Lim, W. M., Dowling, M., Kumar, S., & Rather, R. A. (2022). Advertising expenditure and stock performance: A bibliometric analysis. Finance Research Letters, 50, 103283. https://doi.org/10.1016/j.frl.2022.103283

Rejeb, A., Rejeb, K., & Zailani, S. (2021). Are Halal food supply chains sustainable: A review and bibliometric analysis. Journal of Foodservice Business Research, 24(5), 554–595. https://doi.org/10.1080/15378020.2021.1883214

Roy, A. (2015). Dividend policy and corporate governance: An analysis of listed Indian firms. The Great Lakes Herald, 9(2), 33–75.

Seppa, R. (2014). Implication of inside-debt: Signalling for bankruptcy probabilities within small firms. Baltic Journal of Management, 9(2), 168–188. https://doi.org/10.1108/BJM-03-2013-0043

Serrasqueiro, Z., & Caetano, A. (2014). Trade-off theory versus pecking order theory: Capital structure decisions in a peripheral region of Portugal. Journal of Business Economics and Management, 16(2), 445–466. https://doi.org/10.3846/16111699.2012.744344

Sharma, S., & Lenka, U. (2022). Counterintuitive, yet essential: Taking stock of organizational unlearning research through a scientometric analysis (1976–2019). Knowledge Management Research & Practice, 20(1), 152–174. https://doi.org/10.1080/ 14778238.2021.1943553

Shu, H., Tan, W., & Wei, P. (2023). Carbon policy risk and corporate capital structure decision. International Review of Financial Analysis, 86, 102523. https://doi.org/10.1016/j.irfa.2023.102523

Small, H. (1973). Co-citation in the scientific literature: A new measure of the relationship between two documents. Journal of the American Society for Information Science, 24(4), 265–269.

http://onlinelibrary.wiley.com/doi/10.1002/asi.4630240406/abstract%5CnD:%5CZotero_Data%5CZotero%5CProfiles%5C1sqw9v0j. default%5Czotero%5Cstorage%5CGCR7NPQA%5Cabstract.html

Su, G.-S., & Vo, H. T. (2010). The relationship between corporate strategy, capital structure and firm performance: An empirical study of the listed companies in Vietnam. International Research Journal of Finance and Economics, 50, 62–71.

Su, H.-N., & Lee, P.-C. (2010). Mapping knowledge structure by keyword co-occurrence: A first look at journal papers in technology foresight. Scientometrics, 85(1), 65–79. https://doi.org/10.1007/s11192-010-0259-8

Tan Luc, P., Xuan Lan, P., Nhat Hanh Le, A., & Trang, B. T. (2022). A co-citation and co- word analysis of social entrepreneurship research. Journal of Social Entrepreneurship, 13(3), 324–339. https://doi.org/10.1080/19420676.2020.1782971

Titman, S. (1984). The effect of capital structure on a firm’s liquidation decision. Journal of Financial Economics, 13(1), 137–151. https://doi.org/10.1016/0304-405X(84)90035-7

Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14, 207–222.

Tse, A. S. L. (2020). Dividend policy and capital structure of a defaultable firm. Mathematical Finance, 30(3), 961–994. https://doi.org/10.1111/mafi.12238

van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. https://doi.org/10.1007/s11192-009-0146-3

Yakubu, I. N., & Oumarou, S. (2023). Boardroom dynamics: The power of board composition and gender diversity in shaping capital structure. Cogent Business & Management, 10(2).https://doi.org/10.1080/23311975.2023.2236836

Zeitun, R., & Goaied, M. (2022). Corporate governance and capital structure: Dynamic panel threshold analysis. Applied Economics, 55(50), 5878–5894 https://doi.org/10.1080/00036846.2022.2140770

Zhou, Z., & Wu, K. (2023). Does climate risk exposure affect corporate leverage adjustment speed? International evidence. Journal of Cleaner Production, 389, 136036. https://doi.org/10.1016/j.jclepro.2023.136036